Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Assessing Q1 2023: Growth Stocks Rebound, Safe Havens Lag

Apr 13, 2023

Q1 2023 Quarterly Commentary – April 1, 2023

The first quarter of 2023 offered a continuation of 2022’s volatility, with 29 of the quarter’s 62 trading sessions (46%!) closing plus or minus one percent versus the prior day’s close, and it featured a short period of market turbulence in March when Silicon Valley Bank and two other regional banks experienced runs by depositors and failed. Although the SVB failure was the second largest in history, in the end, investors judged the problems with those institutions as not being systemic, allowing the market to finish the quarter in the black. The S&P 500 provided a total return, with dividends, of +7.5%. The positive results were driven disproportionately by large growth stocks, rebounding from a difficult 2022. The NASDAQ Composite Index, which is dominated by these names, logged a strong return of +17.0%. Those stocks that were viewed as safe havens in 2022 trailed in their performance during the period, with the S&P 500 Dividend Aristocrats producing a return for the quarter of only +1.8%. International stocks, as measured by the MSCI EAFE Index, rose by +6.7%, following a difficult 2022 that roughly paralleled domestic equity markets. European equities showed particular strength while Asian equities lagged. As always in the equity markets, investment fashion changes, sometimes in predictable and other times in unpredictable ways. Ultimately, fundamentals determine long-term winners and losers.

The bond market also reversed trend after a difficult 2022 as 10-year Treasury yields declined by -34 basis points from their December 31st level, finishing at 3.54%. It seems there is a growing consensus view that we’re closer to the end of the Fed’s cycle of rate increases than the beginning, providing investors with some optimism. The Bloomberg Aggregate bond index advanced by +2.96% during the quarter.

We’ve spoken at length in previous commentaries about the pressures imposed on markets by rising interest rates, which act as gravity on asset valuations. This pressure applies to stocks, bonds, real estate and virtually all productive assets. These effects began to be felt when the Federal Reserve launched their push to fight inflation. The effect of rising rates and the tighter monetary conditions imposed by the Fed flows through the real economy as well as the markets. In the most recent quarter, we started seeing pressures on the real economy, including an acceleration of layoffs, soft existing home sales and lower prices, an increase in promotional discounts, and tighter credit conditions. We expect this change in economic conditions to negatively affect corporate earnings.

When earnings announcements are made in the coming weeks, there is a good chance results for the first quarter, in general, will be weak relative to the prior year and to investor expectations set at the outset of the quarter. Managements’ guidance for future results may also reflect uncertainty and lack of conviction by leadership teams about the near term. Some of the weakness that we expect may come from softening demand for products and services, since the actions taken by the Federal Reserve to slow the economy are beginning to take effect. Some of the weakness may come from charges taken by companies in connection with layoffs and restructurings in response to these weakening economic conditions. Some of this weakness may come from the increase in the cost of debt service for those companies that operate with debt on their balance sheets. Here is what’s most important: We think that you and we should not be overly concerned about the upcoming earnings announcements if they demonstrate softness versus previous quarters or the previous year, because we believe periods of softness are integral part of a well-functioning economy. Excesses are reversed and the foundation is laid for the next cycle of economic and business growth. Our objective is to look beyond the near-term outperformance or underperformance of Wall Street estimates and see a larger picture through a full economic cycle. We concern ourselves with long-term earnings power and wealth creation. This doesn’t mean we should write off any concerning announcements. Periods of adversity test their mettle of management teams and demonstrate their strength or weakness. We want to invest long term with those managements that pass the test.

Financial Leverage and Cost of Debt

Among the hallmarks of a good company that meets our investment criteria, beyond having fundamental business attributes, is a balance sheet that is not encumbered by excessive debt. The right amount of debt for any business depends on the attributes of that business. All else equal, a simple business with stable economics can afford to carry higher levels of debt and, all else equal, a complicated, economically sensitive business should show restraint when loading its balance sheet with debt. This is straightforward logic, but “all else” is never equal, and how much debt leverage to layer on a balance sheet is a management choice.

Debt is a two-edge sword. During times of low and declining interest rates, like the world enjoyed for about a decade, borrowing enhances returns. On the other hand, when rates are high and/or rising, leverage can weigh on results, and in certain circumstances, can result in unrecoverable loss.

In the past decade, the cost of debt declined to historic lows, benefitting businesses that borrowed and investment strategies that are reliant on debt leverage to generate returns. It fueled an appetite of our federal government to issue debt to fund its massive budget deficits. It also fueled a persistent inflation that the Federal Reserve is now fighting hard to get under control. The fight includes pulling liquidity from the markets (evidence the reduction in the government’s M2 money supply statistics in recent months). In turn, the cost of borrowed capital has increased dramatically, changing the economics for leveraged businesses and strategies.

