Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Risky Behavior Yields Mixed Results in 2021

Jan 14, 2022

Q4 2021 Quarterly Commentary – January 1, 2022

2021: An Extraordinary Year of Speculation

As we entered 2021, we noted in our quarterly commentary that speculative behavior in the markets was in an uptrend. To address the COVID-19 crisis, the Federal Reserve had flooded the capital markets with liquidity and the Federal government had provided individuals and businesses with large stimulus checks. Both actions fueled a dramatic economic and market recovery and lifted the animal spirits among market participants. Individuals poured money with abandon into stocks, particularly growth and “stay-at-home” stocks, and into ETFs that pursued exciting investment themes. Platforms like Robinhood and Reddit enabled some individuals to engage in completely irrational behavior involving what was dubbed the “meme stocks.” Institutional investors were not to be outdone and poured money into private equity and venture capital at rates never seen previously. According to Crunchbase, venture fundings in the first half of 2021 of nearly $290 billion represented an increase of 61% over the prior peak, and 250 new “unicorns,” defined as private companies with valuations in excess of $1 billion, were minted. We viewed this as a worrisome development but noted that the self-reinforcing nature of the market allows these things to persist for extended periods before the market delivers a wake-up call to remind us that markets are uncaring of those who are careless with their money.

Speculation has always been a two-edged sword. During the year, much of this behavior paid off but we saw instances where the opposite edge of the sword cut deeply. Established companies like Docusign and PayPal, whose stocks simply got grossly ahead of the fundamentals, suffered massive declines when forced to guide the Street’s expectations down. Growth stock investor Cathy Wood’s flagship ARK Innovation Fund lost -21.8% in 2021 as the forces that helped fuel its ascent—momentum-driven investor fund flows into the ETF—reversed and likely accelerated its decline. Crunchbase’s nine “notable” IPOs of the second quarter of 2021 debuted with a collective market capitalization of $276 billion. Today, the total market capitalization of this cohort of businesses is about $185 billion, a decline of roughly -33%. The INDXX SPAC & Nextgen IPO Index, which follows the performance of Special Purpose Acquisitions Corporations (“SPACs”), declined by -30% in 2021. Even the stock of Robinhood, ground zero for retail speculation, was down by -53% at year-end from its July 29, 2021 IPO price. These are signs that the speculative balloon is deflating. We should remain watchful, as both the creation and reversal of bubbles is a process that takes time. These events serve as a reminder that investing is not a game and that we can best serve you by resisting temptation and sticking to our tried-and-true approach to long-term wealth compounding. Not every one of our stocks performed as well as we would have liked, as is always the case, but we believe the businesses we own are sound, their prices are reasonable, and their managements produced real intrinsic value through the year. With this process and with these holdings, we feel that we are poised for further long-term gains.

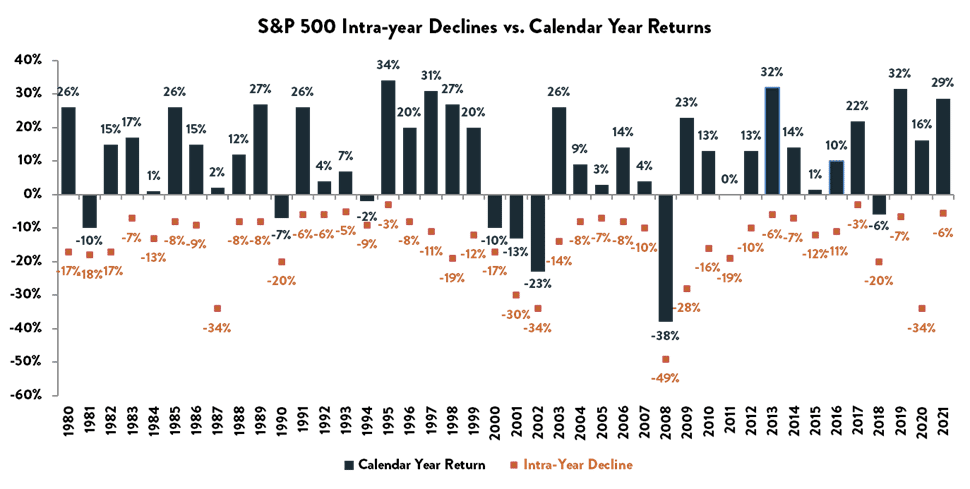

All of this said, it was a very good year for investors in stocks. The Dow Jones Industrial Averages, S&P 500 and NASDAQ Composite indexes rose by 21%, 28.7% and 22.2%, respectively, including dividends. The year finished strong, with fourth quarter total returns for the three indexes of 7.9%, 11% and 8.5%, respectively. Moreover, market volatility was virtually absent during the year. The largest drawdown in the S&P 500 Index, occurring between September 2nd and October 4th, was only -5.5%. It may be hard to reconcile this notion of calmness in the markets with the previous illustrations of losses suffered by speculators, but we note that IPOs do not register in the S&P 500 index, and that the winners in this index of 500 stocks more than compensated for the losers. To put this low drawdown statistic in perspective, in the 41 calendar years since 1980, the market has been this “calm” only three times. The average calendar-year drawdown over this period was -14%.

We spoke about recency bias in our third-quarter investor call and cautioned that the average retail investor has developed unrealistic expectations about the returns that equity markets can generate over the long-run. The relative calm of markets over the past year reinforces these misguided expectations. Investor complacency helps explain why margin debt at brokerages increased by nearly $200 billion, or 27% versus the prior year and domestic equity ETFs enjoyed over $460 billion in net inflows. We expect that investor return expectations will be tested at some point, and that market volatility will eventually return to its previous averages. After-all, the Fed’s next move is to tighten, not loosen, monetary policy and the efforts in Congress to further extend government stimulus payments have stalled. Those market tailwinds are gone. Of course, we have no idea the timing of this return to “normal.” Whether the new money that has entered the market via Robinhood will remain invested amid market volatility or will be withdrawn, time will tell. But if history repeats itself, hot money comes and hot money goes. We have been through many of these episodes without changing our tune. Market volatility is never a pleasant experience, but these periods often provide us with our best opportunities to position our accounts for long-term growth. So, rather than fear market volatility, we will accept that it is a normal market dynamic and seek to take advantage of it.

When bull markets are long in the tooth and valuations are generally full, the work gets harder. We remind ourselves that protection is as important as growth when accepting equity market risk. We remember that the stock market is comprised of thousands of individual securities whose long-term paths are tied to the fortunes of the companies of which these securities represent an ownership interest. We need not “play” the markets with the speculators, but rather we can choose where to put our money to work and which securities to avoid. We work hard to understand the opportunity and the risks we face, and we forge ahead deliberately and unemotionally. We hope and expect that this discipline will serve your long-term financial needs.

Bond markets are a traditional safe haven from equity risk, but with interest rates as low as they are today, the tradeoffs are complicated. Bond markets faced some headwinds in 2021 as the benchmark 10-year Treasury yield rose from 0.87% on January 1, 2021 to 1.44% on December 31, 2021. Bond prices move inversely with changes in interest rates. Investment grade credit spreads (the difference in yield demanded by investors for corporate credit risk relative to “risk-free” Treasury securities) fluctuated throughout the year but ended the year roughly where they began. Consequently, the Barclays Aggregate Bond Index, a fair proxy of the broad investment grade bond market, produced a total loss for the year of -1.77%. High-yield bonds fared a little better, fueled by some of the same factors as the stock market. Investors were inclined over the course of the year to accept more risk, so junk bond credit spreads narrowed by about 76 basis points. Treasury Inflation Protected Securities logged positive returns as the threat of inflation increased as the year progressed. The Blackrock iShares TIP ETF, for example, produced a return of 5.67% in 2021.

We look forward to speaking with you, please drop us a note or contact us.

***

The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Claire Shifren, CFP®

Senior Financial Advisor