Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Why Summitry

We admit it. Our approach to wealth management is different. We’ll work with you to develop a financial plan based on your goals and desires and build a customized portfolio to support those goals while offering complementary investment strategies if you’re inclined to higher risk / higher reward options. Our team and resources are at your disposal at every step of your journey.

Here’s how Summitry is different:

Unique Investment Philosophy

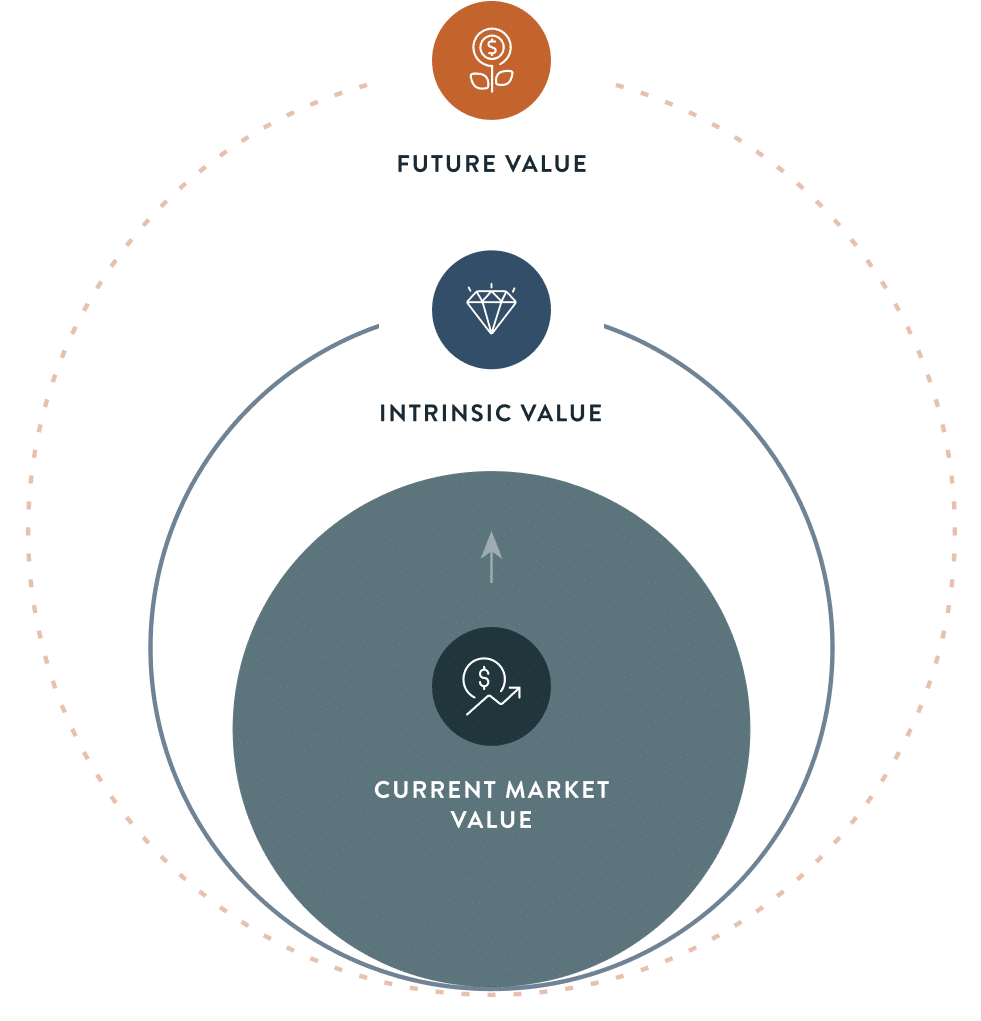

We are not passive investors, top-down asset allocators or macro trend speculators. Rather, we are active investors in assets that we determine are high-quality and well-priced relative to their “intrinsic value.” Investing well requires attention to the details, an understanding of how intrinsic value is created and preserved, and an eye toward managing downside risk.

