Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

6 Reasons for $6 Gasoline

Apr 18, 2022

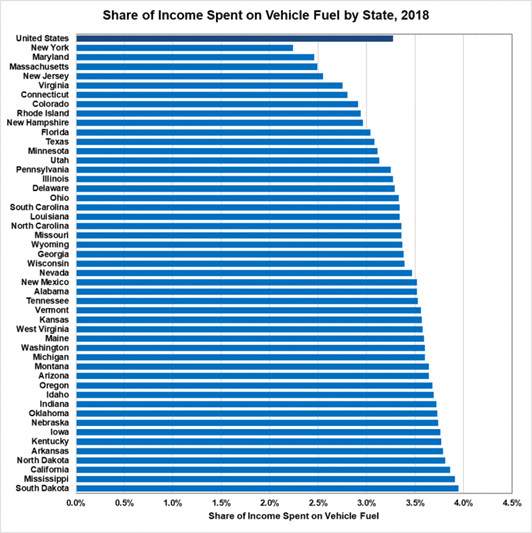

Unless you have been living under a rock, you are aware that gas prices are sky-high. Perhaps no topic elicits more public discussion than gas prices, even if it is a low single-digit percentage of spending[1] (and far lower for those with higher income). The fact that gas prices are broadcast on every street corner attunes us to day-to-day fluctuations in a way different than other items.

Figure 1: Share of Income Spent on Vehicle Fuel; Source: Energy.gov.

However, Californians have little sympathy for headlines about $4 gasoline (the common refrain – “I wish I could pay $4 a gallon!). So why are prices in California so much higher than the rest of the country? Below, we’ll address six important factors that influence both the United States broadly and California specifically.

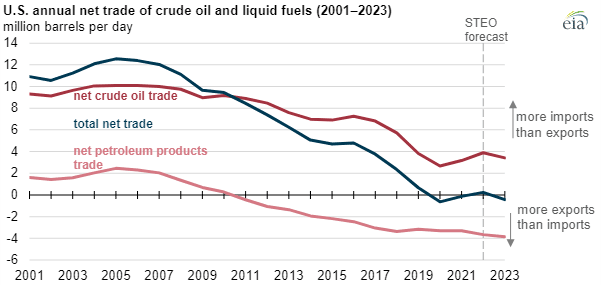

1. Geopolitical Tensions

The most obvious culprit for high prices is the Russian invasion of Ukraine, as well as the subsequent sanctions and economic fallout. However, headlines in recent years have trumpeted the US as an energy-independent exporter of fossil fuels. This statistic, while not technically incorrect, is misleading. The US is a net energy exporter the same way a farmer is a net food exporter. Much like the farmer cannot say she is “food-independent” simply by growing more calories than she exports, the US is not “energy-independent” in the sense that it does not produce the exact types and amounts of fossil fuels needed for the economy. The US still needs to import other fossil fuel products, primarily crude oil and other crude oil products, while exporting primarily natural gas[2].

Figure 2 – Source: US Energy Information Administration (EIA)

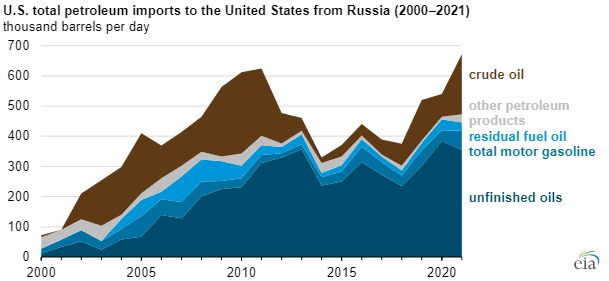

Russia only provides 8% of US petroleum imports. While that 8% may be small, it includes 20% of petroleum products imported[3]. These include everything from finished motor gasoline to additives required to produce gasoline domestically.

Figure 3 – Source: US Energy Information Administration (EIA)

The process of producing gasoline is complex and requires much more than crude oil. As such, even if crude oil can be replaced, replacing products such as petroleum distillates is a more difficult task – imagine trying to bake a cake with flour, sugar, and…nothing else.

2. Bottlenecks

You might be sick of hearing about supply chain disruption, but this 2020 problem continues to plague all industries years later. Much as gasoline is complicated to produce, extracting fossil fuels is more complicated than sticking a tap in the ground. As an example, the sand used in fracking operations is in tight supply, limiting operations[4]. Unfortunately, this sand cannot simply be replaced with a trip to the beach.

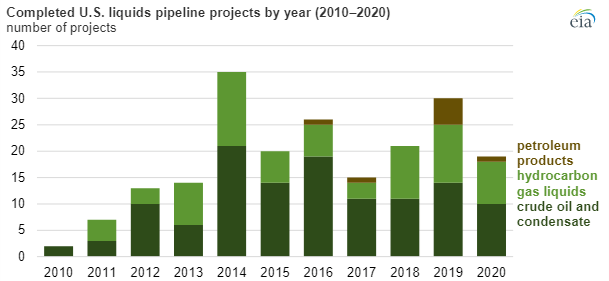

Another constraint is the transportation infrastructure. While much has been made of the Keystone XL pipeline, its primary function would be the delivery of Canadian crude oil to the Midwest (and on to Gulf Coast refineries). The number of liquids pipeline projects completed peaked in 2014[5], before shale over-production caused prices to collapse and capital expenditures to fall accordingly.

Figure 4 – Source: US Energy Information Administration (EIA)

Producers could double their output, but it would be meaningless without a commensurate increase in the transportation infrastructure. While more pipelines come online, these are subject to headwinds from regulatory delays to materials shortages[6] – and there is no quick fix for a pipeline.

3. Investor Demand

The beginning of the 2010s was a boom time for US fossil fuel production, as techniques such as fracking and horizontal drilling had proliferated and changed the landscape of global energy production. Consequently, investors poured capital into the sector, enabling a wildcatter’s dream and empowering controversial executives to take big risks (and sometimes, get into legal trouble[7]).

Unfortunately, the investment truism persisted: a high-growth industry doesn’t necessarily imply high returns. A damning report by Deloitte found that, since 2010[8]:

“The US shale industry registered net negative free cash flows of $300 billion, impaired more than $450 billion of invested capital, and saw more than 190 bankruptcies […]”

In essence, shale producers in aggregate set hundred of billions of dollars of investor capital on fire. Investors were, predictably, frustrated with the “growth-at-any-cost” mentality that predominated. If the shale industry couldn’t grow profitably through multiple bouts of $100+ barrel oil, the future looked grim.

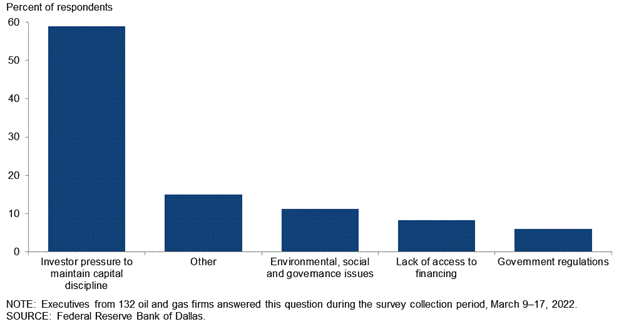

After oil prices collapsed in 2014-2015 from $100/barrel to $30/barrel, the industry was in the Wall Street penalty box. Most producers were not profitable through a five-year slog of persistently low prices. This was capped off by a 2020 that saw oil prices dip into negative territory. Investor appetite for new wells was nonexistent, and a spate of bankruptcies was imminent. Instead of a collapse, prices have roared back to $100/barrel. Company managements have yet to regain the appetite for drilling, and a recent Dallas Fed Energy survey question – “Which of the following is the primary reason that publicly traded oil producers are restraining growth despite high oil prices?” has a consensus answer: investor pressure[9].

Figure 5 – Source: Federal Reserve Bank of Dallas

4. Taxes and Fees

Let’s address one of the California-specific reasons for high prices – taxes. While everyone pays a $0.18 Federal gas tax, California adds a variety of taxes and fees, from sales and excise taxes to “hidden” producer fees, such as the Underground Tank Storage Fee[10]. Overall, these add up to the highest taxes in the US, which results in an approximately $0.86 per gallon in costs to Californians[11] (this assumes a weighted average of local sales tax rates).

The costs break down as follows:

- CA State Excise Tax: $0.511

- Other State Taxes/Fees: $0.1705

- Federal Excise Tax: $0.184

- Total: $0.8655

Some of the producer fees are not immediately visible to the consumer, such as the tank storage fee mentioned above. This cost may be reasonable, as it aids in cleaning up contaminated soil and groundwater from leaking tanks; however, the appropriate amount of taxes is as much a political question as a fiscal one. What is clear is that California’s taxes and fees are a state-specific reason for high prices.

5. Geography

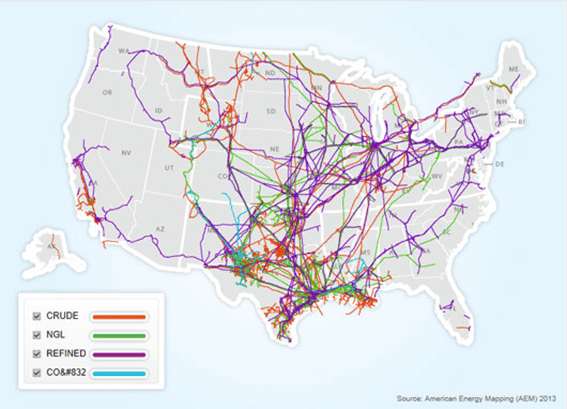

Notice anything about the following map?

Figure 6 – Source: US Energy Information Administration (EIA), US Energy Mapping System Project

Although California is the most populous state in the US, and its population is highly distributed across the entire state, the pipeline infrastructure is mostly the product of legacy oil and gas production in the Central Valley and Southern California. In the Midwest and Gulf Coast, the production and refining capacity mean a robust pipeline infrastructure exists. The East Coast also has more capacity, arguably because of being longer ingrained in US infrastructure and economy (as well as being a distribution point for European petroleum exports).

The beautiful coasts and mountains of California make for a wonderful place to live, but paired with minimal infrastructure, it makes it difficult to transport fossil fuels economically statewide. Moreover, California is a car-heavy culture, resulting in transportation being the largest source of energy consumption, even though Californians are one of the lowest per-capita energy consumers in the US[12].

6. Environmental Regulations

California has long been a leader on environmental regulations. While some of this may be due to California’s political climate, anyone who drove through a smog-filled Los Angeles in decades past understands some of the history that led to gasoline regulations. Most Californians are unaware that California requires its own special blend of gasoline, created by the California Reformulated Gas Program[13]. Introduced in 1991, the program required that all gasoline by 1996 be produced in a manner to reduce emissions of ozone, carbon monoxide, and other carcinogens.

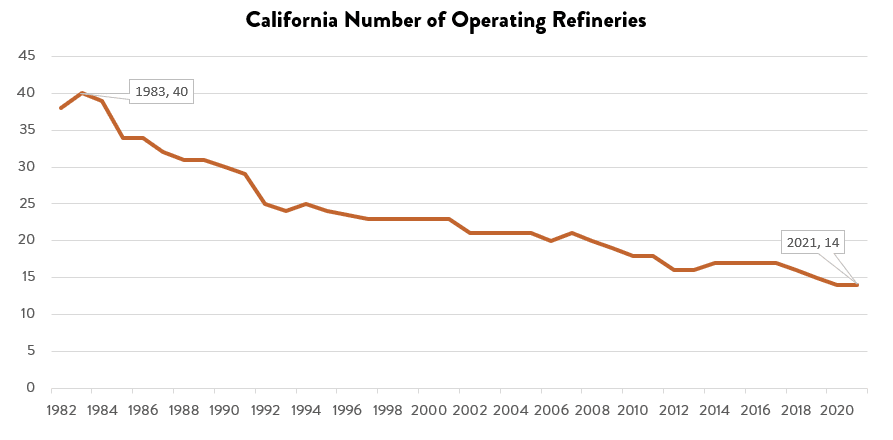

While this may be a worthwhile endeavor, it means that California gasoline (a) requires more work to refine and (b) cannot be replaced with “generic” gasoline. California’s gasoline market is largely isolated from the national market and needs to refine its own gasoline, making the economics less attractive for refiners. This collides with a long-term decline in in-state oil refineries, from a peak of forty to a 2021 count of fourteen.

Figure 7 – Source: US Department of Energy

California’s regulatory climate is not supportive of additional refining capacity, coinciding with the state’s goal of transitioning to renewable energy. That said, a 65% reduction in refineries during a period of economic and population growth is a recipe for higher prices.

Conclusion

There’s a saying in economics: “you can’t do just one thing.” High prices today are a confluence of public policy decisions and exogenous factors beyond our control. This is not to say the policy is incorrect – an economist would also tell you that high prices are an incentive to transition to renewable energy. As we venture into the greatest energy transition since the Industrial Revolution, being better informed allows us to be more active participants in shaping our own future. It is on us to make sure we get this right.

Interested in more of our insights like this? Contact us today!

—-

[1] US Department of Energy, “The Average Household Spent 3.27% of its Income on Vehicle Fuel in 2018” ; 8 March 2021

[2] Ornella Kaze (US Energy Information Administration), “Today in Energy”; 18 February 2022

[3] Kevin Hack (US Energy Information Administration), “Today in Energy”; 22 March 2022

[4] Liz Hampton (Reuters), “As oil prices soar, U.S. drillers scramble to find sand for fracking”; 15 February 2022

[5] Jim O’Sullivan (US Energy Information Administration), “Today in Energy”; 18 February 2022

[6] Dan Eberhart (Forbes), “Supply Chain Woes, Inflation Crimp U.S. Producers’ Growth Potential”; 2 April 2022

[7] Erin Ailworth (The Wall Street Journal), “Aubrey McClendon’s Financier Settles Lawsuit With Chesapeake Energy”; 14 April 2015

[8] Deloitte, “Implications of COVID-19 for the US shale industry”; 2020

[9] Federal Reserve Bank of Dallas, “Dallas Fed Energy Survey”; 23 March 2022

[10] California Department of Tax and Fee Administration, “Publication 88: Underground Tank Storage Fee”; July 2019

[11] American Petroleum Institute, “State Motor Fuel Taxes Report”; January 2022

[12] US Energy Information Administration, “California State Energy Profile”; 17 March 2022

[13] California Air Resources Board, “California Reformulated Gasoline: An Overview”; February 1995

[14] US Energy Information Administration, “Number and Capacity of Petroleum Refineries (California)”; 1 January 2022

This article is for informational purposes only. Summitry obtains information from sources it believes to be reliable, however, Summitry does not guarantee the accuracy of the information from third-party sources. Summitry provides links for your convenience to websites produced by third-party providers. Accessing websites through links directs you away from Summitry’s website. Summitry is not responsible for any errors or ommissions in the material on third-party websites, and does not necessarily approve or endorse the information contained therein.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.