Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Recession Fears and Forward-Looking Markets

Jul 13, 2022

Q2 Quarterly Commentary – July 1, 2022

The second quarter of 2022 was not good for investors in virtually any asset. The S&P 500, a broad indicator of large-capitalization domestic stock performance, fell by -16.1% during the quarter (including dividends), and finished the first half with cumulative losses of -20.0%. Foreign equities posted a similar result, with the International MSCI EAFE Index off by -14.5% and -19.6% for the second quarter and year-to-date, respectively. While the Federal Reserve raised the Fed Funds target rate from 0.25% at year-end to 1.75% at June 30, 2022, bond values further weakened as investors demanded higher yields and wider credit spreads (bond prices move inversely with the direction of interest rates). The Barclay’s Aggregate Bond index was down by -4.7% in the second quarter, and by -10.4% year-to-date.

We have spoken in our recent client webinar and in written communications over the past several months about the possibility of recession, and the impact that such an event might have on the markets. We may already be in a recession. The first quarter logged a decline in real gross domestic product (“GDP”) of -1.5%. In its late-July announcement on GDP growth for the second quarter, the National Bureau of Economic Research (“NBER”) may declare that it too was negative, and if so, could proclaim that the US has dipped into a recession, which NBER defines as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.” If so, it has been a most unusual recession because it is not driven by the consumer, but rather by business investment and government spending. The decline in real GDP in the first quarter was largely driven by reduced business inventories and falling exports, lower federal, state and local government spending and higher imports. However, personal consumption, employment rates, corporate earnings and private residential and non-residential fixed investments remained firm. In the second quarter, employment data remained strong for the most part, and expectations of corporate earnings also remain firm. On the other hand, businesses appear to be further depleting inventories and deferring new equipment purchases, and residential and non-residential investments and private fixed investment appears to be waning. Inflation, rising interest rates, the war in Ukraine and a sour sentiment among businesses and consumers seem to be having an effect on these important economic factors that may dip GDP into negative territory for a second consecutive quarter.

The equity market declines that we have experienced, we believe, were in anticipation that these signs of weakness in parts of our economy grow into a full recession. It’s a reminder that markets are forward-looking, and that the economic news of the day, which frankly has not been all that bad, is not what determines whether the market will go up or down. Rather, markets are a collective view of the future, and that view is filled with uncertainty and speculation about how the future will evolve. The data we see on rising inflation, falling consumer sentiment, tightening Federal Reserve policy, domestic politics and geopolitics is troubling, to be sure, but investors should be careful not to assume that if the economic data worsens from here, or if corporate earnings soften as a consequence of a deteriorating macro environment, that the markets will necessarily fall in tandem. The forward-looking market may instead rise in anticipation of an eventual economic recovery.

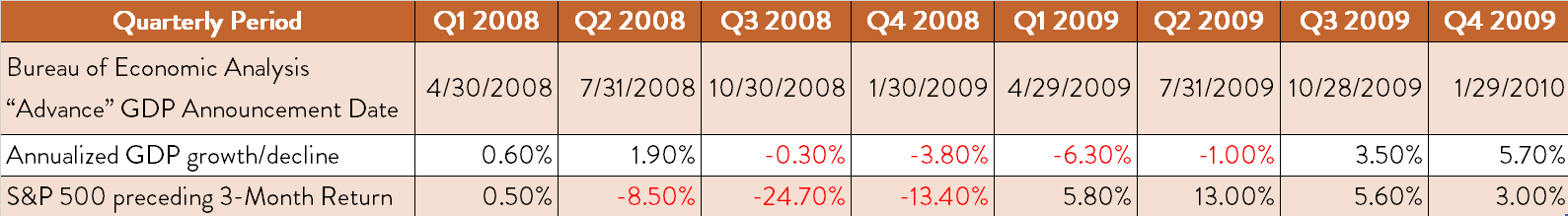

As an example of this phenomenon, we think it is useful to go back to the period surrounding the Global Financial Crisis in 2008 and 2009, the most fraught economic period in the United States since the Great Depression. Most of the market damage was done prior to the first announcement of a quarterly decline in economic output. When the economy was performing at its worst, in Q1 of 2009, the stock market rose.

Source: Bureau of Economic Analysis press releases & Bloomberg

The important thing that we note, as we have been through many market cycles like the one illustrated above, is that it is very difficult to make predictions about future market directions by reading the tea leaves of contemporary events. We have perfect clarity when looking backward in time, but little visibility looking forward. Seeking safe harbors as storm clouds appear on the horizon works when navigating the high seas, but this tactic doesn’t necessarily help the investor. It may in fact hurt the investor, given the tendency of markets to look well over the horizon.

Consequently, we are not predicting that the volatility we’ve experienced in the markets is necessarily behind us. We always feel that investors should be prepared for adversity regardless the current economic backdrop. This is best accomplished, in our opinion, by avoiding speculative impulses and stay rooted in both Quality and Value. “Quality” has both objective and subjective elements, so we think it is useful to describe what we mean by the term when we are considering a new investment for the portfolio or monitoring our holdings. The below “Business Quality Checklist” is not exhaustive, and quality businesses do not necessarily need to meet all of the criteria, but this list helps us decide whether a business is worth our consideration, provided it also is available in the markets at a price that represents good “value.”

Summitry’s Business Quality Checklist

Market Characteristics

- The addressable market is sufficiently large and growing faster than GDP.

- The industry has high barriers to entry due to network effects, brand loyalty, patent/regulatory protection, switching costs, or sustainable input cost advantages.

Company Characteristics

- The company is an industry incumbent that holds significant market power or is a disruptor/innovator in a changing industry.

- The company enjoys significant scale advantages relative to its competitors, is a platform company on which other companies build their own businesses and serve their own customers, or is an aggregator of customers for other businesses.

