Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Fostering Economic Prosperity: A Post-Election Wish List

Nov 25, 2024

The recent election has spurred a lot of emotions and raised a range of questions among clients. Elections are important because they shape policies that impact us, directly and indirectly. Policy can also have broader ramifications for the things that matter to us as investors in stocks and bonds. We note there can be a wide gulf between shaping policy and enacting policy because in our system of government, checks and balances exist that require compromise.

Following inauguration, House and Senate committees will convene to draft laws to enact policies espoused by the Trump administration and the majority Republican party. Without a doubt, there will be some stark changes from the most recent past, not just in tone but also in substance. As investors and stewards of our clients’ wealth, we need to consider these changes and their impact on our stock and bond holdings.

We tell our clients that a key advantage of owning exceptional businesses is their ability to adapt better than most to changing circumstances. However, some changes can benefit all businesses. With the election behind us, we have compiled a wish list of policies that can foster broad economic prosperity and will be welcomed by all investors, regardless of political affiliation.

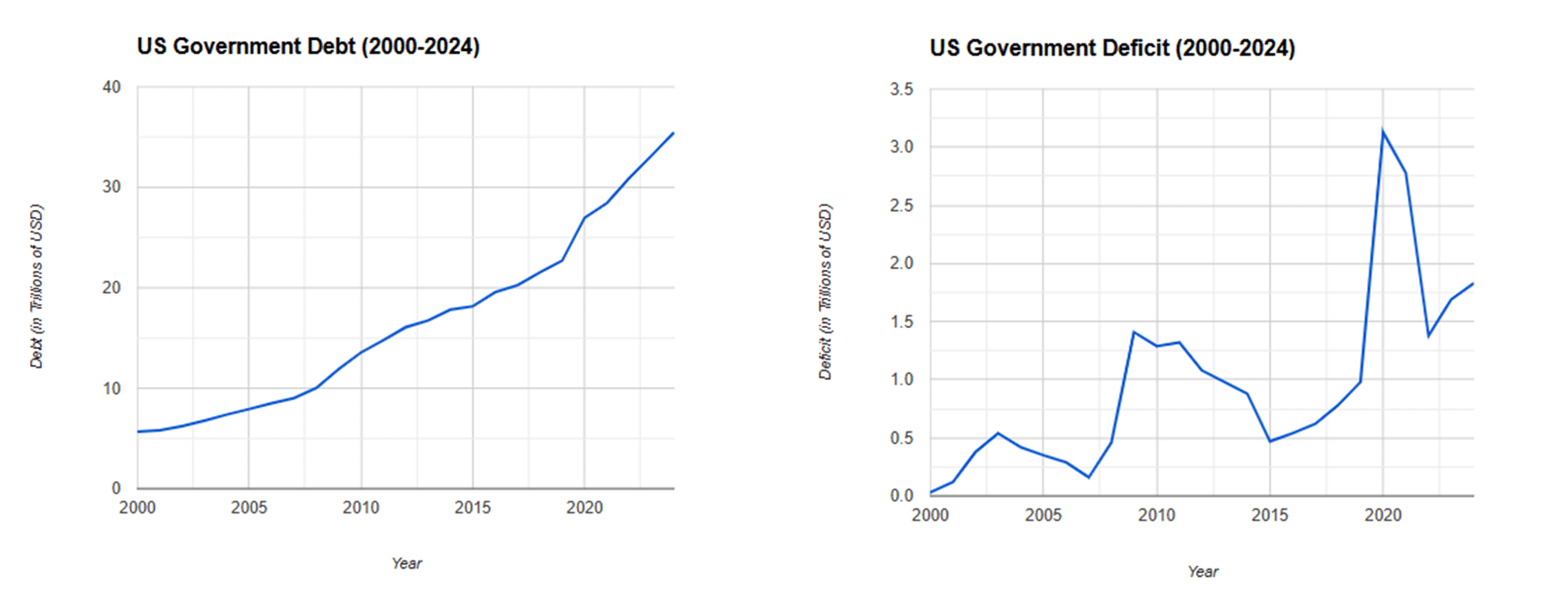

Tackling the Deficit: A Path to Economic Stability

The ballooning deficit and national debt are economic headwinds. The last time the US government had a budget surplus was in 2001. Since then, the US government debt increased 5.8x and the ratio of government debt to GDP increased from 55% to 120%. Higher levels of indebtedness force the government to channel tax revenues to service bond interest and principal