Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Bear Markets & The Importance Of Staying Invested

Dec 22, 2022

The following is an excerpt taken from our Quarterly Investment Update webinar, which we host exclusively for our clients.

With 2022 coming to a close, we should remind ourselves that bear markets like the one we’ve experienced this year–while they do occur–are the exception when viewed over the long arc of market history. They are uncomfortable, but they should not lead you to question the assumptions you’ve made in carefully planning your financial futures. In the same way that earthquakes are necessary to release pressures that build between tectonic plates, bear markets relieve speculative stresses that accumulate in times that money is too easy, interest rates too low, and speculative juices too frothy to continue forever. Following earthquakes, we rebuild and life moves on. Similarly, bear markets foster a renewed respect for risk, and consequently create the conditions for markets to reward investors who focus on the long-term compounding of their wealth. Bear markets don’t begin and end with the annual calendar, but this chart illustrates an important point about the rarity of these events.

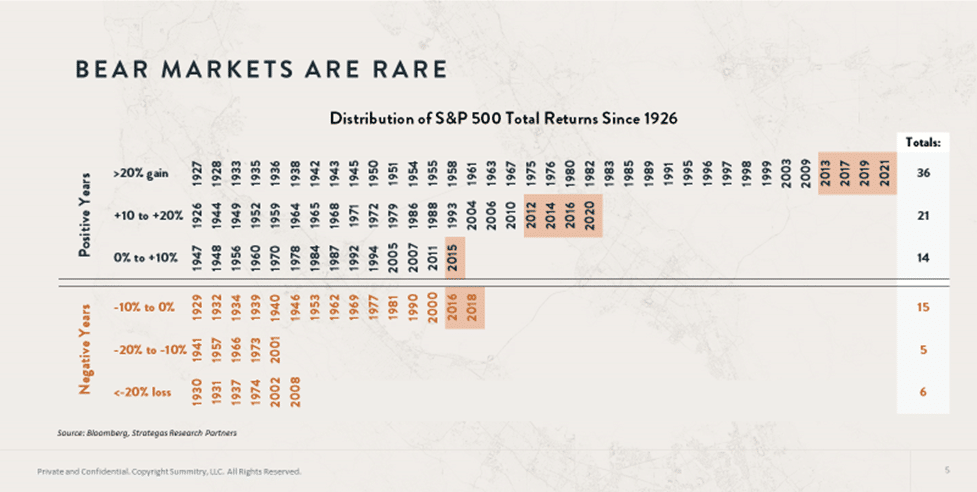

Above the double line in the middle of the chart are the years when the market, as represented by the S&P 500, ended with gains. The very strong years with 20% or greater returns are at the top, years with 10% to 20% total return are the second line from the top, and years with zero to 10% positive total return are the third line from the top. Negative returns are below the double line, and the lower the line, the worse the returns. Here’s the message: in the past century, including the years during the Great Depression, only a quarter of those years ended in losses, and only six of them ended with declines in the S&P 500 of greater than 20%. It shouldn’t be a surprise that these periods were often followed by some of the Index’s largest increases. Another point worth noting on this chart is how the returns are skewed to the upside, with 36 of the annual periods providing returns higher than 20%. The highlighted years are the last decade, which appears to follow the normal pattern.

We don’t know where 2022 will end up on the chart. If it’s a loss, that will be normal. Losses have happened about 25% of the time. If it is a significant loss, it will fall among those rare periods that we’ve seen from time to time over the years. This is also normal for markets. The markets have been and we believe will continue to be an incredible tool for compounding your wealth, provided we remain unemotional about them and keep our eyes on full market cycles rather than on the short term.

Bear market is driven by valuation multiple declines

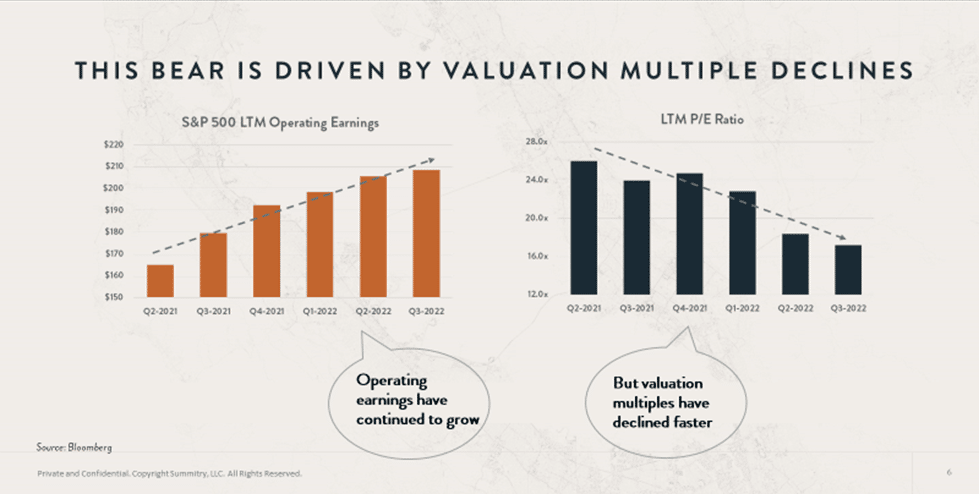

We are in a bear market now, and this particular one is occurring in an environment of continued economic growth and corporate earnings growth.

