Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Unlocking Wealth: Using Charitable Remainder Trusts for Diversification

Jun 14, 2024

How Bay Area Tech Employees Can Use Charitable Remainder Trusts to Diversify Stock Holdings and Secure Retirement

Bay Area tech companies are famous for offering equity as a significant part of their compensation packages, allowing employees to participate in the growth of the business. While focusing on building their careers and spending most of their cash compensation, dedicated tech employees often find themselves with most of their liquid assets inadvertently tied up in one or a few company stocks where they work or used to work. These stocks can be very volatile and may not generate much income, if at all. They also likely have a very low-cost basis, resulting in a sizable tax liability when they are sold, particularly when the individual is still working and is already in the highest tax bracket. It is very common for us to meet prospective clients with portfolios worth tens of millions of dollars, comprised of a few tech stocks, who feel cash-poor and uncertain about when or if they can retire.

If you are one of these individuals, a Charitable Remainder Trust (CRT) can be an effective vehicle to convert your low-basis concentrated position into a diversified, income-generating pool of assets to replace your paycheck and fund your lifestyle for life. For many of our clients, creating and funding a CRT with a portion of their low-basis concentrated holdings helps solve a piece of their retirement puzzle and gives them the peace of mind to continue taking risks and building their wealth.

How Does a Charitable Remainder Trust Work?

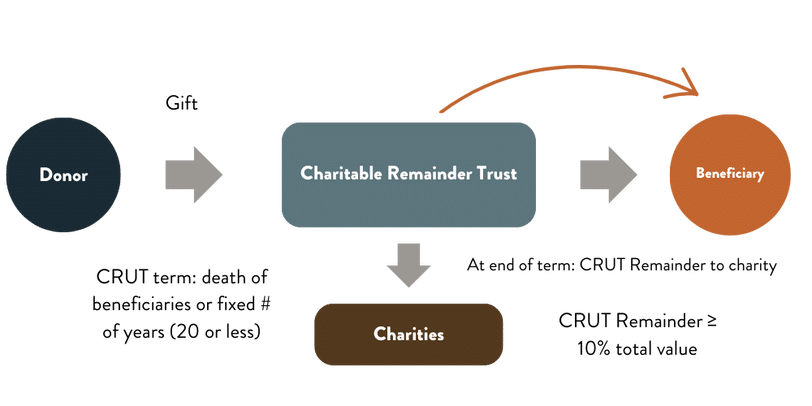

You initially fund the CRT with low-basis, highly appreciated assets. When the CRT sells these highly appreciated assets, the CRT itself, as a tax-exempt entity, is not subject to capital gains tax, thus preserving the full value to reinvest in a diversified portfolio. The CRT can be set up so that the trust will distribute a percentage of its balance to you and your spouse (the beneficiary/ies) for the rest of your life. The capital gains taxes will be spread out and payable as you receive payments from the CRT.

You will also receive an immediate charitable income tax deduction in the current year, as an added bonus. The value of the charitable deduction will depend on the distribution percentage, current interest rate, and distribution period or beneficiaries’ age in the case of lifetime distribution.

Figure 1: Workflow of a Charitable Remainder Unitrust (CRUT).

A Client Success Story: Dave and Kate Hamlin

Take our clients Dave and Kate Hamlin* as an example. They are in their early 50s; Dave has been working with NVIDIA, and Kate has been working for Cisco for a long time. They both held on to most of their stock grants over the years. Money has always felt tight as they live off their cash compensation while raising their two daughters in the Bay Area. Besides contributing to their 401(k)s, they have not been actively saving for their retirement. With the recent run in NVDA stock, Dave’s NVDA position is now valued at over $30 million, with less than $1 million cost basis.

Working with a Summitry advisor, Dave and Kate decided to establish a Charitable Remainder Unitrust (CRUT) and funded the trust with $5 million worth of NVDA shares with the lowest cost basis. Since they plan to work for at least another four years, the CRUT is structured to pay only net income (dividend and interest) to Dave and Kate for the next four years and start the full 6% distribution in year five. We anticipate that by that time, the CRUT balance will have grown to over $6 million and will start paying them about $360,000 per year ($30,000 a month) for the rest of their lives.

This strategy allows them to diversify a significant portion of their NVDA position without any immediate tax liability, and they also get over $600,000 in charitable deductions to offset their ordinary income, which in their tax bracket translates into about $300,000 in tax savings. Taking advantage of the write-off, Dave and Kate decided to sell about $2 million worth of NVDA shares outside of the trust. They are planning to use the proceeds to purchase a vacation home in Santa Cruz. Dave and the kids love to surf!

If Dave and Kate had sold the $5 million low-basis NVDA shares outright, they would have been hit with a $1.7 million tax liability on the capital gains and wouldn’t have the $300,000 tax benefit from the charitable deduction. The strategy works because the CRUT allows them to reinvest $2 million in tax money, spread the tax bill over their lifetime as they receive the payments, and essentially create a “pension” for themselves. Additionally, they will likely be in a lower tax bracket when they take distributions, which means that the deferred gains might be taxed at a lower tax rate.

*Dave and Katherine Hamlin are fictitious names, but the scenario described is based on actual client experiences.

Potential Concerns and Added Complexities

While a Charitable Remainder Trust can be a powerful tool to unlock the value of your concentrated stock positions in a tax efficient manner, it does create additional complexities that you should be aware of:

Irrevocability: Once the CRT is established and funded, the contribution is irrevocable. It is important to determine the appropriate amount in the context of a comprehensive financial and estate plan.

Complexity: Setting up and funding a charitable remainder trust is only the first step. There are additional ongoing reporting requirements that must be met throughout the trust’s duration to maintain its tax-exempt status.

Costs: In addition to the initial costs of establishing the entity, the trust will also require tax reporting on an annual basis. These expenses could make a charitable remainder trust impractical for smaller contributions.

Conclusion

A Charitable Remainder Trust can provide both immediate and long-term tax benefits, a reliable income stream, and the opportunity to make a lasting impact by supporting a worthwhile charity in the process. A Summitry advisor can help you understand if a CRT is the right solution for you and your family and put together a team of qualified professionals to guide you through the added complexities.

The client stories featured are provided for illustrative purposes only and are not representative of all clients’ experiences or results with Summitry. Individual results vary based on each person’s unique circumstances, goals, risk tolerance, and other factors. This article is for informational purposes only. Summitry, LLC does not provide tax advice. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer