Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Sustainable Income

Sustainable Income Strategy – October 1, 2024

Amid a rotation in stock market leadership away from mega-cap tech stocks in favor of a broader universe of equities, dividend stocks as a class performed well in Q3’24. At the same time, falling interest rates fueled gains for fixed income investors. Against this backdrop, Summitry’s Sustainable Income strategy produced strong returns in the third quarter of 2024, with our composite of client accounts achieving gains from dividends, interest, and capital appreciation of +6.7%, net after fees. This brings year-to-date performance for the Strategy, which is allocated roughly 70% to dividend growth equities and 30% to high quality bonds, to +14.0%, net of fees.

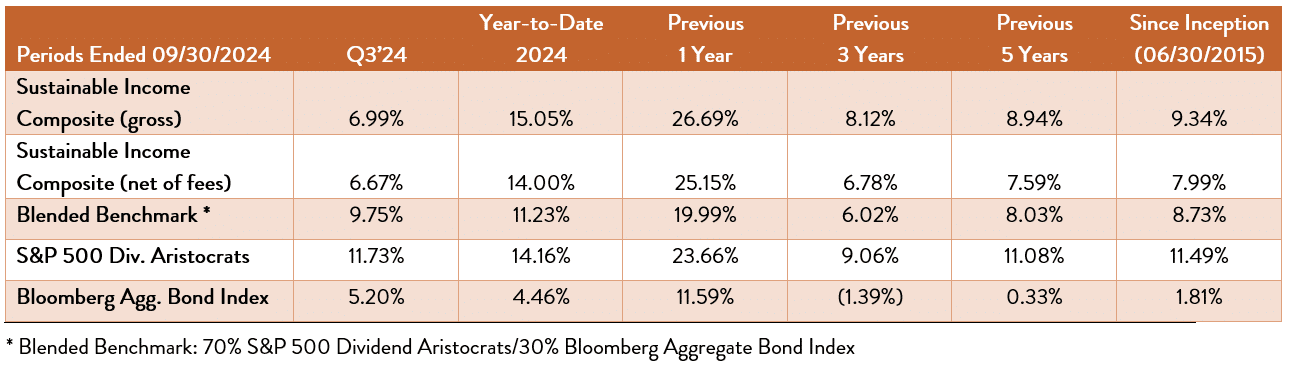

Notwithstanding these strong gains, the strategy trailed the performance of its benchmark, comprised of the S&P 500 Dividend Aristocrats (70%) and the Bloomberg Aggregate Bond Index (30%), in Q3, as shown in the table below. Year-to-date comparisons are much more favorable to our clients than the recent quarter’s results, with outperformance relative to the benchmark of +382 basis points (gross) and +277 basis points (net). Individual client account performance varied around this composite average, reflecting their specific mix of stocks, bonds, preferred stocks, and bond ETF’s. As always, we remind you that returns from this strategy will ebb and flow over time, as do the stock and bond markets in which this strategy invests.

Here is the record for the Sustainable Income Composite since inception (please see performance disclosure at end of this note)[i].

Dividend Growth

Seven companies in the Sustainable Income portfolio increased their dividend in Q3, including: CAT (+8%), CSCO (+3%), LOW (+5%), TGT (+2%), TSM (+15%), USB (+2%), WFC (+14%). No companies reduced their dividend during the quarter.

Of the many factors that we consider when selecting companies to own in the Sustainable Income portfolio, the capacity and commitment to pay sustainable and growing dividends are among the most important. The capacity to pay growing dividends is derived from earnings growth and strong balance sheets. The commitment comes from company managements and boards of directors who choose to share surplus earnings with shareholders. Not every great company will pass through earnings in the form of a dividend, which is a reasonable choice if the earnings can be reinvested in the business in initiatives that promise high returns on investment. Those stocks will not qualify for the Sustainable Income strategy, but they may be held in other strategies managed by Summitry. But when a management team cannot redeploy cash in a manner that will generate a high return within the company’s operations, we would prefer they remit that cash to shareholders in the form of a dividend. These are ideal stocks for Summitry’s Sustainable Income portfolio strategy.

When reviewing stock market performance of the Sustainable Income strategy’s individual holdings, we note that much of the variability in stock prices has come around the time of individual company earnings announcements. This dynamic is nothing new, but it seemed pronounced in Q3. If it continues, it could add to the volatility of our relatively concentrated portfolio around earnings season, but it should not be seen as a cause for concern. We firmly believe that market overreactions to good or bad news creates opportunities for investors like Summitry, who understand how to measure a stock’s intrinsic value, to make advantageous purchase and sale decisions with a counterparty who does not have that same perspective, but rather transacts based on short-term factors.

Q3 2024 Top Contributors

- 3M (MMM) returned +34.3% in Q3, as the company beat Wall Street earnings estimates handily and raised its “adjusted” earnings guidance for 2024. Management made progress with its margin improvement initiatives, raising EBIT margins to 21.6% versus the prior year’s 17.2%. Investors reacted favorably to new CEO Bill Brown’s statement that he felt a refocused MMM management team, after the 1Q spinoff of its healthcare business and the settlement of some key legal issues, could focus on “driving sustained organic revenue growth, increasing operational performance, and effectively deploying capital.”

- Carrier Global (CARR) returned +28.0% in Q3. CARR’s financial performance surpassed analysts’ estimates for the second quarter, benefiting from price hikes, and resilient demand for its HVAC products and repair services. Strong cost controls drove adjusted earnings up double-digits to $0.87 per share, ahead of the $0.84/share expected. Perhaps more importantly, the company completed all of its planned divestitures with a combined value of over $10 billion and realized what we believe to be a full and fair mid-teens EBITDA multiple in aggregate for these assets. CARR has reduced debt by roughly $5 billion, and management expects to deploy a significant portion of the net proceeds toward share repurchases. Investors cheered this capital allocation discipline.

- Lockheed Martin Corp. (LMT) produced a total return of +25.9% in Q3. During the quarter, it reported strong growth in sales and segment operating profit of +9% and +10%, respectively, and free cash flow generation in excess of $1.5 billion. Management modestly boosted its guidance across its income statement and confirmed its estimate of free cash flow for the fiscal year of $6.0-$6.3 billion. The results exceeded analyst expectations, which had called for a slight decline in earnings for the quarter. Investors reacted favorably to news that LMT resumed deliveries of the F-35 jet after software-related delays and confirmed its plan to deliver 75-100 F-35s during the current fiscal year.

Q3 2024 Top Detractors

- Universal Music Group (UNVGY) declined -12.6% in Q3. In July, the company reported higher-than-expected sales, but beneath the headline were details of a slowdown in the subscription and streaming segment. Further, with its eye on driving long-term growth of these two key sources of revenue and earnings, management has stepped up the company’s investment in content, pressuring their ability to generate near-term distributable free cash flow. After a difficult report and a significant one-day drop in price, the stock has staged a modest recovery, but well short of the levels achieved prior to the announcement. We subscribe to the view of UMG’s third-largest shareholder, Pershing Square Holdings, that music content “remains under-monetized relative to history and when compared to other forms of media.” This is a long-term play.

- Charles Schwab & Co. (SCHW) returned -11.6% in Q3. Higher interest rates continue to be a headwind for SCHW as clients shift their cash balances from low-yielding Schwab Bank savings accounts to higher-yielding products, putting pressure on the banking business that had driven so much of the Company’s consolidated earnings growth in recent years. Flat year-over-year Q2 earnings results reported in July highlighted this particular challenge, and the stock has languished. Nevertheless, the key long-term driver of value for SCHW, client asset flows into Schwab accounts, continues to be strong. TD Bank, which received SCHW shares in its sale of TD Ameritrade to Schwab, has been selling down its stake in open market transactions. It now owns 10.1% of SCHW. It is possible that this added supply of shares into the market may have a near-term effect on the stock price, but TD’s sales have no impact on the intrinsic value of SCHW. We note that key insiders bought stock for their own accounts during the quarter.

- Wells Fargo & Co. (WFC) returned -4.2% in Q3. A weak July jobs report pressured shares across the entire U.S. banking sector. Specific to Wells Fargo, the U.S. Office of the Comptroller of the Currency (“OCC”) launched an enforcement action with the bank, without charging any penalties, ordering the bank to address certain risk-management practices and internal controls relating to its anti-money laundering program. While this is not a material action, it may have heightened some investor concerns over the timing of the Fed’s decision to remove or raise WFC’s asset cap, a restriction that has limited WFC’s ability to invest in its business and grow its franchise. It was reported that in September, the bank submitted a third-party review of its risk and control overhauls to the Fed, a crucial step toward the lifting of the asset cap.

Income Securities

The Sustainable Income portfolio has traditionally held approximately 30% of its assets in bonds and similar securities that offer a fixed yield. Their primary purpose is to increase the overall portfolio yield rather than offer long-term appreciation potential. Nevertheless, in the short term these securities rise and fall in price, sometimes considerably, in reaction to changes in the interest rate environment. A decline in interest rates in the third quarter in reaction to weakening job data and an expectation that the Federal Reserve would cut its policy rate in its September meeting, fueled gains in the fixed income markets. As noted in previous letters, we have concentrated our exposures at the shorter end of the yield curve, with a few longer-term issues to offer some balance within the portfolio. Until “real” interest rates on long-term bonds (defined as the nominal yield minus the inflation rate), are high enough to offer us an attractive return, we will likely continue in this posture. Because our average portfolio duration is lower than the benchmark, our bond allocations underperformed the Bloomberg Aggregate benchmark during the quarter. In general, accounts that held preferred stock did slightly better on the margin than accounts that held only bonds.

On June 24th, clients whose fixed income allocations are held in iBonds ETFs saw a rebalancing of the account that extended the portfolio’s average duration slightly. For those who hold individual securities, maturing bonds in client accounts were rolled over into new bonds with longer maturities.

Key Actions

The investment team reviewed several ideas during the third quarter for inclusion in the Sustainable Income strategy’s equity portfolio but took no action during the quarter. Nor did we exit any of our current positions.

Conclusion

The Sustainable Income strategy has produced respectable returns in volatile markets and over a market cycle. Looking forward, in an interest rate environment that offers higher yields on fixed income and preferred securities than we have experienced for many years, Sustainable Income remains a good choice for the client who seeks growth of income over time and reduced portfolio volatility, while retaining some opportunity for capital appreciation.

Introducing the Summitry Dividend Growth Strategy

During the quarter, the Sustainable Income team went before Summitry’s Investment Oversight Committee with a proposal to offer clients access to SI’s equity sleeve as a stand-alone portfolio, independent of the bonds that traditionally included in the allocation. The new asset allocation, comprised 100% of dividend-paying equities, is called Summitry’s Dividend Growth Strategy. Bonds have served two purposes in Sustainable Income accounts: (1) increasing the overall portfolio yield, and (2) dampening the volatility that one would expect in an all-equity account. These important benefits have also come with a cost. As one compares the long-term return of the Bloomberg Aggregate Bond Index to the S&P 500 Dividend Aristocrats Index in the above performance table, it becomes clear that bonds have been a drag on long-term overall portfolio performance. With the introduction of the Dividend Growth Strategy, we leave the choice of asset allocation to clients and their Summitry Financial Advisor. Now, clients seeking growth of income and potential for capital appreciation may continue to invest in Sustainable Income with the current 70:30 asset allocation, or they can choose to invest in a 100% dividend growth stock allocation.

About Summitry’s Sustainable Income Strategy

Many clients ask us to address the tradeoff between their need for current income and desire for capital growth. Bonds alone are unlikely to generate sufficient returns to preserve purchasing power over the long-term, and stocks subject the investor to greater volatility. The power of long-term compounding of wealth provided by the equity markets can be lost if clients need to liquidate securities during market drawdowns. This concern typically grows more acute as clients age and time horizons compress.

To meet this challenge, we devised a portfolio strategy back in 2015 that attempts to balance the need for reduced volatility with a desire for capital appreciation. Our solution is a diversified portfolio primarily consisting of blue-chip companies that pay regular and growing dividends out of surplus cash flow. We believe these companies generate earnings beyond what is needed to grow their businesses. This surplus allows management to raise their dividend payouts over time. We call this our Sustainable Income strategy. To learn more, we gave a behind-the-scenes look at our Sustainable Income strategy here.

This commentary reflects the opinions of Summitry, LLC and is for informational purposes only. Nothing herein constitutes investment advice or any recommendation that any particular security, transaction, or strategy is suitable for any specific person. The securities identified do not represent all the securities purchased, sold, or recommended for client accounts. Past performance does not guarantee future returns. Investing involves risk. The reader should not assume that an investment in the securities identified was or will be profitable. An index is a hypothetical portfolio of securities representing a particular market or market segment and is used as an indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses, and cannot be invested in directly.

[i] Sustainable Income Composite includes all Sustainable Income accounts with a long-term target of 70% investment in primarily U.S. dividend paying stocks and 30% investment in income producing securities which include bonds and/or ETFs, preferred securities, REITs and MLPs. The allocation among asset classes generally may vary around this long-term target by plus or minus 10 percentage points and we may hold cash balances. The primary objective of the strategy is to produce monthly income that grows at a rate faster than inflation through a portfolio principally invested in equities, and a secondary objective to participate in the long-term appreciation of the equity securities held. Bonds and preferred stocks are selected to add stability to the portfolio’s cash flow. Summitry employs a value-based investment strategy focusing on high-quality multi-national businesses that can be purchased at a discount to their estimate of intrinsic value. The benchmark for this composite is a blended benchmark consisting of 70% S&P 500 Dividend Aristocrats Index, and the Bloomberg Aggregate Bond index (30%) (Formerly Barclays Capital Aggregate Bond Index) and is rebalanced monthly. After March 31, 2020, the equity portion of the blended benchmark was replaced from the S&P 500 Index to the S&P 500 Dividend Aristocrats Index. Summitry believes this most closely represents the strategy pursued in the equity allocation. Anytime the individual components are shown, should be considered supplemental information. The minimum account size for this composite is $250 thousand.

The U.S. Dollar is the currency used to express performance. Returns are presented net of management fees and include the reinvestment of all income. Net performance is calculated by reducing the gross performance by the model fee of 1.25% applied monthly. The inception and creation of the Sustainable Income Composite was on June 30, 2015.