On the left, you can see that operating earnings of the companies that comprise the S&P 500 have continued to grow in successive quarters. Corporations are adjusting to changing economic environments, and they’re fueling their bottom lines, but stocks are down nevertheless. On the right, you can see that the price the market is paying for those earnings has declined significantly. PE ratios – that’s the price of the S&P 500 divided by the earnings generated by those companies – over the prior twelve-month period have declined from roughly 26x six quarters ago to roughly 17x at the end of the most recent quarter. The market’s obviously worried that this fundamental economic and business strength that we’ve seen will turn negative in the quarters ahead. After all, the Federal Reserve has declared its intent to fight inflation by raising the cost of credit and dampening aggregate demand. Markets are forward looking, and they’re concerned about the near term.

The correction that we’ve seen in valuation multiples has brought us to a level in terms of PE ratio, which, when we look at the historical record since the late 1980s, puts us at about average. It is in this kind of environment that our research team feels that it can be productive in finding opportunities for the portfolio.

The importance of staying invested

We think it’s an unwinnable game to try to guess when markets are going to reach tops and when markets reach bottoms. Rather than speculate with market timing, the investor needs to accept that markets are volatile in the short term. They always have been. Instead, they should focus on investing in quality securities at reasonable prices, allow the market to react to short term impulses as it will, and think in terms of investing over their relevant time horizons.

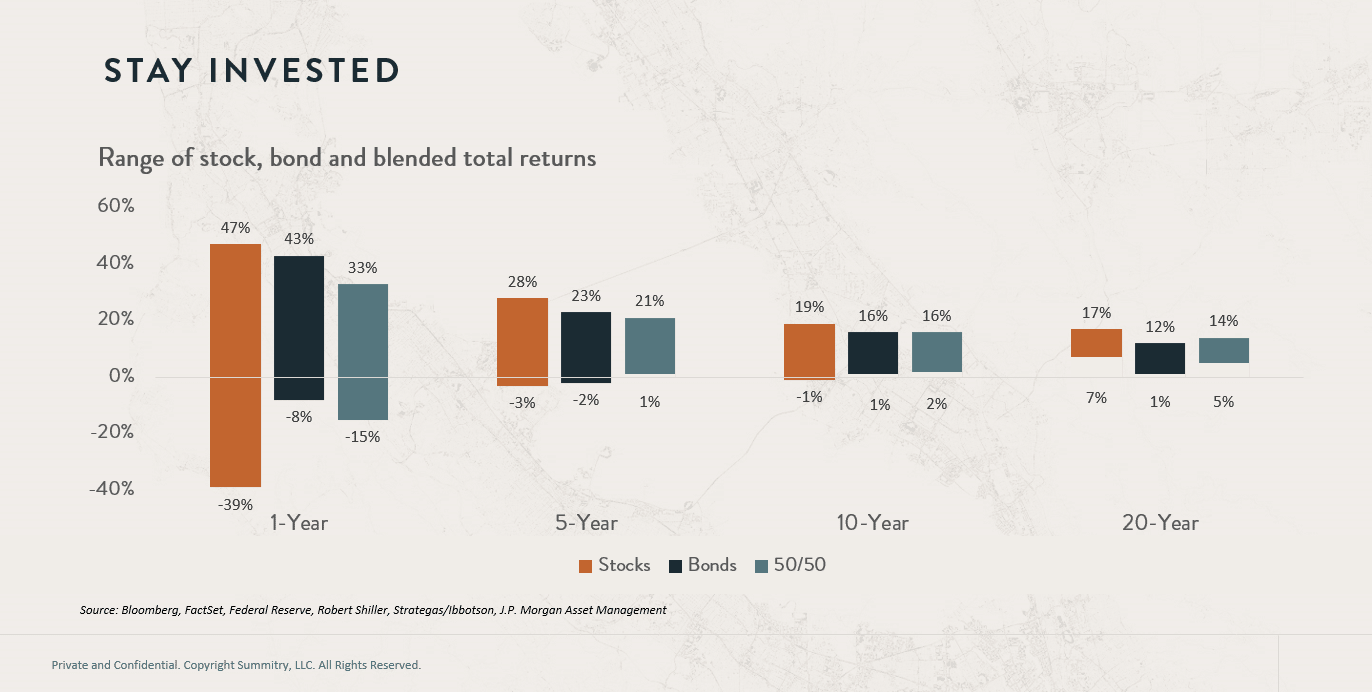

This chart evaluates returns in the markets from 1950 to the present.

It demonstrates that in any one-year period (the group on the left side of this chart): whether an investor owns all stock, all bond, or 50/50 blended portfolio, the range of outcomes has been really wide. There have been years when they’ve made a lot and years when they’ve lost a lot. For example, in one calendar year, the S&P 500 Index produced a return of 47%, and another when it lost 39%. But as you move to the right on this chart, and your time horizon extends to 5, 10 and 20 years, the range of outcomes narrows dramatically. In this period since 1950, the worst that an investor in an all-stock portfolio would have done over any 20 year period was to make 7% per annum.

That’s a positive 7% per annum, enough to turn a $1 million investment into a $4 million investment. And that’s the worst outcome. According to the data, the worst return in an all-bond portfolio was 1% per year, and a blended portfolio, 5% per year. Ask yourself: what’s your real time horizon? And even for those of you who are in the later years of your lives, is your horizon dictated by your personal longevity or by the lives of your children and grandchildren?

Interested in hearing more of our perspective? Contact us today for the full webinar or to schedule a meeting with one of our advisors!

—

This article is for informational purposes only. Nothing in this article constitutes investment advice or any recommendation that any particular strategy is suitable for any specific person. Past performance does not guarantee future returns. Investing involves risk and possible loss of principal capital.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Emily Hazelroth, CFP®

Senior Financial Advisor & Advisor Manager