Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Dividing Stock Options in Divorce: How to Split Your Restricted Stock Units

Apr 29, 2025

For the most part, stock options and restricted stock units (RSUs) are treated as marital assets during a divorce. Their division isn’t typically straightforward due to issues like vesting schedules, valuation, tax implications, and state laws.

Here’s how to make sense of it—and protect your share.

What Counts as Marital Property?

Employee stock options granted during marriage are generally considered marital property, even if they vest after the divorce. Courts may differentiate between options earned for past work (marital property) and those granted for future performance(separate property).

Some states treat unvested options differently depending on whether they are tied to past or future performance. California courts often use time-based formulas to determine the marital portion (more on that below).

But here’s where it gets tricky:

Even if the options vest after the divorce, they could still be considered marital assets.

Three Ways to Divide Stock Options in a Divorce

1. Deferred Distribution

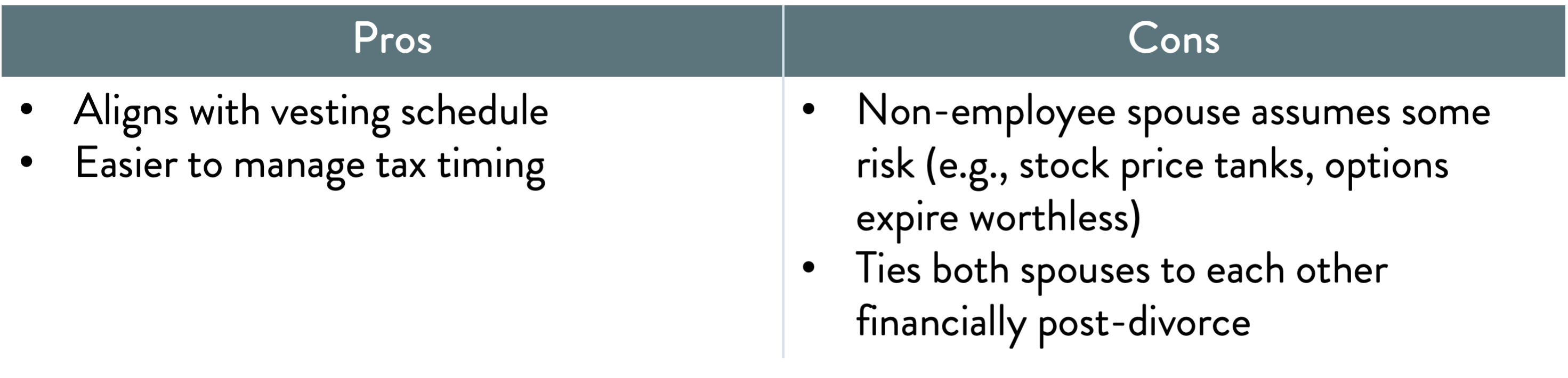

Also called the “if, as, and when” method. The non-employee spouse gets their share if and when the options are exercised. Note that deferred distribution often requires constructive trusts or court orders to ensure compliance since stock option agreements typically prohibit direct transfer to non-employees.

2. Offset with Other Assets

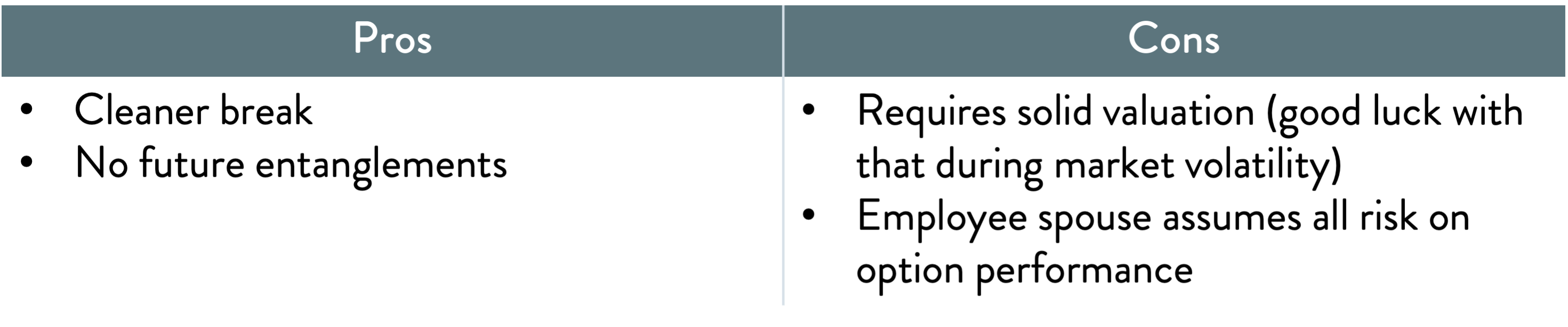

The employee spouse keeps the options. The non-employee spouse gets other assets of equal value (think: real estate, retirement accounts).

3. Sell or Exercise & Hold, then Split

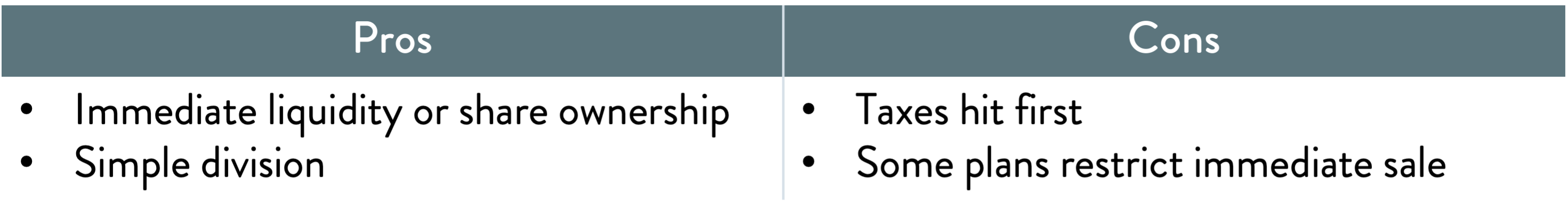

If the options are vested and the plan allows it, exercise the option, then hold or sell the stock and split the resulting shares or proceeds.

How is Unvested Stock Valued?

Unvested stock options are hard to value because they depend on:

- Future stock price

- Vesting conditions

- Expiration dates

- Company restrictions

Here’s a common approach:

“TechCrunch Value”: A rough estimate calculated as:

(Company Value ÷ Total Outstanding Shares) × Number of Shares Held.

Scenario:

- Company Value: $1 billion

- Total Outstanding Shares: 10 million

- Number of Shares Held: 1,000

Calculation:

TechCrunch Value=( 10,000,000 / 1,000,000,000)×1,000=100,000

Result:

The estimated value of the stock options is $100,000.

IRS Rev. Proc. 98-34

A more detailed method using pricing models (similar to Black-Scholes) to account for time, volatility, and contract terms.

Advanced models like Black-Scholes or Monte Carlo simulations are sometimes used for precise valuation, especially for performance-based options. Talk with your financial advisor or lawyer to make sure yours are being valued using the most appropriate formula.

What About RSUs?

Unlike stock options, RSUs don’t have an “exercise price”. They’re just promised stock, delivered once they vest.

Here’s how they’re usually handled:

Marital vs. Separate Property:

RSUs granted during the marriage are typically marital property, but unvested RSUs may be excluded if tied to future performance after separation.

Division Methods:

Buyout: The employee spouse retains the RSUs and pays the non-employee spouse their share based on current value.

Deferred Division: The RSUs remain with the employee spouse until they vest, at which point the non-employee spouse receives their portion after taxes.

Tax Considerations:

Taxes on RSUs or stock options are often deducted before division to ensure fairness.

State-Specific Rules:

Some states use specific formulas (e.g., Hug or Nelson formulas in California) to allocate unvested RSUs based on marital contributions.

What About SARs?

In addition to traditional stock options and RSUs, some employees receive Stock Appreciation Rights (SARs). SARs function similarly to options but provide a payout based on the increase in stock value rather than granting actual shares. Courts generally treat SARs granted during the marriage as marital property, even if unvested at separation. Speak with a specialist to verify whether your SARs are private or marital property, and what that means for you.

Divorce Law Considerations for California Residents

Community Property Laws

In California, all assets acquired during the marriage, including stock options and RSUs, are typically considered community property and are subject to equal division unless otherwise agreed upon in a prenuptial or postnuptial agreement.

Hug and Nelson Formulas

California courts often use these formulas to divide unvested stock options:

- Hug Formula: Allocates stock options based on the time worked during the marriage relative to the total time from the grant date to vesting. This formula is typically used when stock options are granted as compensation for past performance.

- Nelson Formula: Focuses on the time between the grant date and vesting date, emphasizing future performance incentives. This is used when stock options are granted to encourage continued employment.

Tax Implications

Employee & non-employee spouses should be aware of tax rules surrounding options, as taxes on stock options (NSOs or ISOs) can significantly impact their net value. For example, ISOs may trigger Alternative Minimum Tax (AMT), which should be factored into any settlement.

Section 83(b) Election

For certain stock options and restricted stock awards, employees may have the opportunity to make a Section 83(b) election. This IRS election allows the recipient to pay taxes on the fair market value of the stock at the time of grant, rather than at vesting.

In a divorce, whether an 83(b) election was made can materially affect the after-tax value of the asset being divided. If the election was made, taxes were prepaid at grant, and future appreciation may be taxed at more favorable capital gains rates. If not, the tax burden will fall at vesting or exercise, potentially at higher ordinary income rates. The existence (or absence) of an 83(b) election should be disclosed during divorce negotiations, as it impacts both valuation and how the tax burden is shared between spouses

Market Fluctuations

Courts recognize that market volatility can affect the value of the stock options or RSUs. Because of this, deferred distribution methods are commonly used to ensure fairness if the stock’s value changes after divorce.

Here’s an example illustrating how market fluctuations can affect the division of stock options in a divorce and why deferred distribution is often used:

Example Scenario

A couple divorces in 2025, and the employee spouse holds 1,000 stock options granted during the marriage. At the time of divorce, the company’s stock is valued at $50 per share, but the options are unvested and will vest in 2027. The couple agrees to use deferred distribution to divide the options.

Market Fluctuation Impact:

By 2027 when the options vest, the stock price could rise to $100 per share or drop to $30 per share. If the stock price rises to $100, the non-employee spouse receives a much larger payout than if it drops to $30. Deferred distribution ensures that both spouses share in the actual value of the options at the time they are exercised, reflecting real market conditions.

Why Deferred Distribution Works:

It avoids overestimating or underestimating the value of unvested options at the time of divorce. Both parties share in the risks and rewards of market fluctuations, ensuring fairness.

Key Takeaways

When stock compensation is involved in a divorce, the details matter. Here are three things you can’t afford to overlook.

1. Track Everything

Vesting schedules, grant letters, stock plans—document it all.

2. Get Professional Help

Don’t DIY this. Work with an attorney or financial expert who understands stock-based compensation.

3. Consider the Taxes

Options and RSUs often come with big tax hits. That needs to be factored into any split.

Make The Most of Your Unvested Stock Options with Summitry

At Summitry, we specialize in helping tech professionals navigate complex financial situations—like dividing stock options and RSUs in a divorce. Our Bay Area advisors understand the nuances of equity compensation, community property laws, and tax implications that come with living and working in California. If you’re facing a divorce and want to protect your financial future, let’s talk.

We’ll help you make smarter decisions around your stock—and everything else.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President