Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Exercising Discipline in Uncertain Times

Oct 14, 2022

Q3 2022 Quarterly Commentary – October 1, 2022

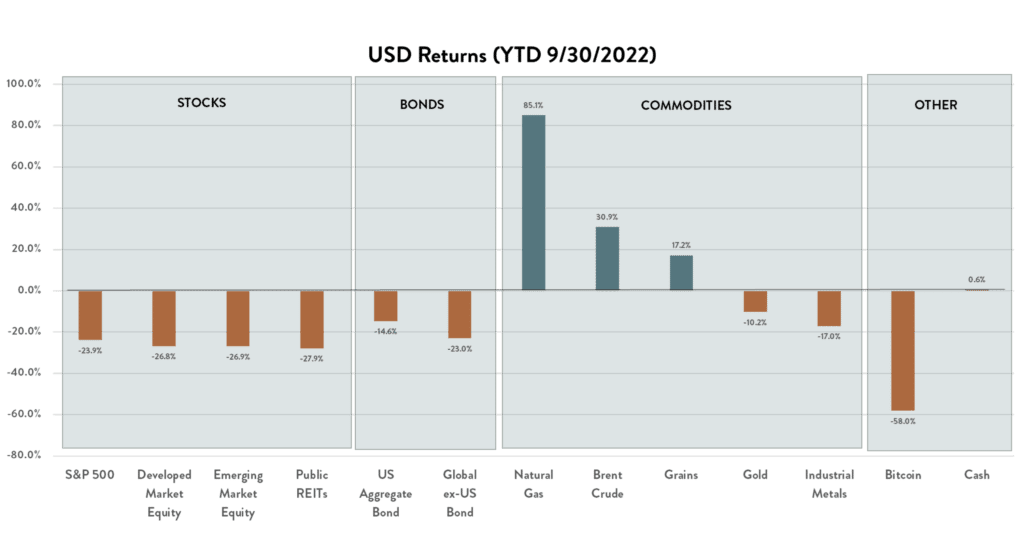

The first three quarters of 2022 have been challenging for investors, to put it mildly. What separates this year from other difficult periods in the markets is that the pain has been felt across virtually all asset classes. Losses are not limited to U.S. stocks but have been felt in a significant way across global equity and fixed income markets. Traditional safe havens like high-quality bonds have disappointed under the pressure of inflation. Crypto currencies, once described by their promoters as an ideal hedge against inflation-driven currency debasement, have been anything but that. Sadly, the only asset classes that have risen in 2022 are the ones that Vladimir Putin holds in size and is using to finance his war on Ukraine and the West: hydrocarbons and agricultural commodities.

Exhibit 1: Year-to-date returns for key asset classes

Source: Bloomberg, J.P. Morgan Asset Management

The Federal Reserve, in response to persistent inflation, is tapping the brakes hard on the U.S. economy, using the tools it has available to it. Specifically, it has raised the Federal Funds rate from close to zero in February 2022 to roughly 3% today and is signaling further increases in that benchmark rate. Further, it has begun a process called Quantitative Tightening (also known as “QT”) by shrinking the size of its massive bond portfolio. The Fed has removed itself in a meaningful way as a large buyer of bonds, which puts upward pressure on rates across the market. The Fed hopes that by raising the cost of credit in the U.S. economy, “aggregate demand” for goods and services will slow and inflation pressures will subside. The question across Wall Street and Main Street is whether these actions will tip the economy into a deep recession or if instead – ideally – inflation can be tamed while economic growth and employment is maintained. The truth, we believe, will be somewhere in-between. The Fed was late to react to inflationary pressures and has put itself in a position to use blunt force rather than finesse to fight the inflation scourge.

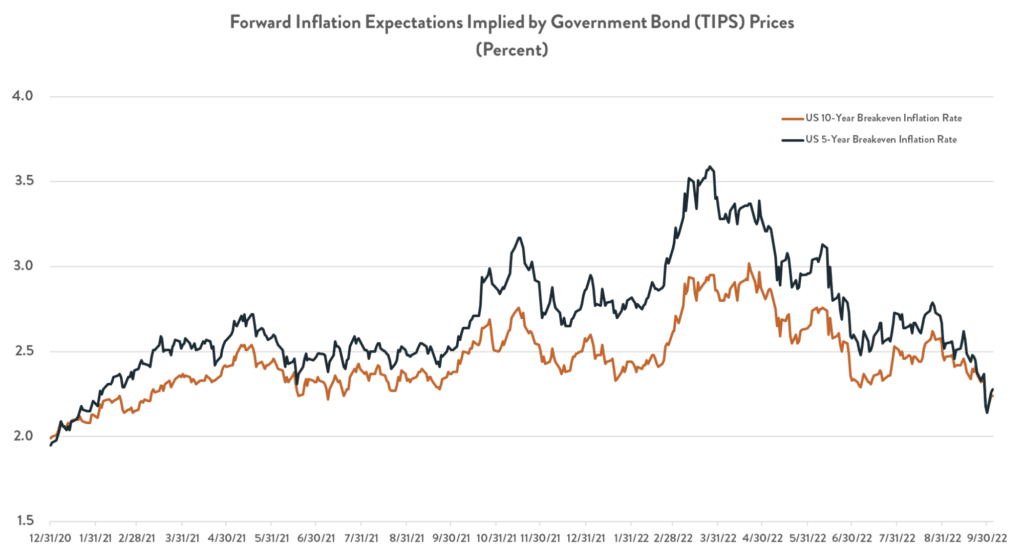

We can’t know for sure whether the medicine to fight persistent inflation will work exactly as advertised by the Fed, but we do see some signs of hope. One such measure is the expected level of long-term inflation that is reflected in the prices of Treasury securities. We can ascertain the level of inflation expected by participants in the massive market for U.S. Treasury securities when we subtract yields on Treasury Inflation Protected Securities (“TIPS”) from yields on traditional Treasury notes with identical maturities. Tracking this spread over time, we can see that the market “believes” the inflation wave to be breaking. If the market is correct, it doesn’t preclude a continued battle with inflation over the short term, but it would be very good news for you and us as long-term investors if inflation returns to the 2.0%-2.5% level “predicted” by the markets.

