Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

RSU Vesting Schedules: How & When Your Restricted Stock Units Vest (+ Tax Implications)

Aug 7, 2025

If you’re already familiar with RSUs, the real questions probably are: When do these promised shares become yours? And what happens when they do? The answer lies in your vesting schedule.

This timeline dictates when your RSUs convert into stock you can actually own and sell — and crucially, when the tax bill hits, sometimes sooner and bigger than you expect. Understanding vesting and the ripple effects it sets off lets you take control of your equity, taxes, and long-term financial planning. Here’s how to navigate it with confidence.

Restricted Stock Unit Basics

Restricted Stock Units (RSUs) are a popular form of equity compensation, particularly in the technology and large public company sectors. When granted RSUs, you’re promised company shares, but you don’t receive them immediately.

Instead, you earn ownership over time, usually by staying with your company for a set period or reaching specific performance goals. This process is called vesting. Until RSUs vest, they have value but no ownership rights — they have future value, but you don’t actually own the underlying shares yet.

Popular RSU Vesting Schedules

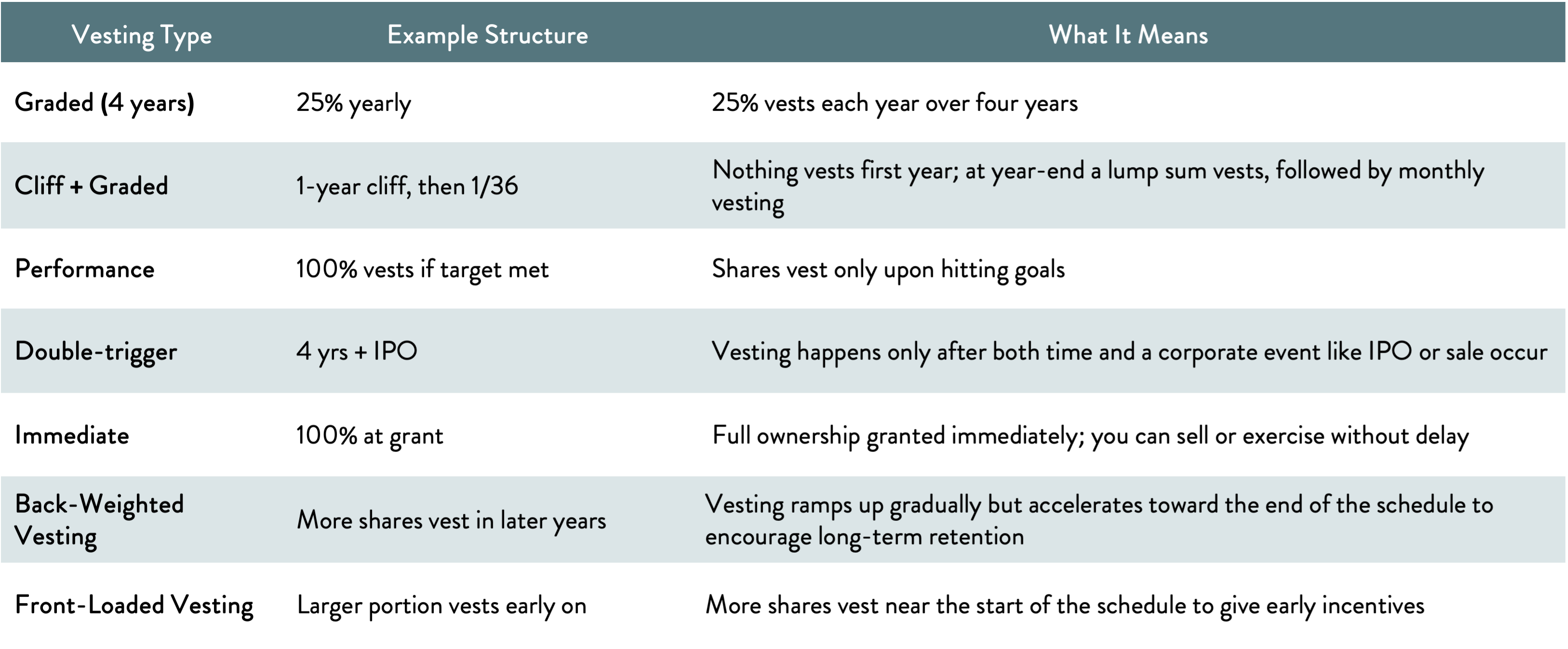

Your vesting schedule governs exactly when and how your RSUs become yours. The most common are time-based schedules, but some also include performance conditions.

Time-Based Vesting (Graded and Cliff)

Your RSUs vest gradually over a period. For example, with a standard four-year graded schedule, you might receive 25% of your shares each year. Sometimes, there’s a cliff vesting setup – an initial waiting period (often one year) during which nothing vests, then a lump sum vests all at once, followed by gradual vesting.

Performance-Based and Double-Trigger Vesting

Some RSUs vest only when certain company goals are achieved, or require both a time-based condition and a company event (such as IPO or acquisition) to be met. These are called double-trigger RSUs and are especially common in private companies.

Back-Weighted Vesting

An emerging trend especially in startups is back-weighted vesting, where a larger portion of equity vests toward the end of the vesting period. This approach aims to incentivize long-term retention further, but can affect employee morale due to delayed rewards.

Front-Loaded Vesting

Front-loaded vesting means you get a larger percentage of your shares early in the vesting period—giving quick access to equity before the remaining shares vest more gradually. It’s designed to reward early commitment or compensate for shorter expected tenure.

The specific schedule will be outlined in your RSU grant agreement, and you should carefully review it to determine when you can expect to receive shares.