- The company enjoys high customer retention rates due to its unique and essential product or service, high switching costs, or long-term contractual agreements.

- The company can raise prices without leading to significant customer loss or can lower its prices over time without hurting profitability.

- The company can reinvest capital at a consistently high rate of return due to a combination of market characteristics, focused M&A that reinforces its moat, and strong execution.

- The company has a symbiotic relationship with its suppliers, who are diversified across regions.

- The company has a long history of delighting its stakeholders, which includes customers, employees, suppliers, and shareholders.

- The company is a responsible citizen, doing well while doing good.

Notwithstanding the constant change in economic backdrop, quality businesses we seek tend to demonstrate most if not all the above characteristics. Their near-term fortunes can’t completely escape macro reality, but they tend to ride through adversity better than companies that do not possess these qualities, and are more quick to recover when the environment improves. Declines in market prices are painful, but they create opportunities to acquire businesses that possess quality and durability at more attractive prices.

Q2 Portfolio Changes

Please keep in mind, these commentaries should not be construed as a recommendation to buy or sell the securities discussed. Such decisions are made only within the context of the market environment as we perceive it at the time of the decisions and the structure of the diversified portfolio of which the securities are a component.

During the quarter we initiated a new position in Amazon and sold our position in Booking Holdings.

Amazon

“Be greedy when others are fearful” – Warren Buffett.

Amazon is the undisputed leader of ecommerce. Hundreds of millions of people and businesses around the world rely on “The Everything Store” for their daily needs. Amazon benefits from unmatched scale, switching costs, and network effects. We think these exceptional advantages will propel the business for years to come.

What’s less appreciated is Amazon’s leadership in cloud computing. Amazon pioneered the cloud industry by offering hyperscale computing power to any business with a credit card. Today, Amazon is the largest cloud services provider globally, and together with Microsoft, and Alphabet dominates this critical industry. Cloud computing is growing quickly because more and more corporations outsource their tech infrastructure to third parties. Like with the ecommerce business, Amazon’s cloud computing business benefits from scale and switching costs. It also generates sticky and attractive revenue and high profits for shareholders.

Amazon’s business benefitted from the pandemic, and the stock followed suit. But since the beginning of the bear market many “pandemic winners” saw their stocks cut by half or worse. Amazon wasn’t spared and the stock has declined by more than 30% year-to-date. Some of this decline was driven by general market sentiment, but part of it is because investors are concerned Amazon suffers from overcapacity in its ecommerce business. Regardless of the reason for the selloff, fear is abundant. We thought it was time to be greedy.

Booking Holdings

Booking Holdings operates an online travel agency helping families book their dream vacations. Owning the stock over the past five years was more like a vacation gone bad. We initially bought the shares because we were attracted to Booking’s dominant position in Europe, and the network effects embedded in its business model. We thought the business is well shielded from competition and expected it to keep growing at a healthy pace for many years.

And then came the pandemic and disrupted global travel. Booking’s revenue in the second quarter of 2020 was down a whopping 84%. Few businesses can survive such a sharp drop in volume, but Booking isn’t your average business. Revenue is now trending well above pre-pandemic levels, which is a testament to the quality and resiliency of the business. Nevertheless, we concluded that we have better opportunities and decided to exit the position and reallocate the funds to more attractive names.

New Additions to the Summitry Team

During the quarter, we welcomed three new members to the Summitry family, Carissa Yen, Alisha Sinha and Jaime Kauble.

Carissa Yen joined Summitry in April as a Financial Planning Associate, to provide advisory and planning support for the firm’s Advisors and as a builder of comprehensive financial plans for clients of the firm. Carissa joined us from a San Jose-based boutique investment advisory firm, where she gained experience and honed her skills as a Financial Paraplanner Qualified Professional (“FPQP™”). Carissa is a graduate of University of California, Santa Cruz, where she earned her Bachelor of Arts degree in Anthropology, and is native to the Bay Area. She is a traveler, a baker and a gardener in her spare time.

Alisha Sinha joined Summitry in the role of Business Development Associate, helping the team engage with new and prospective clients, organize efforts with our partners at Charles Schwab and elsewhere to ensure that the experience of becoming a Summitry client is smooth and efficient. A graduate of California Polytechnic State University, San Luis Obispo (“Cal Poly”) with a Bachelor of Science degree in Business Administration, Alisha has had a fascinating professional background in M&A advisory services for RSM, and in legal case analysis for the alternative asset management firm, Legalist. Alisha is an avid reader and a loving cat owner.

Jaime Kauble serves as the firm’s Office Administrator, handling the complex and growing needs of a 40+ person organization. When you meet Jaime, you will know why we have her seated at the front desk, in a position to meet and greet the important people who walk through our front door. With years of client services and event coordination roles in hospitality industries, including at golf clubs in Northern California, Jaime knows how to deliver great customer satisfaction and client experience. She has also served some really tough customers, as a local elementary school teacher. Jaime graduated from University of California, Santa Barbara with a Bachelor of Arts degree in Sociology. A resident of San Mateo, Jaime enjoys hiking, spending time with family and friends, caring for her dog and traveling.

The Office is Open

As was suggested in the previous paragraph, the office is open and we are hosting clients and friends in meetings in our conference rooms. We have gained a lot of proficiency with the use of Zoom to conduct meetings, but we have also noticed that there is something intangible gained from old-fashioned face-to-face connections. We would be delighted and honored to have you pay us a visit in our offices for your next meeting with our Financial Advisors.

We look forward to speaking with you, please drop us a note or give us a call.

Past performance is not indicative of future results. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. An index is a hypothetical portfolio of securities representing a particular market or market segment used as an indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer