Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Understanding Roth IRA Limits and Conversion Strategies

May 29, 2024

Individual Retirement Accounts (IRAs) have long been a tool to save money for retirement on a tax-deferred basis. When contributing to a traditional IRA most taxpayers get a deduction for the amount contributed. The funds then grow within the IRA free of taxes on interest, dividends, and realized capital gains. When funds are withdrawn from a traditional IRA they are generally taxed as ordinary income. Sub-types of traditional IRAs include IRA rollover accounts, contributory IRAs, SEP IRAs, and SIMPLE IRAs.

Roth IRAs are a distinct type of IRA created by the Taxpayer Relief Act of 1997. They differ from other IRA types in that contributions are not tax-deductible, however, funds withdrawn in retirement are not subject to tax as ordinary income. Like other IRA types, as funds grow within a Roth IRA they are not subject to interest, dividends, or capital gains taxes.

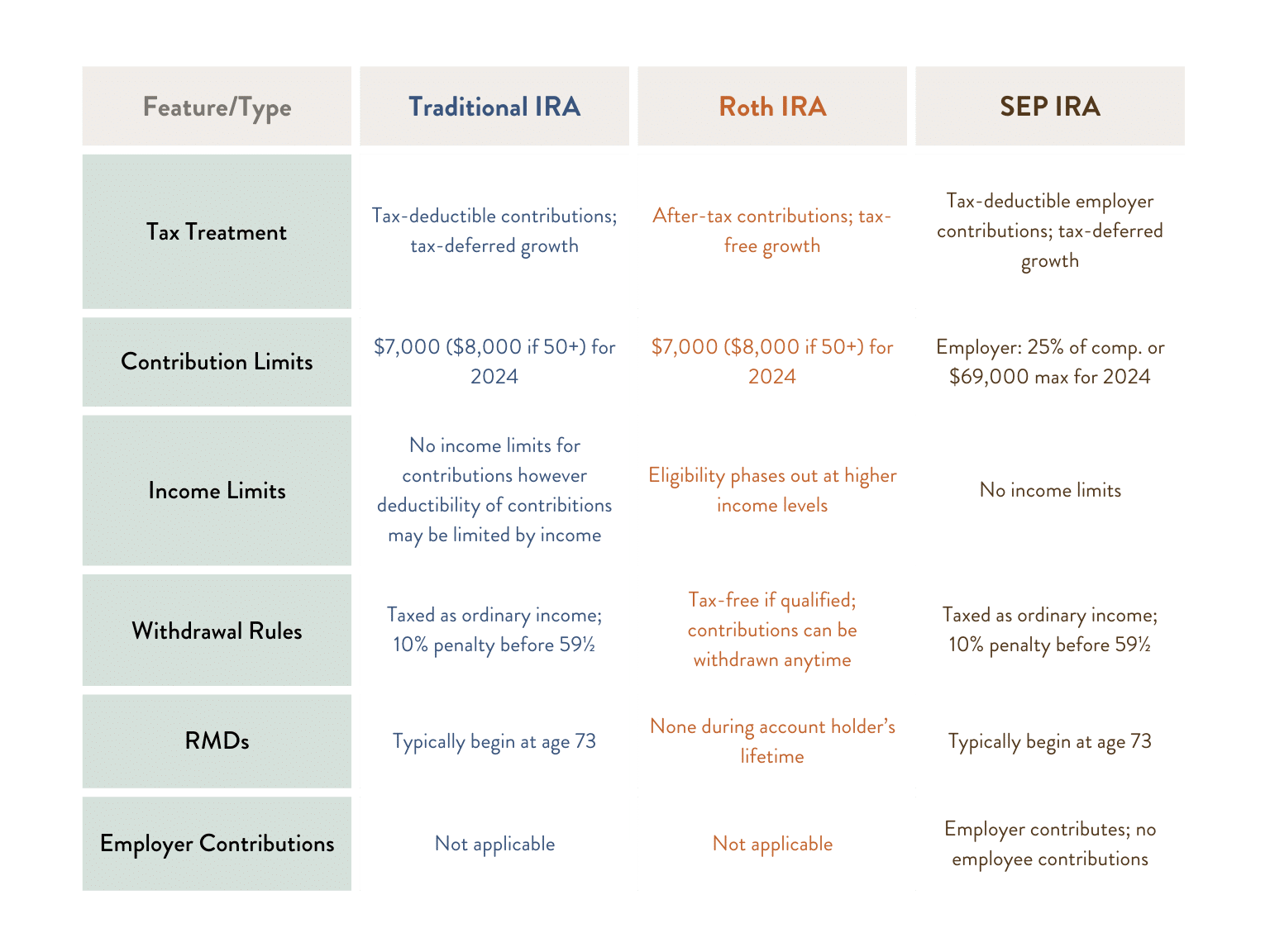

Common IRA Types at Glance

Source: Ken Vander Kooi

2024 Roth IRA Contribution & Income Limits

All IRA accounts are subject to certain limits on contributions. In 2024 the IRA contribution limit is $7,000, with an additional $1,000 “catch up” contribution allowed for taxpayers aged 50 or over. Also, it is worth noting that beginning in 2025 the total contribution limits will be increased to $10,000 for taxpayers between the ages of 60 and 63.

While contributions to Roth IRAs are not tax deductible, there are income limits based on MAGI (modified adjusted gross income) which determine your eligibility to contribute directly to a Roth IRA. MAGI is your adjusted gross income plus an “add back” of certain deductions. These deductions include student loan interest, half of self-employment tax, IRA contributions, and more. In 2024, if you are filing single or head of household your MAGI must be below $146,000 to contribute the maximum allowed ($7,000 in 2024 or $8,000 if over 50). From there contribution limits are reduced until no contribution is allowed at MAGI of $161,000 or more. If married filing jointly, in 2024 the maximum contribution is allowed at MAGI below $230,000, and no contribution is allowed if MAGI is $240,000 or more.

Strategy for Roth Conversions

The IRS allows taxpayers to convert funds from traditional IRAs to Roth IRA format without limits on income or limits to the amount converted. This allows taxpayers who might not be allowed to directly deposit funds to a Roth IRA to contribute by converting funds. It should be noted that the IRS treats any amount converted as ordinary income in the year of conversion, and federal and state taxes may be due based on that ordinary income.

When funds are distributed from a Roth IRA after age 59 1/2 they may be free of income tax. Also, Roth IRAs are not subject to minimum required distributions and thus funds can be kept in the Roth IRA for a longer period to grow free of tax. When considering conversions there are generally a couple of factors to consider including age, timeline for needing funds, cash available for paying taxes incurred on conversion, and current and expected future tax rates.

With regards to age at the time of conversion, the IRS does not place restrictions on conversions at any age. It should be noted however that amounts converted to Roth format are not counted toward meeting your required minimum distribution (RMD), those must be satisfied separately. In terms of strategy, generally, the longer you have before funds will be needed from the Roth IRA the more advantageous the conversion can be. This is because of the power of compounding investment gains and income within the Roth IRA are free from taxes. The same reasoning typically applies to the amount of time before funds are needed from the Roth, with longer timeframes increasing the benefit of converting funds.

Another factor to consider when thinking about converting funds is your current versus expected future marginal tax rates. Generally, the thinking is that if current marginal tax rates are below expected future marginal rates (particularly at RMD age), conversion becomes more attractive. The idea in that scenario is to fill your current marginal tax bracket with conversion income, taking advantage of the lower rate now as compared to a higher rate on income at the time of expected withdrawals or RMDs. It should be noted that the IRS does not allow you to “undo” conversions, so often it is suggested that you plan early for conversion but wait until you near year end to enact the plan as other income items could change unexpectedly before year end.

Finally, when looking at possible conversions you will want to consider available sources of cash to pay for the tax due on the conversion. While you can take a distribution from your IRA to pay the tax without penalty if you are over 59 ½, doing so will further increase your taxable income and may reduce the ultimate benefit of converting funds. If cash is available outside of your retirement accounts to pay the tax on conversions, using those funds may be preferable.

Should I Convert Funds to a Roth IRA?

Roth IRAs can be a powerful tool to save funds for retirement in a tax-advantaged manner. While there are restrictions on contributions to Roth IRAs based on income and limits to the amount that can be contributed, the IRS does allow for the conversion of funds from traditional IRA accounts to Roth IRA format. While we have discussed some of the factors to consider when thinking about conversions, it is recommended that you speak with both your financial advisor and your CPA to fully understand the ramifications of a conversion specific to your situation. If you have any questions or would like to further explore a possible Roth conversion, please contact your Summitry financial advisor.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President