Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Why We Sold Our Apple Stock

Aug 28, 2020

Selling Apple Stock

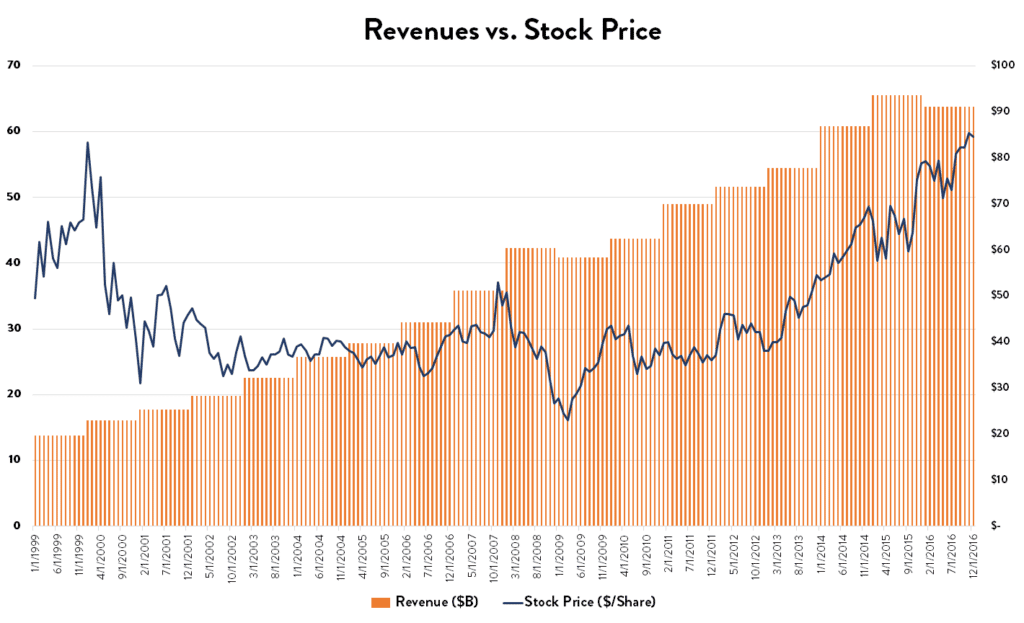

This week, after 8 years of owning the stock, we sold out of our position in Apple. Our initial investment thesis was that Apple had become a premium brand desired by consumers. The smartphone industry was benefiting from growing penetration around the world, and Apple was well-positioned to benefit. Our investment thesis evolved over the years as Apple built a powerful ecosystem around its devices and pursued new areas of growth in wearables and services, which expanded its economic moat. Today, the future of Apple looks promising. The number of iPhone users will keep rising and users will spend more on Apple’s services and devices. We are almost certain that the business will be worth more in the future. So why did we sell our Apple stock?

Selling a great business is always a tough decision. Great businesses tend to generate high returns on invested capital, which means they need to reinvest less of their earnings to generate the same level of growth compared to inferior businesses. A great business benefits from sustainable competitive advantages, which results in more stable financial performance. And from an investment perspective, it is very difficult to replace a good business in a portfolio. Research takes considerable time and effort. It might take years to build the knowledge base necessary to buy with conviction. Good businesses also tend to be expensive, and attractive buying opportunities are rare. For these reasons, when we find a great business, our preference is always to hold on to it for as long as possible.

Stock Price vs. Value of the Business

But at a certain price, even the best business will be a bad investment. To quote Warren Buffett, “price is what you pay, but value is what you get.” Paying too much for any business will result in poor returns. A prime example is Microsoft. In 1999, Microsoft was the most dominant technology company in the world. The business was growing at a rapid pace and appeared unstoppable. Buying Microsoft stock in 1999 seemed like a safe bet.

It turned out to be a terrible investment if bought in 1999. After touching $60, Microsoft stock lost more than two-thirds of its value, bottoming at $14, even though the business continued to grow and increase in value. It took the stock 17 years to get back to $60. We are very patient investors, but 17 years…

Microsoft was a great business in 1999, but a terrible investment because the stock price was too high relative to the value of the business. We feel the same way about Apple. To be clear, we are not making a call on the direction of the stock. Apple’s stock does not have to follow the path of Microsoft after 1999 and Mr. Market can keep bidding up the stock price for years. What we are making a call on is the value of Apple’s business. In our view, its value is far below its current stock price.

Probability of Outcomes

The future is uncertain, which is why we like to think of it as a range of potential outcomes. We stress test our businesses for tough economic conditions, poor execution by management, and increased competition. Our favorite price to pay for any business is with a discount to what we consider the worst-case scenario. The less you pay, the higher your expected return and the lower your chance of losing money if things go wrong.

In addition to worrying about what could go wrong, we also think about what the business would look like firing on all cylinders. In this scenario, we envision all the factors that can result in a very positive outcome. We feel safe paying a price equal to our worst-case scenario but as the price goes up, our safety net erodes and expected returns contract. If the stock price exceeds our best-case scenario by a considerable margin, the probability of generating a positive return is much lower. In order to stack the probabilities in our favor, we prefer to buy at the “worst-case” price and will consider selling at the “best-case” price.

Process

Accurate assessment of possible future outcomes is critical. To achieve it, we put in place a rigorous process that takes into account all points of view before reaching a decision. The sale of Apple stock was preceded by many hours of team discussions, modeling and stress testing, and other research. Selling Apple stock was not an easy decision.

Final Thoughts

Apple is a great company and has been a great investment for our clients. However, we sold the stock because it became significantly overvalued. While we are always willing to hold on to great businesses indefinitely, we cannot justify holding a position when the stock price materially exceeds our fair value estimate in the best-case scenario. At $500, Apple stock trades at almost 40x earnings, a valuation that assumes nothing short of perfection. We are confident the business will continue to benefit from growth in loyal users, who will keep upgrading their devices and spend more money on services within the Apple ecosystem, but the stock market appears to be ignoring some major risks:

- The market appears to ignore the fact that much of the services revenue growth is tied to iPhone sales, which are unlikely to accelerate over the long run.

- Only a few months ago investors were terrified by the possibility of US and global regulators taking anti-trust enforcement actions against big technology firms. This risk is very real, and there is consensus among many prominent venture capitalists and tech leaders in Silicon Valley that some of Apple’s practices are anti-competitive. While anti-trust concerns continue to mount, investors in Apple stock appear to be heavily discounting the potential impact on Apple’s App Store and services revenue. We think this is a mistake.

- Apple has significant exposure to China. Most of Apple’s products are assembled in China, and the country is an important growth market for iPhone and services. Import bans, boycotts, new App Store regulations, or other actions to restrict trade put Apple at risk.

Selling a great business is difficult but necessary when the probability of generating a positive return is very low. The market rewards discipline and patience, and like the Microsoft example, we may get an opportunity to buy Apple stock again in the future.

Interested in learning more about our investment philosophy? Contact us today!

The securities identified do not represent all of the securities purchased, sold or recommended for client accounts. Nothing in this article constitutes investment advice or a recommendation that any particular strategy is suitable for any specific person.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Jack Zhao, CFA®

Senior Equity Analyst & Portfolio Manager of Explore Strategies