Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Decoding Q3: From Fed Moves to Market Reactions – A Closer Look at Stocks, Bonds, and Rising Rates

Oct 18, 2023

Q3 2023 Quarterly Commentary – October 1, 2023

Most stock and bond market indexes suffered modest declines in the third quarter of 2023. After a good first half, stocks in the most recent period fought against a headwind of rising long-term interest rates. In Q3, the S&P 500, Dow Jones Industrials and tech-heavy NASDAQ Composite lost -3.3%, -2.1% and -4.0%, respectively, including dividends. International stocks, as measured by the MSCI EAFE Index, fell by -4.0% in a strengthening dollar environment, and small cap domestic stocks, as reflected in the Russell 2000 Index, shed -5.1%. Bonds provided no safe haven, with the Bloomberg Aggregate Bond Index falling by -3.2%.

Year-to-date results are far better, with all the above stock indexes delivering gains. Tech stocks led the charge, with the NASDAQ Composite up by +27.1%. The broader S&P 500 index has logged a solid return of +13.1% for the first nine months, reflecting its tilt toward large cap technology stocks. International stocks comprising the MSCI EAFE Index rose by +7.6% in US dollar terms. Non-tech related issues and small cap stocks are up in aggregate for the year to date but are lagging their brethren. The Dow Jones Industrials and Russell 2000 are up +2.7% and +2.5%, respectively. While stocks are up overall for the year to date, the Bloomberg Aggregate Bond Index is off by -1.2%.

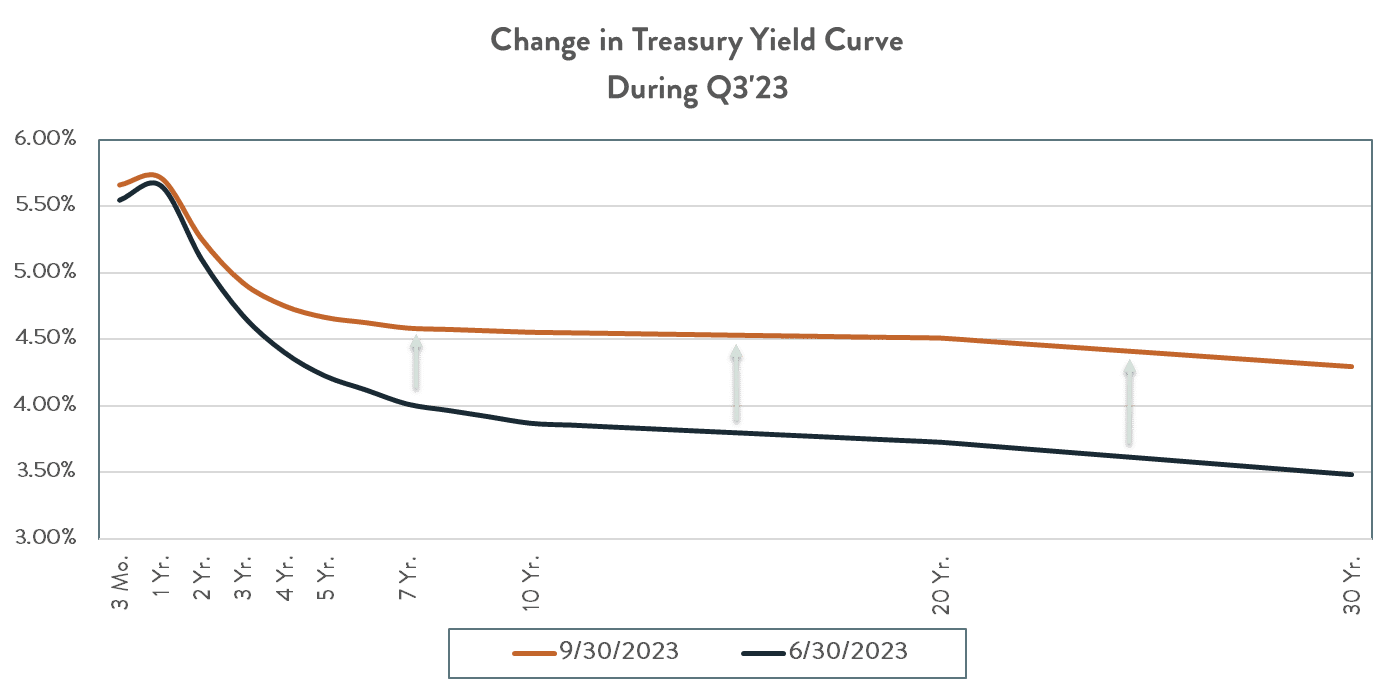

While there were many factors at play in the third quarter, rising long-term bond yields clearly weighed on stock valuations. The benchmark 10-year Treasury note finished the quarter yielding 4.57%, a rise of +73 basis points from its level on June 30th. The increase in rates is a reflection of the market’s ongoing concern about inflation, which is proving to be stubborn. During the quarter, the Federal Reserve raised the Fed Funds rate by +25 basis points and signaled that it was likely not finished. At the same time, the Federal Reserve is shrinking its balance sheet through a program called “quantitative tightening,” whereby it does not reinvest the proceeds of maturing securities into new ones. While the Fed has walked away from its Covid-era role of bolstering the credit markets, instead reducing the size of its balance sheet by roughly $1 trillion since April, the Federal government is still running record fiscal budget deficits that need to be funded with new issuances in the Treasury bond market. The forces of higher supply and reduced demand have helped to push bond prices lower, and bond yields higher (see Exhibit 1).