Exhibit 2: A breaking wave of expected long-term inflation

Source: Federal Reserve Bank of St. Louis – FRED

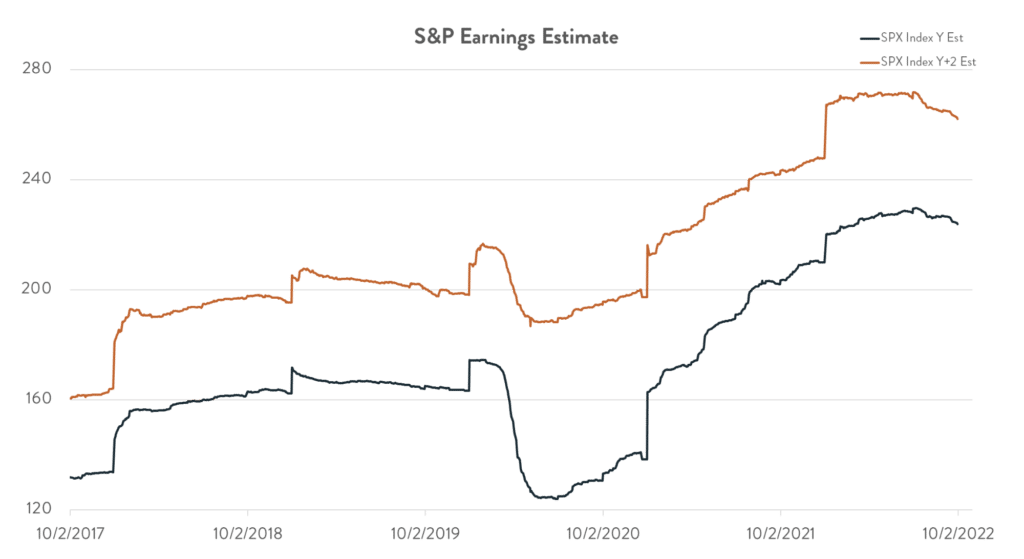

Stocks comprise a majority of our investment exposure, and this uncertain environment has clearly weighed heavily on stock prices. Have the declines gone too far relative to the most important long-term driver of stock valuations: corporate earnings? Perhaps. Amid the current economic uncertainties, Wall Street analysts have reduced their estimates of future earnings, but not by much. The following data compiled by Bloomberg keeps a running tally of Street earnings estimates of S&P 500 companies over the past 5 years. The lower line shows consensus analyst estimates of S&P 500 earnings for the 12 months succeeding the date of the estimate, and the upper line shows consensus analyst estimates for the period two years forward from the date of the estimate. Note the long-term trend of growing earnings estimates over time and the frequent changes along the way to reflect the evolution of analyst opinion. During the Covid crisis in 2020, forward estimates declined dramatically, as should be expected given the economic disruption the disease caused, and then estimates of future earnings quickly recovered. In the current economic malaise and possible recession, analysts have indeed reduced their estimates, but by an amount substantially less than the decline in prices of the securities that will produce these future earnings, suggesting the market may have overshot.

Exhibit 3: Forward analyst earnings estimates for S&P 500 constituents

Source: Bloomberg

We believe that markets like these, mired in conflict, concern and uncertainty, actually present an opportunity for investors who exercise discipline. At the S&P 500’s closing price of 3585.62 on September 30, 2022, the market trades at a P/E multiple of 15.4x forward earnings (based on the above Bloomberg estimates), and 13.6x two-year-forward earnings, which in our view, is not a rich valuation. Time will determine if these earnings materialize as Wall Street analysts expect, but among the 500 companies that make up the index, some well-managed companies will certainly do well. We will continue exercising discipline to maintain positions in well-priced, resilient businesses, and to find new ones we believe will shine over the next several years. In our experience, this is the best way to protect and grow clients’ wealth over the long-term.

The dramatic changes in interest rates on government, municipal and corporate bonds also presented us an opportunity to adjust some of our exposures to the fixed income markets during the third quarter of 2022. The Treasury curve is inverted at present, which means short term Treasuries carry higher yields than longer-term Treasuries. In our opinion, this is neither a normal nor a sustainable relationship between yields and bond maturities. Similarly, the corporate bond curve is relatively flat when compared to historical norms. Finally, yields across the curves for all bonds are significantly higher than they were at the outset of the year, as the market responded to inflation pressures and the Federal Reserve acted to tighten monetary conditions. In response to these forces, we’ve sought to ensure that all client bond holdings are relatively short in duration and high in quality. We have added to our toolkit a suite of ETFs offered by BlackRock called iBonds®, which enable us to pick spots on the Treasury and corporate yield curves to focus our exposures while maintaining high liquidity, broad diversification and low cost.

We recognize that these are uncertain times and that market volatility as we have experienced in 2022 can affect your sense of financial security. We encourage you to have open and honest discussions about your financial plans with your Financial Advisor, who will offer useful perspective based on their time and experience in and around markets. Meanwhile, our investment team is energized by the opportunity that is created by market volatility and is laser-focused on uncovering new opportunities to improve your stock and bond exposures for the long term.

In September we welcomed Abegail (“Abby”) Cordero to the team, in the role of Client Service Specialist. Abby brings to Summitry over five years of client service and administrative experience in the Bay Area biotech and clinical laboratory industries, honing a skillset and a service-orientation that we felt well-suited to our business and our clients’ needs. She graduated from Cal State East Bay with a Bachelor’s degree in Health Science Administration, and has settled in her hometown, Fremont, where she enjoys yoga and hiking, and cares for two tiny Yorkshire Terriers.

Interested in learning more about us or our perspective? Contact us today!

This commentary is for informational purposes only, and the views reflected herein are subject to change at any time without notice. Summitry obtains information from sources it believes to be reliable, however, the accuracy of such information cannot be guaranteed. Past performance does not guarantee future returns. Investing involves risk and possible loss of principal capital.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer