Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

A Behind-the-Scenes Look at Our Sustainable Income Strategy

Aug 24, 2021

Purpose and Philosophy Behind Our Sustainable Income Strategy

Many clients ask us to address the tradeoff between their need for current income and desire for capital growth. Given the low interest rate environment, bonds alone are unlikely to generate meaningful income, and stocks subject the investor to greater volatility. The power of long-term compounding of wealth provided by the equity markets can be lost if clients need to liquidate securities during market drawdowns. This concern typically grows more acute as clients age and time horizons compress.

To meet this challenge, we devised a portfolio strategy back in 2015 that attempts to balance the need for reduced volatility with a desire for capital appreciation. Our solution is a diversified portfolio primarily consisting of blue-chip companies that pay regular and growing dividends out of surplus cash flow. We believe these companies generate earnings beyond what is needed to grow their businesses. This surplus allows management to raise their dividend payouts over time. We call this our Sustainable Income strategy.

Portfolio Construction

Historically, 30-35 equity securities have made up roughly 70% of this portfolio, with the remaining 30% in equal allocations to bonds and preferred stock. In periods of low interest rates and the potential for future inflation, like today, we believe equities offer better inflation-protection than most bonds, so we have increased our allocation to equities above the 70% threshold. We will be flexible in our allocation strategy to take advantage of what the market presents us.

We look for competitively-advantaged companies that can earn a return on invested capital above their cost of capital. We shy away from companies that carry too much debt on their balance sheets. Companies in this portfolio must generate enough free cash flow to service their debts, reinvest and grow their businesses, and pay a sustainable dividend. We assess the sustainability of the dividend in two ways: payout ratio (dividend payments divided by current and anticipated future net income) and free cash flow conversion (free cash flow divided by net income). A payout ratio that is too high could mean a dividend gets cut in difficult economic environments. It could also signal that management is starving the company of funds to fuel future growth. Free cash flow conversion is a measure of the quality of earnings, identifying how much of a company’s accounting earnings (which can be subject to “manipulation”) are being converted to cash. A 100% cash conversion ratio means all of a company’s net income flows into its cash balance, which can then be reinvested in the business or paid to shareholders.

Growth vs. Yield

A question we get asked often, understandably, is what kind of yield should I expect from this portfolio? Historically, the Sustainable Income strategy has targeted roughly a 3.5% current yield from dividends and interest. While we aim to construct a portfolio with a yield greater than the S&P 500’s (currently ~1.4%), we do not have a minimum requirement. A yield is a snapshot in time – the annual dividend paid that year divided by its stock price at that time. The yield changes every day as prices move but this does not change the attractiveness of the business as a dividend-payer for long-term shareholders. While it is a useful metric to measure the level of income received for a given amount of investment, the yield on its own fails to capture important context around the portfolio’s growth potential. Our goal is to increase dividends and interest clients receive from their portfolios over time in dollars.

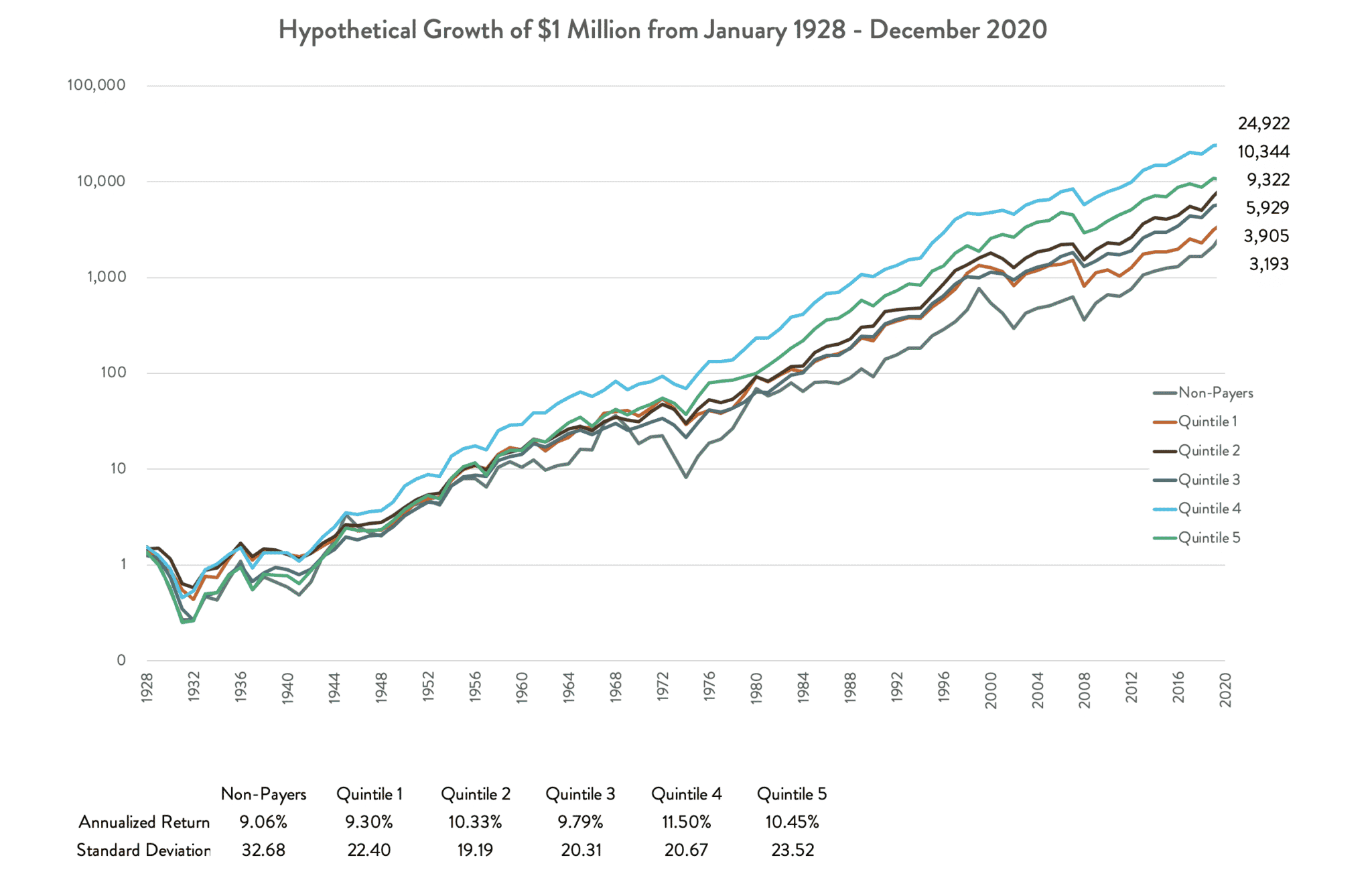

The Center for Research in Security Prices (CRSP) from the University of Chicago’s Booth School of Business conducted a study in which they reviewed returns of equity securities listed on major US exchanges, divided them into quintiles and ranked them by their dividend yields (Quintile 1 being the lowest-yielding stocks and Quintile 5 being the highest-yielding). The study found Quintile 4 had the highest absolute return on average (11.5%) over the 93-year period reviewed in this study. This seems to corroborate our thinking that companies that pay out too much in dividends do so at the expense of their total return opportunity. While we do not use these macroeconomic findings in our stock selection process, they do help us contextualize our bottom-up analysis and avoid “yield chasing.”

Dividend Policy

We also monitor management’s philosophy around dividends. Does management recognize the importance of dividends to their shareholders and the need to grow them or are they likely to cut payouts at the first sign of a tough economic environment? The pandemic provided us with an opportunity to review our portfolio for indications of their commitment to the dividend.

- “3M will also continue to return cash to shareholders through dividends and share repurchases. Sources for cash availability in the United States, such as ongoing cash flow from operations and access to capital markets, have historically been sufficient to fund dividend payments to shareholders, as well as funding U.S. acquisitions and other items as needed… Importantly, we remain committed to our dividend as a high priority for capital allocation. Our first priority is to invest in our business; and second, maintaining our dividend; and lastly, flexible deployment for M&A and share repurchases.” –3M’s management in 2020

- We expect to grow the dividend by the high single digits percentage, even though we are in a slightly negative turn…we think the dividend will represent between 50% and 60% of free cash flow in a trough scenario… As a reminder, Caterpillar has paid a quarterly dividend every year since 1933 through a variety of challenging business conditions.” – Caterpillar’s management in 2020

The Role of Fixed Income

To complement the equity portion of this strategy, we include fixed income to dampen portfolio volatility and augment current income. Equities are inherently volatile as an asset class. The annualized volatility of the S&P 500, measured by standard deviation of returns, is approximately 15% over the decade ending 3/31/2021. Bonds are less volatile. To illustrate, investment grade bonds, as measured by the Bloomberg Barclays Aggregate index, experienced annualized volatility over that same period of only 3%. Further, changes in the value of bonds did not correlate with changes in the value of equities. Over the 10-year period ended 3/31/2021, the correlation coefficient of investment grade bonds with U.S. large capitalization stocks was negative 0.20. In other words, on average, when stocks rose in any quarter over the past 10 years, bonds declined, and vice versa.

Achieving diversification benefits is one component of our portfolio management, but not the only one. Our goal is to achieve strong total returns, and in the case of Sustainable Income, above-market levels of income that can be sustained and grown over time. To capture higher returns in the bond market, we believe one must accept higher risk, principally credit risk. We focus on corporate bonds, taxable municipal bonds and trust preferred securities, all of which are issued by entities that need to be evaluated by us for their capacity to service their obligations. We often accept subordinated debt and preferred securities to provide us with additional income, and floating rate securities to control our duration risk (duration is a measure of a bond’s price sensitivity to changes in interest rates).

Ultimately, our fixed income securities, which have comprised roughly 25-30% of the Sustainable Income strategy since its inception, have served their purpose of enhancing overall portfolio yield and dampening overall portfolio volatility.

Talk to Us

Sustainable Income is just one of the strategies we can employ for our clients. Get in touch with us today to discuss the best strategy for you.

—

The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer