Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Are There Tax Benefits to the California 529 Plan? Alternatives to Scholarshare 529 for College Savings

Jul 2, 2025

Talk with a Summitry Advisor About College Savings Options

Saving for college is top of mind for many California families, and 529 plans are one of the most popular ways to do it. But, unlike residents in some states, Californians don’t get a state tax break for using their home plan. So how do you know if ScholarShare 529 is right for you?

How Does a 529 Plan Work?

A 529 plan is a savings account that helps you save for education costs like college tuition, K-12 schooling, and even student loans. You open the account for a future student (the beneficiary) and contribute after-tax money, which is then invested and grows tax-free. When it’s time to pay for qualified education expenses, you can withdraw the money without paying taxes on the earnings.

Plans are flexible. You can change the beneficiary or transfer funds to another family member if needed. It’s a smart, tax-friendly way to prepare for education expenses and make your savings stretch further.

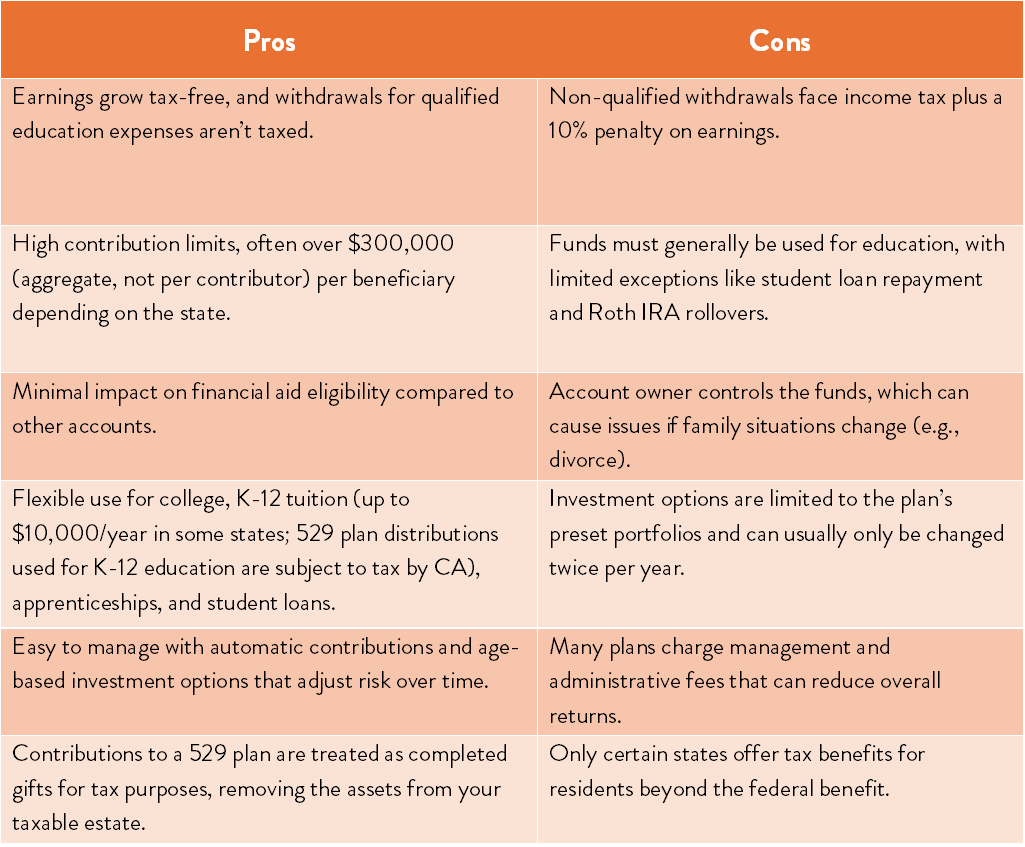

Pros, Cons, and Tax Benefits of 529s

What Counts as a Qualified Expense?

Funds from your 529 can be used for a wide range of education-related costs:

- College Tuition and Fees: At any accredited college, university, vocational, or postgraduate program in the U.S.—and even some abroad.

- Room and Board: For students enrolled at least half-time, including on-campus housing or off-campus rent up to the school’s published cost of attendance.

- Books, Supplies, and Equipment: Including required textbooks, lab materials, computers, printers, and internet access.

- Special Needs Services: For students with disabilities, if required for enrollment or attendance.

- K-12 Tuition: Up to $10,000 per year per student can be used for tuition at public, private, or religious elementary or secondary schools.

- Student Loan Repayment: Up to $10,000 lifetime per beneficiary can be used to pay down student loans.

- Apprenticeship Programs: Registered programs’ fees, supplies, and equipment qualify.

Withdrawals for non-qualified expenses are subject to income tax and a 10% penalty on earnings.

What Happens If the Beneficiary Doesn’t Go to College?

If the original beneficiary decides not to pursue higher education, don’t panic. Fortunately, you still have several options:

Change the Beneficiary

You can change the beneficiary to another qualifying family member at any time without tax consequences. Eligible family members include siblings, parents, cousins, and even yourself, among others. This flexibility means your savings can support another family member’s education—even if plans change.

Use for Other Qualified Expenses

The definition of qualified expenses has expanded in recent years. For example, you can use funds to repay student loans or fund registered apprenticeship programs, K-12 tuition, and more.

Rollover to a Roth IRA

Thanks to the SECURE 2.0 Act, you may be able to roll over up to $35,000 (lifetime limit) from a 529 plan to a Roth IRA for the beneficiary, provided the account has been open for at least 15 years and other IRS requirements are met. This can give your beneficiary a head start on retirement savings without incurring federal income tax or penalties (state tax treatment may vary).

Non-Qualified Withdrawals

Let’s say you don’t have any other loved ones with educational needs. If you withdraw funds for non-qualified purposes, the earnings portion will be subject to federal and state income tax and a 10% penalty. The original contributions (principal) are returned tax-free.

Gifting and Contributions from Family and Friends

529 plans make it easy for grandparents, relatives, and friends to help fund a child’s education:

- Anyone Can Contribute: Contributions can be made by anyone, not just the account owner or immediate family. This makes it a popular option for birthday gifts, holidays, or special occasions.

- Gift Tax Rules: Contributions are treated as gifts for tax purposes. In 2025, an individual can give up to $19,000 per beneficiary per year ($38,000 for married couples) without triggering federal gift taxes. The “superfunding” provision allows you to contribute up to five times the annual exclusion in a single year (up to $95,000 for individuals or $190,000 for married couples in 2025), jumpstarting the account’s earnings potential. If you “superfund” a 529 plan for an individual up to the limit ($95,000 for individuals or $190,000 for married couples in 2025), you do need to wait 5 years before being able to gift to that person again if wanting to do so under the annual exclusion amount rules.

- Account Owner Control: Even if others contribute, the account owner retains full control over the account and how funds are used.

These features make it simple and tax-efficient for loved ones to support a child’s educational journey while providing estate planning advantages for contributors.

About the California 529 Plan

California’s version is called ScholarShare 529. Here’s how it works:

- Open an Account: You can open an account in about 15 minutes, choosing from a range of professionally managed investment portfolios depending on your risk tolerance.

- Make Contributions: There are no minimum contribution requirements, and you can contribute as much or as little as you like, whenever you like, up to $529,000 per beneficiary.

- Grow Your Savings: Your contributions are invested, and the account’s earnings grow over time, tax-free.

If your child or grandchild doesn’t use the funds, you can switch the beneficiary to another family member or even yourself as long as the money is spent on education (more on that below).

Is CA’s 529 the Best Option for Residents?

It may not be.

While ScholarShare 529 is California’s official 529 plan, it doesn’t provide a state income tax deduction for contributions. That means California residents don’t get a direct state tax break for using ScholarShare compared to some other states’ 529 plans.

That’s why Summitry doesn’t default to ScholarShare. We get to know your goals and recommend the plan, California’s or another state’s, that best matches your needs.

So, while ScholarShare is a strong, user-friendly choice, it’s not automatically the best fit just because you live in California.

Example ScholarShare 529 Scenario

Let’s say you open a ScholarShare 529 account when your child is born and contribute $100 per month for 18 years, averaging a 5% annual return. By the time your child heads to college, your account could grow to over $35,000. You would avoid paying taxes on the $13,400 in earnings.

If you had saved in a regular taxable account, you’d owe taxes on your investment gains each year. In California, capital gains are taxed as regular income. With a 529, all your money goes further for your child’s education.

Alternative College Savings Options

Historically, we have favored Virginia’s CollegeAmerica 529 plan managed by American Funds thanks to its below average fees, flexible investment options, solid results, and top-notch management. Even if you don’t live in Virginia or get their state tax break, you might find its features (like a wide range of investments and an easy-to-use platform) make it a standout. It’s also been a Morningstar favorite for over 20 years.

Another option many of Summitry’s clients use is the Schwab 529 Education Savings Plan which is administered by the Kansas State Treasurer and managed by American Century Investments. In addition to the features and benefits of other 529 plans, the Schwab 529 Plan offers flexible investment options and no account maintenance fees plus below average overall expenses.

Finding the Best Option for Your Family

When it comes to saving for college, the early bird doesn’t just get the worm; he gets a bigger nest egg thanks to compounding returns. The sooner you make a plan and start saving, the better off you’ll be.

At Summitry, we specialize in California tax strategy as an integral part of comprehensive financial planning. If you’d like to explore all of your options and find a strategy that truly works for you, our team is here to help. Reach out to start a conversation about your full financial picture and discover the college savings plan that makes the most sense for your family. We’ve only outlined above the major considerations, features, and benefits, and the nuances matter when it comes to taking care of your family’s personalized educational goals and objectives.

Speak with a Summitry Advisor – contact us today!

Information provided in this article is current as of the date of writing and is for general informational purposes only. It should not be considered financial, tax, or legal advice. Individual situations vary—please consult with a qualified professional or reach out to our team for guidance tailored to your specific needs.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President