Since Summitry’s founding, common stocks have comprised the core of our offering. Our investment team is dedicated to doing the rigorous research and continuous monitoring required to identify and invest in companies that meet our guidelines, which means they have:

- strong competitive advantages

- competent, shareholder-friendly management

- favorable long-term growth prospects

- trade in the market at a price materially below the investment team’s calculation of underlying intrinsic value

Comprehensive Investment Strategies

Our Core Strategies form the foundation of our client portfolios. This foundation is managed by our in-house research and investment team, adhering to our intrinsic value investing philosophy.

Summitry Explore Strategies expand the investment offering to provide broader access to the global capital markets, including liquid (public markets) and alternative investments. For Explore, we delegate authority to best-of-breed, third-party manager teams that share Summitry’s intrinsic value investing philosophy. The selection of managers is subject to deep due diligence of their team, processes, and historical results through market cycles.

Core Equity

Designed to generate strong total returns over a market cycle, our Core Equity approach at Summitry focuses on investing in high-quality businesses with strong competitive advantages, deep customer relationships, and significant growth potential. By purchasing these businesses at a discount to their intrinsic value, we provide downside protection in volatile markets while positioning our clients for long-term upside as earnings growth drives stock appreciation.

Select Equity

Designed to seek excess returns over a market cycle, this strategy focuses on a concentrated portfolio of 10–15 of the highest-quality, fastest-growing businesses in our Core Equity coverage universe. The strategy prioritizes select opportunities with the greatest long-term potential. With less diversification across economic sectors and business models, this approach is best suited for clients who have both the capacity and appetite for higher risk in pursuit of enhanced returns.

Dividend Growth Equity

Designed to generate a growing dividend stream with capital appreciation, this strategy focuses on high-quality, dividend-paying stocks. It seeks to provide reliable and growing income, help protect against inflation, and offer long-term growth, making it ideal for retirees, fiduciaries, and income-focused investors. It is also suitable for clients who seek broader diversification across their Core equity allocations.

Fixed Income

Designed to produce income and preserve capital, our approach offers taxable and tax-exempt solutions tailored to client needs. We invest in a diversified mix of bonds and other fixed income securities, structuring portfolios with a conservative approach to balance tax treatment, cash flow, and risk. This strategy aims to maintain principal, hedge equity exposure, and generate reliable income.

Liquid Explore

Designed to provide exposure to underrepresented market sectors in our Core strategies, our liquid Explore sleeves expand opportunities in areas like small-cap domestic equities and international markets. We partner with third-party managers who share Summitry’s intrinsic value philosophy and have a proven track record of strong, consistent performance through market cycles.

Alternatives

These strategies provide clients with access to private markets, including real assets, private equity, and private credit. The strategies seek to deliver returns through income and capital appreciation that are uncorrelated with our clients’ stock and bond investments. We partner with top-tier managers who share Summitry’s intrinsic value philosophy and have a strong track record of performance through market cycles.

Customized Portfolios

Through a combination of conversations and sophisticated software tools, we’ll determine your investment objectives and current level of risk tolerance, taking into consideration your time horizon, cash flow needs, and growth objectives.

We use objective-based portfolio strategies as a starting point to allocate your accounts across liquid equity and fixed-income securities. Then, customize the portfolio according to your current holdings, concentrated stock positions, or other personal desires.

Exceptional Client Experience

A Unique Approach to Wealth Management

At Summitry, our firm is structured such that each member can focus on their domain of expertise, contributing to a unique client experience.

As our client, you will be paired with an advisory team suited to your personal attributes. Each advisory team has a Lead Financial Advisor and an Associate Financial Advisor. You will also be supported by our Operations, Investment, Onboarding and Strategy teams. You will also have access to our professional centers of influence, such as attorneys, accountants, consultants, and more.

Meet your New Team

We'll assemble a talented team like this one to support your goals.

1

Colin Higgins

Chief Executive Officer

Cynthia Duncan

Senior Financial Advisor

Daniel Spector-Franson, CFP®

Financial Advisor

Demia Edwards

Lead Client Service Specialist

Meet the Team