Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Sustainable Income

Sustainable Income Strategy – December 31, 2025

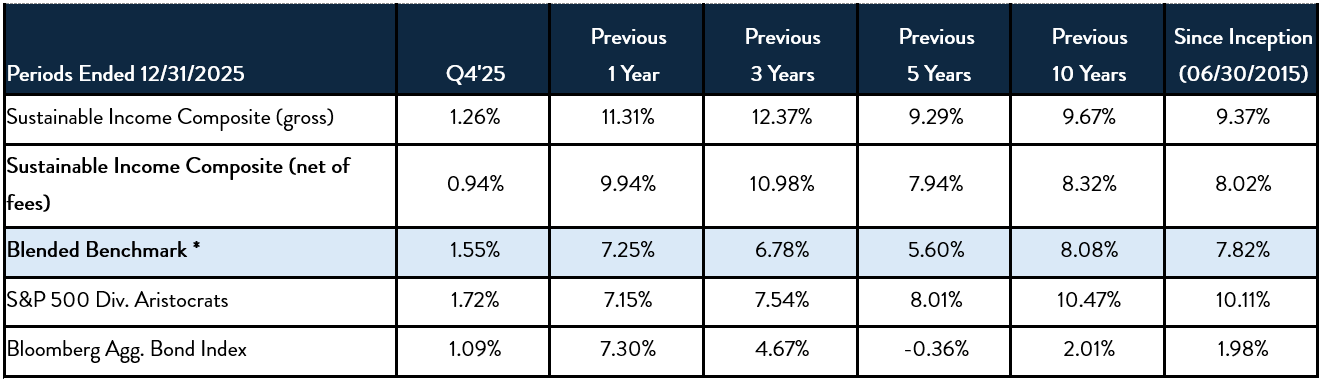

In the final quarter of 2025, our Sustainable Income strategy offered modest positive returns, principally from the income produced through dividends and interest. Capital appreciation was a very minor contributor to returns for the quarter. A composite of client accounts in the strategy delivered +1.26%, gross before fees, and +0.94% net after fees (calculated by assessing the maximum fee Summitry can charge). This performance trailed our benchmark, comprised of 70% S&P 500 Dividend Aristocrats index, and 30% Bloomberg Aggregate Bond index by -29 basis points, gross, and by -61 basis points, net. For the full year, 2025, the composite’s gross and net returns of +11.31% and +9.94% exceeded our benchmark by +406 basis points and +269 basis points, respectively. By the numbers, it was a good year for this strategy. Over longer periods, the strategy has also met its objective of delivering returns ahead of its benchmark, while staying true to its mission of investing in stocks of resilient businesses that share surplus earnings with their shareholders in the form of regular cash dividends, and in bonds and preferred securities that we deem to have little chance of default. Through continuous research on holdings in the strategy and potential replacement securities, we make changes when we believe they will improve the portfolio in terms of higher-quality, better value, greater opportunity for growing dividends, or a combination of these benefits. In practice, these changes are infrequent, but the search is continuous.

Individual client account performance varied around this composite average, reflecting their specific mix of stocks, bonds, preferred stocks, and bond ETFs. As always, we remind you that returns from this strategy and performance relative to our benchmark will ebb and flow over time, as do the stock and bond markets in which this strategy invests.

Here is the record for the Sustainable Income Composite since inception (please see performance disclosure at the end of this note)[i].

* Blended Benchmark: 70% S&P 500 Dividend Aristocrats/30% Bloomberg Aggregate Bond Index

Dividend Growth

Seven companies in the Sustainable Income portfolio increased their dividends in Q4, including: COR (+9.1%), EMR (+5.1%), MCD (+5.1%), MSFT (+9.6%), SBUX (+1.6%), V (+13.6%), and VZ (+1.8%). Note that most of these increases are well ahead of the current level of inflation, meaning that the purchasing power of this income stream is growing in real terms. This is precisely the objective of the Sustainable Income strategy. No companies in the portfolio decreased their dividends this quarter.

Of the many factors that we consider when selecting companies to own in the Sustainable Income portfolio, the capacity and commitment to pay sustainable and growing dividends are among the most important. The capacity to pay growing dividends is derived from earnings growth and strong balance sheets. The commitment comes from various company managements and boards of directors who choose to share surplus earnings with shareholders. Not every great company will pass earnings through in the form of a dividend, which is a reasonable choice if the earnings can be reinvested in the business in initiatives that promise high returns on investment. Those stocks will not qualify for the Sustainable Income strategy, but they may be held in other strategies managed by Summitry. But when a management team cannot redeploy cash in a manner that will generate a high return within the company’s operations, we would prefer they remit that cash to shareholders in the form of a dividend. These are ideal stocks for Summitry’s Sustainable Income portfolio strategy.

