Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Time to part with your company stock? It depends.

Apr 28, 2021

I have the pleasure of speaking with prospective clients from all over the Bay Area and there is one question, in particular, that is becoming very common: “What should I do about my significant company stock position, given the taxes I would pay if I sold?” The short answer is universal: “It depends.”

So, let’s unpack that “it depends” answer a bit and speak about what, exactly, it depends upon.

1. Your relationship with the stock

As the old investment saying goes, don’t fall in love with a stock! This is difficult enough when it’s simply a stock you’ve bought and it has done very well for you, but when it’s the stock of the company for which you work (or worked), there tends to be a bit more of an emotional connection. This is not surprising – you know the company, you trust the leadership, in many cases your RSUs/ Options/ ESPPs have generated significant wealth for you and most importantly you believe in the future direction (and growth) of the company. Generally, people fall into one of these categories :

![]()

2. Your relationship with risk

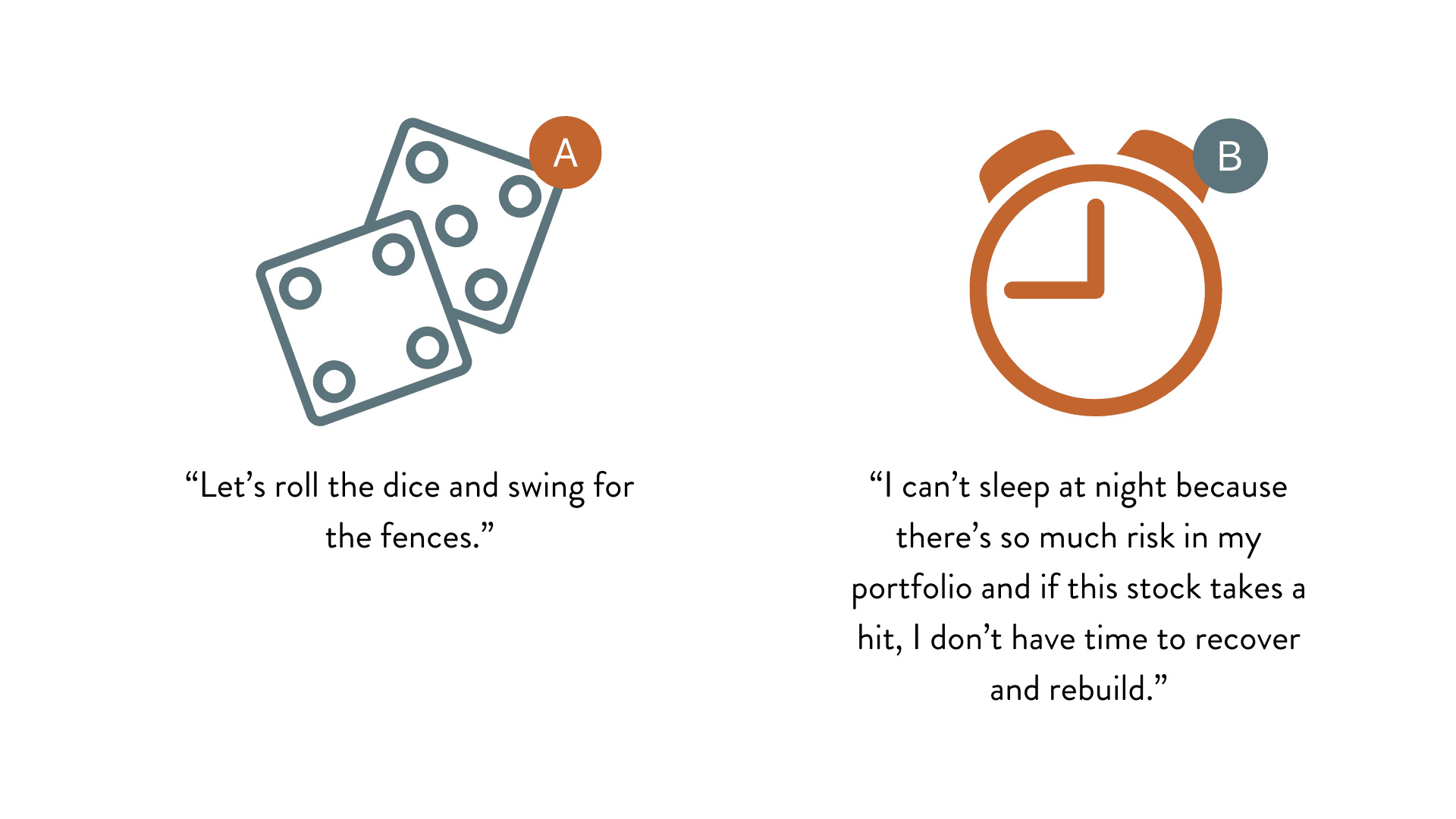

While over the last five years having most of your wealth tied up in a single tech company’s stock may have been great for your net worth, most people know intuitively that where there is massive upside potential, the downside potential is equally severe. The finance industry adage in this situation is that concentrated positions are a great way to build wealth, but not a great way to sustainably maintain wealth. Painting with very broad brushstrokes, clients tend to fall into one of two categories:

When it comes to risk, our clients look to us to help them establish how much risk is required in order to achieve their financial goals. They can then choose to increase that risk if they’re more of a “swing for the fences” sort of investor, looking to capture a bit more upside. Importantly, we use sophisticated software to quantify a “risk tolerance score” of 1 to 99 for our clients, which you can think of as your “ability to sleep at night” score. We then import their existing portfolio into this same software and score their current portfolio’s risk. Frequently, we’ll meet a client with a personal risk tolerance score of 50 who owns a portfolio with a risk score of 90. It’s unlikely their financial plan requires them to take on that much risk, so clearly there’s some work to be done.

When it comes to risk, our clients look to us to help them establish how much risk is required in order to achieve their financial goals. They can then choose to increase that risk if they’re more of a “swing for the fences” sort of investor, looking to capture a bit more upside. Importantly, we use sophisticated software to quantify a “risk tolerance score” of 1 to 99 for our clients, which you can think of as your “ability to sleep at night” score. We then import their existing portfolio into this same software and score their current portfolio’s risk. Frequently, we’ll meet a client with a personal risk tolerance score of 50 who owns a portfolio with a risk score of 90. It’s unlikely their financial plan requires them to take on that much risk, so clearly there’s some work to be done.

3. Your systematic, deliberate assessment of the company’s value

Admittedly, this one is a bit more rare, but we work with enough engineers (and engineer-minded investors) that on occasion a client will have constructed an intrinsic value model for the concentrated company stock they own. The more sophisticated models include a strong thesis to own the stock, as well as a base, bull and bear case outcome for the price of this stock. These investors listen to earnings calls, read relevant industry publications and essentially act as a professional equity analyst relative to their concentrated position. While rare, these dispassionate investors do exist and tend to make their decisions based on their conviction in a thesis. Noteworthy, this is essentially the same approach our research team takes when evaluating companies we might purchase (or sell) on behalf of our clients, the big difference is the time, expertise and research budget that we can commit to this process.

4. What does this wealth mean for your future

This is the big one. Until you have a coherent narrative about your financial future and what this wealth needs to accomplish within that narrative, selecting a tactical solution to your concentrated wealth “problem” is clearly putting the cart before the horse. A couple of examples, to illustrate the point:

1. If you are charitably inclined, this opens a number of potential tax-advantaged diversification strategies. Creating a Donor Advised Fund (DAF) or a Charitable Remainder Unit Trust (CRUT) can create significant tax benefits while also accomplishing your philanthropic ambitions in a more efficient manner. See how that played out for one of our clients here.

2. When are you planning to retire? If retirement is in the near-term, and your taxable income is about to become significantly reduced, this may influence not only the diversification approach, but also the replacement strategy as it will likely need to produce income. Whereas if you’re planning to work for another decade and simply want to kick the tax can down the road while diversifying out of your concentration, we might consider an exchange fund as part of the solution set.

As my father told me when I was eight years old learning basic woodworking skills, you absolutely must have the right tool for the job at hand. Concentrated position solutions may seem like a single job, but they are very clearly not and that’s why we have a dozen or so tools in the proverbial tool belt, ensuring we can use the right one, or more frequently right ones, for the job at hand.

Contact us to discuss what strategies may make the most sense for your particular scenario.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Leitzes

Principal