rather than to projects that have societal benefit. Federal debt service is growing faster than government tax revenues, exposing the country and the US dollar to interest rate and economic shocks. It is no secret in Washington that the policy of deficit spending at the current rate is unsustainable over the long run.

Source: Charts created by Gemini using data from US Treasury Department, Congressional Budget Office, Federal Reserve, Office of Management and Budget

Source: Charts created by Gemini using data from US Treasury Department, Congressional Budget Office, Federal Reserve, Office of Management and Budget

Nevertheless, every administration since 2001 has failed to address this problem. Will the new administration be any different? We don’t know, but we are encouraged by the renewed focus on this problem through the establishment of the Department of Government Efficiency (“DOGE”). Getting the deficit back in check and reducing the growth of the national debt will be net positive for economic activity, and as a result, corporate earnings. DOGE will likely have modest impact in terms of dollar savings relative to the size of the Federal budget unless it takes on entitlement programs (unlikely), but if it ushers in a change in culture, then it will be a success, and investors will applaud.

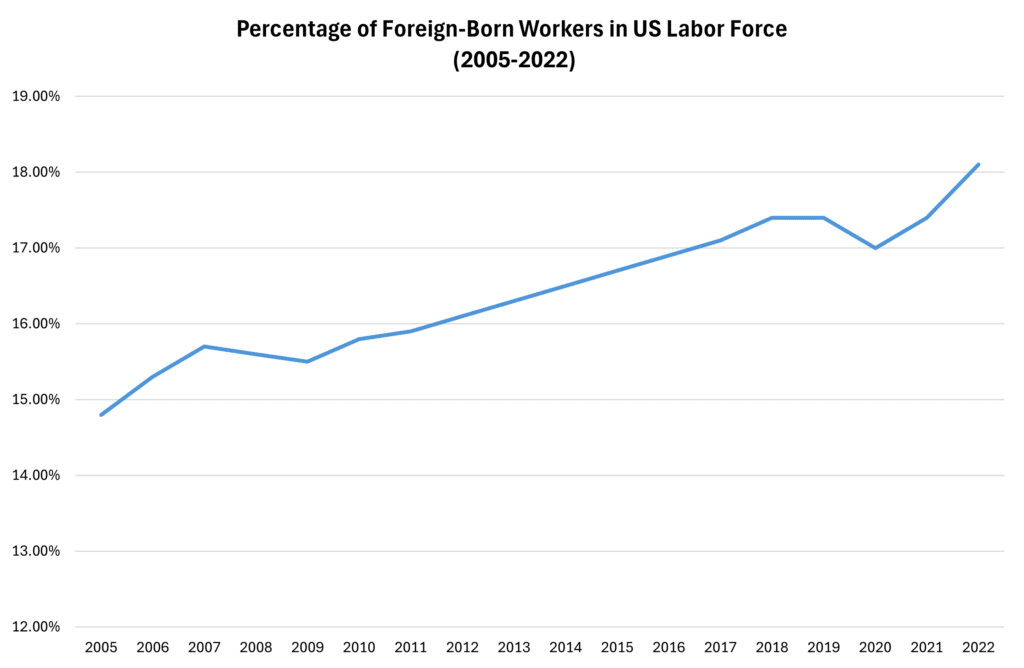

Immigration Reform: Fueling Economic Growth through Talent

Politicians in both parties concur that our current immigration system is broken. While much of the political debate focused on the southern border, many talented professionals, college graduates, and entrepreneurs are stuck in the bureaucracy clog. Our ask from the incoming administration is to reduce barriers for skilled, law-abiding professionals to come to this country and become positive contributors to the economy.

Source: Charts created by Gemini using data from the Bureau of Labor Statistics

Several of our portfolio holdings are led by talented managers that immigrated from another country. For example, the CEOs of Alphabet and Microsoft were born in India. There is no better region in the country than the Bay Area that demonstrates how much economic value can be created with sensible immigration policy. We would love to see the incoming administration address this issue head on.

Ending Trade Discrimination: Leveling the Global Playing Field

US businesses are being discriminated against by other countries. Visa and Mastercard cannot operate freely in China. Google and Facebook are banned in China. The European Union has passed laws targeting most of the tech companies we own. The Digital Markets Act (DMA) that regulates large online platforms in Europe includes many provisions intended to promote competition. However, certain provisions have been interpreted to require companies like Google and Meta to degrade their services, offering less personalization and inferior user experiences to prop up ailing competitors. While many of these rules seem absurd from an American perspective, Europeans certainly have the right to regulate their markets however they see fit. However, the European Union accounts for about 10% of revenue at Meta and less than 7% of revenue at Apple, so why should the United States accept a DMA that allows foreign regulators to fine American companies up to 10% of their global revenue, a number that is many multiples of revenue earned in the European Union, for business decisions that are entirely acceptable in other regions?

Regardless of where one stands on tariffs, as investors we welcome actions that level the playing field for American businesses abroad.