Q4’25 Top Contributors

- Moët Hennessy Louis Vuitton (LVMUY) returned +23.7% in the quarter. LVMH had been impacted by a general slowdown in luxury spending following strong growth during the pandemic and weaker consumer health in recent quarters. Q3 results delivered sequential improvement across the board, which suggests they could be back on the growth trajectory. While we would hesitate to call a bottom here, we are comfortable holding this collection of high-quality brands under the management of the Arnault family over the long term. Moreover, their strong balance sheet should allow them to weather most scenarios we can think of and pursue acquisition opportunities when available.

- Caterpillar (CAT) returned +20.2%. CAT has had a stellar quarter and full year, driven by demand for its equipment and power generators related to the data center buildout. CAT provides the critical backup power in scenarios where a data center’s main power source is interrupted. As such, revenue and backlog have reached record highs.

- Rentokil Initial (RTO) returned +16.6%. RTO has been a strong performer since our purchase for this portfolio in early August. The company delivered encouraging sequential improvement in organic growth and stable and rising customer and employee retention. While growth remains well below that of its biggest competitor, recent results suggest the worst of the disruption from the Terminix integration is behind it. The stock is no longer as attractive, but the business should continue to offer durable earnings growth that should support its dividend obligations.

Q4’25 Top Detractors

- Nintendo (NTDOY) returned -21.8% in the quarter. Nintendo gave back much of its gains from earlier in the year. After a successful launch of the Switch 2 console, which we anticipated would unlock significant pent-up demand from the company’s massive installed base, the stock has cooled due to concerns about memory chip shortages. However, we view these concerns as a temporary headwind and remain confident in Nintendo’s unique strategy of leveraging its portfolio of iconic characters to drive recurring revenue and high-margin software sales.

- Kimberly Clark (KMB) returned -18.1% in the quarter, spurred by its announcement to acquire Kenvue for $48.7 billion in November. The Kenvue deal adds household name brands such as Tylenol, Neutrogena, Listerine, and Band-Aid, and more importantly, expands KMB’s addressable market into the faster-growing beauty and health categories. While management’s plan to improve margins appears reasonable ($1.9 billion in cost savings across manufacturing, sales and administrative expenses), we believe the market skepticism toward the deal is well-warranted. KMB was undergoing its own portfolio transformation to divest underperforming assets and this massive deal now increases its debt load while setting a higher emphasis on execution. Our analysis suggests management targets are achievable but we are prepared to take action should we see signs of issues with execution.

- Eaton (ETN) returned -14.8% in Q4. This was another name that needed a breather after a period of strong performance. ETN has been a key supplier to the AI-driven data center buildout and we would expect stock performance could be volatile due to heavy scrutiny on the massive industry capital expenditure targets. It’s important to note that while the data center segment has driven record revenues and margins, it is only 20% of ETN’s overall revenues today and AI is a further subset of that. We tend to believe that AI will eventually penetrate every segment of the economy. Further, AI has exposed some vulnerabilities and shortcomings of our electrical grid infrastructure and a period of investment is likely needed to support future usage. As such, we think ETN should continue to benefit from the electrification trend beyond the current period.

Fixed Income Securities

The Sustainable Income portfolio has traditionally held approximately 30% of its assets in bonds and similar securities that offer a fixed yield. Their primary purpose is to increase the overall portfolio yield rather than offer long-term appreciation potential.

Our client accounts will not necessarily all hold the same securities in the same proportions, so individual results will vary. However, overall, modest increases in the bond markets helped give a lift to our bond and preferred stock positions. These bond market gains were driven by a range of factors, particularly a decrease in interest rates across the yield curve. As always, we seek to hold high-quality, “investment grade” securities, rather than speculate on high-yield (i.e., “junk”) bonds and instruments. Those certainly offer the potential for higher returns, but this higher potential return is accompanied by higher risk of default.

Key Actions

Our only portfolio action in Q4 was our decision to sell Target Corp (TGT) in December. When we purchased TGT in 2002, we concluded Target’s omnichannel offerings were ahead of most brick-and-mortar competitors and its unique store experience and product assortment garnered a loyal customer base. Unfortunately, execution since then has been disappointing.

- Its biggest competitor, Walmart, quickly caught up on omnichannel by similarly utilizing its existing store footprint as distribution channels.

- Target seemed to have lost some of their magic in driving consumer excitement through its trendy product assortment.

- All this was further compounded by the tough consumer environment post-pandemic, which disproportionately impacted Target’s majority discretionary mix and favored Walmart’s heavy grocery mix.

While we hate to exit any position at a time when sentiment is so poor, we believe a turnaround could take more time and capital than expected and thus decided to take our learnings and apply our efforts elsewhere.

Conclusion

The Sustainable Income strategy has produced respectable returns in volatile markets and over a market cycle. We believe Sustainable Income remains a good choice for clients who seek growth of income over time and reduced portfolio volatility, while retaining some opportunity for capital appreciation.

About Summitry’s Sustainable Income Strategy

Many clients ask us to address the tradeoff between their need for current income and desire for capital growth. Bonds alone are unlikely to generate sufficient returns to preserve purchasing power over the longterm, but stocks subject the investor to greater volatility. The power of long-term compounding of wealth provided by the equity markets can be lost if volatility compels clients to liquidate securities during market drawdowns. This concern typically grows more acute as clients age and time horizons compress.

To meet this challenge, we devised a portfolio strategy in 2015 that attempts to balance the need for reduced volatility with a desire for capital appreciation. Our solution is a diversified portfolio primarily consisting of blue-chip companies that pay regular and growing dividends out of surplus cash flow. We believe these companies generate earnings beyond what is needed to grow their businesses. This surplus allows management to raise their dividend payouts over time. We call this our Sustainable Income strategy. To learn more, we gave a behind-the-scenes look at our Sustainable Income strategy here.

Summitry’s Dividend Growth Strategy

Summitry’s Dividend Growth Strategy is comprised 100% of dividend-paying equities and is made available to clients who wish to have exposure to the income generation and total return opportunity that is offered from the equities held in the Sustainable Income strategy, but without the exposure to SI’s bond and preferred stock holdings. Your Financial Advisor can help you decide if this is a useful and appropriate strategy given your personal financial circumstances.

This commentary reflects the opinions of Summitry, LLC and is for informational purposes only. Nothing herein constitutes investment advice or any recommendation that any particular security, transaction, or strategy is suitable for any specific person. The securities identified do not represent all the securities purchased, sold, or recommended for client accounts. Past performance does not guarantee future returns. Investing involves risk. The reader should not assume that an investment in the securities identified was or will be profitable. An index is a hypothetical portfolio of securities representing a particular market or market segment and is used as an indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses, and cannot be invested in directly. For Top Contributors and Top Detractors, the investment characteristics presented are shown on a gross basis and do not reflect the deduction of advisory fees, trading costs, custodial fees, or other costs that clients have paid or would have paid. The deduction of fees and expenses reduces investment returns and would also affect the investment characteristics presented. The criteria used to select the presented investments are based on the top contributors to performance for the period and top detractors to performance for the period. Other investments held during the same period may have performed differently, including experiencing losses. For a complete list of holdings during the period discussed, please contact your Advisor.

[i] Sustainable Income Composite includes all Sustainable Income accounts with a long-term target of 70% investment in primarily U.S. dividend paying stocks and 30% investment in income producing securities which include bonds and/or ETFs, preferred securities, REITs and MLPs. The allocation among asset classes generally may vary around this long-term target by plus or minus 10 percentage points and we may hold cash balances. The primary objective of the strategy is to produce monthly income that grows at a rate faster than inflation through a portfolio principally invested in equities, and a secondary objective to participate in the long-term appreciation of the equity securities held. Bonds and preferred stocks are selected to add stability to the portfolio’s cash flow. Summitry employs a value-based investment strategy focusing on high-quality multi-national businesses that can be purchased at a discount to their estimate of intrinsic value. The benchmark for this composite is a blended benchmark consisting of 70% S&P 500 Dividend Aristocrats Index, and the Bloomberg Aggregate Bond index (30%) (Formerly Barclays Capital Aggregate Bond Index) and is rebalanced monthly. After March 31, 2020, the equity portion of the blended benchmark was replaced from the S&P 500 Index to the S&P 500 Dividend Aristocrats Index. Summitry believes this most closely represents the strategy pursued in the equity allocation. Anytime the individual components are shown, should be considered supplemental information. The minimum account size for this composite is $250 thousand.

The U.S. Dollar is the currency used to express performance. Returns are presented net of management fees and include the reinvestment of all income. Net performance is calculated by reducing the gross performance by the model fee of 1.25% applied monthly. The inception and creation of the Sustainable Income Composite was on June 30, 2015.