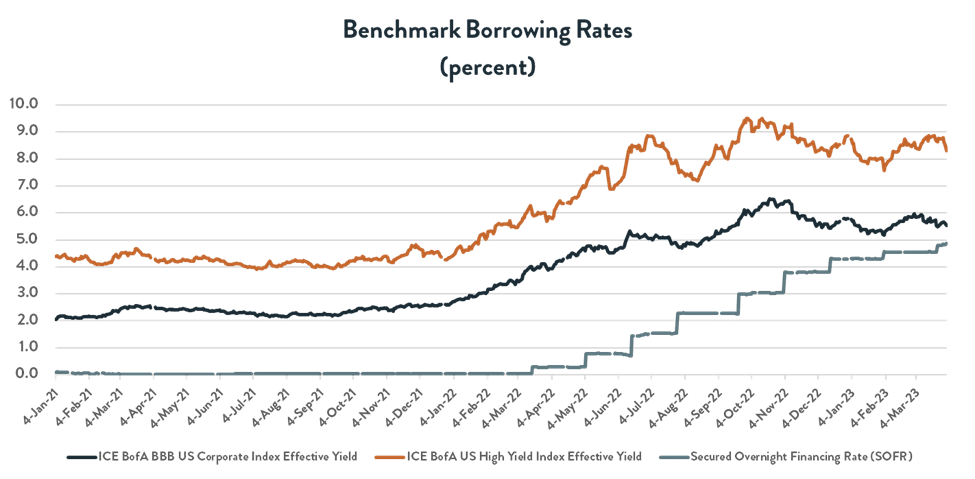

Corporations and individuals who borrow on a floating rate basis are already feeling the impact of higher rates. The Secured Overnight Funding Rate (“SOFR”), which is the cost of borrowing cash collateralized by Treasury securities overnight in the repurchase (or, “repo”) market, has risen dramatically from 0.05% on January 1, 2022, to 4.8% at the end of March 2023. Corporate lines of credit, adjustable-rate residential mortgages, credit cards and other forms of commercial and consumer credit are frequently priced with a spread over the SOFR benchmark rate, have become far more expensive within the span of only several months. There have been some casualties. An extreme example is Silicon Valley Bank, which borrowed in the ultra-short-term deposit market to fund a portfolio of long-term, fixed-rate government-backed debt.

Those corporations that need to access the fixed-rate bond markets for financing are also beginning to feel the pinch, as they refinance maturing debt with new note offerings. Yields on investment grade and high yield corporate bonds have risen by several hundred basis points over that same time, with triple-B and high-yield benchmarks yielding 5.5% and 8.3%, respectively, at the end of the first quarter. Those companies with high debt loads will obviously be affected most by changing market conditions.

As borrowing costs rise, fewer dollars are available to flow to the bottom line, where we shareholders benefit. When we build stock portfolios, we favor those businesses that have manageable debt levels, and where interest rate spikes like the one we’re witnessing will not place our management teams at a disadvantage. We look for balance sheets with lots of rainy-day cash, companies that produce “free cash flow,” that is cash earnings well above what is needed to sustain the business. We prefer “asset-light” businesses that don’t require a large reinvestment of earnings to grow, and favor management teams that show caution when using borrowed money to pay for acquisitions, repurchase stock or fund a dividend.

There is some good news that comes with higher levels of interest rates. We are lenders to corporations, municipalities and other government borrowers through our bond holdings. For most of the past decade, we’ve struggled to generate returns on these fixed-income portfolios, but now the returns are much more attractive. Higher inflation takes a bite out of these higher returns, but assuming the Fed is successful in containing inflation, we may be able to look to our bond portfolios to generate reasonable returns in addition to reducing our overall portfolio risk.

Portfolio Changes

In the first quarter of 2023, we purchased and sold shares in client accounts to increase or decrease position weightings in our Core managed portfolios, but we neither introduced a new name nor sell completely out of any of our holdings. As we are long-term owners of businesses, this is not unusual within any three-month period. Meanwhile, the research team continued to build its Focus List of stocks that could become potential future holdings in the portfolios.

New to Summitry

In March we welcomed Michelle Wong to Summitry as our Workplace Experience Coordinator. As the firm migrates back to the office after years of remote and hybrid operations, we need to ensure that clients and employees have the best possible experience under our roof. Michelle, who comes to Summitry with extensive experience in sales and customer service, will be the first to welcome you when you pay us a visit. Michelle earned a Bachelor of Arts degree in Communications Studies from San Francisco State University, has incredible energy and a can-do attitude. We’re thrilled to have her on our team.

This commentary is for informational purposes only, and the views reflected herein are subject to change at any time without notice. Summitry obtains information from sources it believes to be reliable, however, the accuracy of such information cannot be guaranteed. Past performance does not guarantee future returns. Investing involves risk and possible loss of principal capital.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President