Real-World Vesting Schedule Examples

Schedule Adjustments: What You Should Know

Vesting schedules are generally set when your RSUs are granted, but they aren’t always fixed. Various events can cause your vesting timeline to change, which is important to understand for planning purposes.

- Accelerated Vesting Triggers: Certain corporate events like mergers, acquisitions, IPOs, or change of control can speed up your vesting schedule. For example, in a single-trigger acceleration, your unvested shares may vest immediately upon the company getting acquired. More commonly, double-trigger acceleration requires two events—such as the acquisition plus your termination without cause—before unvested shares vest early. This protects employees in situations like layoffs after acquisition while aligning incentives with the company’s success.

- Forfeiture Rules: If you leave your company voluntarily or are terminated for cause before your RSUs vest, you typically forfeit those unvested shares. Understanding your company’s specific rules around this will help prevent surprises.

- Multiple Grants and Overlapping Schedules: It’s common to receive multiple RSU grants over time, each with different vesting schedules. Keeping track of these overlapping schedules helps you plan better for liquidity events and tax obligations.

- Plan Changes: Sometimes companies revise vesting schedules for new or existing employees, which could accelerate, delay, or otherwise modify your vesting timelines.

Understanding adjustments helps you anticipate when shares could become yours outside the usual schedule—and how that fits into your financial planning.

What Happens When RSUs Vest

Once your RSUs hit their vesting date (or meet required performance milestones), you own the shares. The company will transfer the vested shares to your brokerage account or, less commonly, pay you an equivalent cash value. From this point, the shares are yours. You can hold or sell them as you wish, subject to any company restrictions. If you leave your employer before your RSUs vest, you generally forfeit the unvested units.

Tax Implications of Vesting or Selling Stock

Tax applies only when the shares vest and are actually delivered to you. At vesting, the full market value of the shares you receive is treated as ordinary income and appears on your W-2. This amount is subject to federal, state, Social Security, and Medicare taxes.

Employers typically withhold taxes at vesting, often by holding back some of the newly vested shares and selling them automatically (“sell-to-cover”). This is to ensure the tax bill is covered. The standard federal rate for these withholdings is usually 22% (for the first $1 million in income), but your ultimate tax rate may be higher based on your total taxable income for the year. This means that the withheld taxes might only cover part of your ultimate tax liability, potentially leaving you with an unexpected bill when you file your return. If you later sell the shares, you’ll owe capital gains tax on any gain over the value reported at vesting.

Because of these complexities and individual circumstances, it’s highly recommended that you consult with a tax professional who understands equity compensation. They can help you estimate your true tax burden, optimize your cash flow, and plan when to sell shares or set aside funds to cover taxes efficiently.

RSU Vesting Example Scenario

Regina works at a tech company making $100,000 a year. She also receives $50,000 worth of RSUs that vest this year. When those RSUs vest, Regina gets actual shares worth $50,000, and that amount is treated like extra income by the IRS. So, instead of $100,000 income, she now has $150,000 for the year.

This means Regina will owe taxes not just on her salary but also on the $50,000 value of her RSUs. Her employer will withhold some taxes when the shares vest, often around 22% for federal tax, as well as a percentage for state taxes where applicable. Still, depending on her total income, she might owe more when she files her tax return.

Regina works with an RSU advisor to manage the tax impact and diversify her investments.

Here’s what they decide:

Sell to Cover Taxes and Diversify: Regina sells a portion of the vested shares immediately to cover the tax bill and sells a portion of the remaining shares to diversify her portfolio. This strategy prevents Regina from being caught off guard by taxes and reduces the risk of having too much of her wealth tied up in a single company. While she might miss out on future stock gains, holding a large amount of employer stock is extremely risky, as both her job security and a significant portion of her investments depend on the same company’s performance. The proceeds of her stock company sales can be reinvested into some other asset, like a diversified portfolio of stocks, that may earn a return that is uncorrelated to her company’s stock.

Maximize Retirement Contributions: The advisor suggests that Regina maximize contributions to tax-advantaged accounts, such as her 401(k), in the year her RSUs vest. This helps lower her overall taxable income, potentially keeping her in a lower tax bracket.

Other Important Considerations

RSUs are typically used as a retention tool by employers to encourage you to stay with the company. The details of vesting schedules, and whether your RSUs can vest early in specific situations like a company acquisition, are set out in your RSU agreement. If you leave your job before your vesting schedule completes, unvested RSUs are usually forfeited. Once shares are vested and delivered, they generally can’t be clawed back, even if you leave.

It’s crucial to plan for the tax consequences at vesting, which can result in a surprisingly large tax bill, especially if your tax bracket shifts upward due to the value of the shares upon vesting. You may need to decide whether to hold or sell vested shares depending on your financial goals, risk tolerance, and tax planning needs.

Make the Most of Your Equity

Navigating your equity compensation—whether it’s non-qualified stock options, RSUs, or other awards—can feel complicated. You’re managing vesting periods, timing a liquidity event, and trying to understand how your equity shapes your overall compensation package. It’s a lot to think about.

That’s where Summitry comes in. We specialize in helping people like you make the most of your equity compensation. Our team works closely with client tax professionals and attorneys to ensure every piece of your financial picture fits together smoothly. Whether you’re figuring out when to exercise stock options, how to cover tax bills without surprises, or how to diversify your investments for a balanced and secure future, we provide clear guidance every step of the way.

At Summitry, you’re not just getting advice about stocks. You’re getting a partner who understands your goals and helps you turn your compensation into lasting wealth. Ready to take control of your equity and build a strategy that works for you?

Reach out to Summitry today, and let’s get started.

This material is intended for general informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. It does not consider the specific investment objectives, tax and financial condition or needs of any specific person. An investor should consult with their financial professional before making any investment decisions. Investing in securities involves the risk of loss.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President