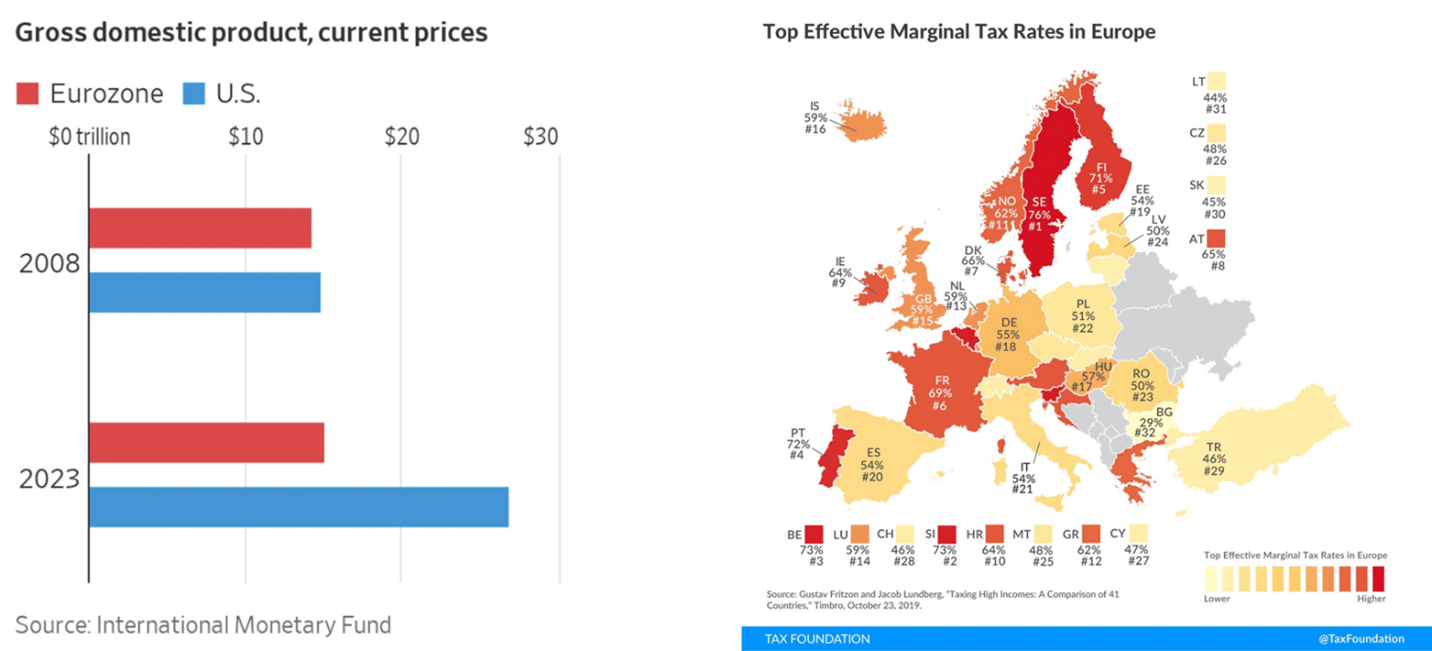

Deregulation & Tax Reform: Boosting Innovation and Growth

Rules, regulations, and taxes are essential to sustain modern societies but too much of anything positive can be harmful. Excessive regulations stifle innovation and increase costs. High taxes weigh on economic activity, limit investment, and hinder job growth. Just look at Europe compared to the US over the past 15 years. High taxes coupled with an extreme bureaucracy resulted in slow economic growth and talent flight to the US.

The incoming administration will seek to make the 2017 tax cuts permanent in order to maintain our relative advantage to other economies. As noted earlier, Senate rules will require consent from several Democrats, but we are fairly confident that most elements of the plan will be enacted. Additional tax cuts and shedding unnecessary rules could be positive for economic growth and corporate earnings.

Conclusion

Our wish list isn’t a prediction. We don’t know if the incoming administration will choose to pursue any of these goals, despite promises on the campaign trail. The businesses we tend to own will adapt to any outcome, but we remain hopeful that the administration will pursue some of these goals, as a rising tide lifts all boats.

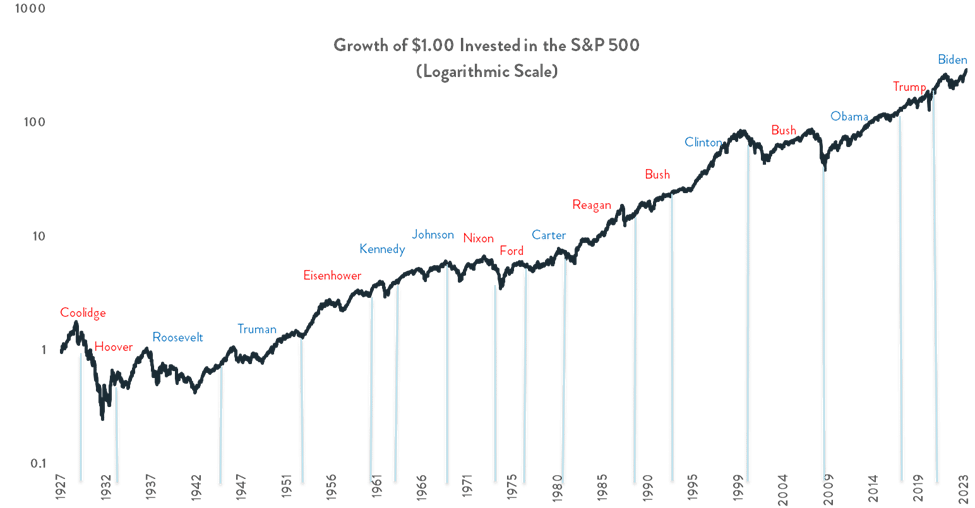

Long term investors are likely to approve our policy wish list, but they shouldn’t be overly concerned if the administration fails to act on it. As history has demonstrated, businesses continue to grow in value, regardless of who holds the power in Washington, D.C.

Interested in learning more about our insights? Contact us today!

The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Past performance does not guarantee future returns. Investing involves risk of loss.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President