Exhibit 1 – Rising Long-Term Interest Rates

While the relationship between yield and price in the bond market is straightforward (higher yields depress bond prices), how can rising bond rates pressure stock prices as they did in Q3? In simple terms, yields on US government bonds serve as a baseline for investors. If one can achieve a 4.57% nominal return from owning a 10-year US Treasury note until its maturity, free of any risk of default, then one should demand a higher return from any other security to compensate for the added risk. Since corporate bonds are riskier than government bonds, their yields should be higher. Since stocks are riskier still, they should be priced at a level that offers even higher returns. Therefore, the meaningful increase in Treasury yields during the third quarter rippled through all capital markets, pressuring stocks as well as bonds.

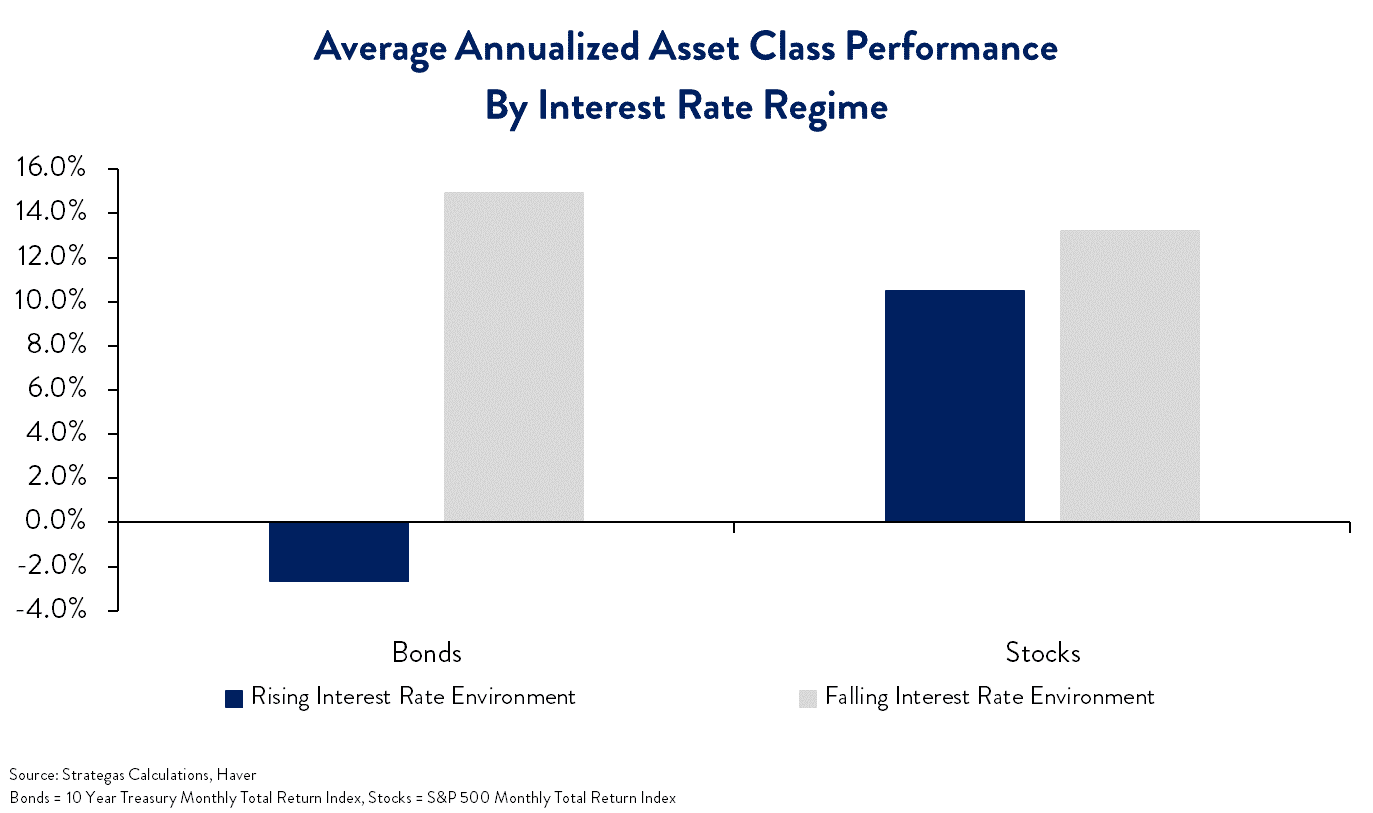

If history is any indicator, this pressure on stock prices should be temporary. Over previous economic and market cycles, the positive force of growing corporate earnings has overcome the negative force of rising interest rates, fueling long-term stock price growth. Since 1960, we have experienced eleven sustained periods in which interest rates rose (see Exhibit 2). During those periods, presented in blue, bonds delivered negative returns overall, as bond valuation declines exceeded interest income produced. The straightforward and predictable relationship between yield and price prevailed in the bond markets. Stocks on the other hand, driven by growth in corporate earnings, produced positive returns over these same periods. Note that periods of declining rates, presented in gray, provided rocket fuel for growth of both asset classes.

Exhibit 2 – Impact of Interest Rates on Long-Term Bond and Stock Returns

The risk-to-return relationship in the bond markets is simple. If interest rates rise, then it’s likely that Treasury, corporate and municipal bond prices will decline. But in equity markets, there is no direct relationship between interest rate changes and stock price movements. It comes down to business fundamentals. One business may be impacted by the forces of inflation and the concomitant increase in interest rates differently than another business. Our job as stewards of our clients’ wealth is to do the deep research necessary to understand these differences, and to position accounts to survive and thrive in this changing environment.

One key differentiator is pricing power, or the ability of a firm to pass inflationary pressures in its cost structure on to its customers through higher prices for the firm’s goods or services. A second key differentiator is the asset intensity of a business. Those companies that require significant investment in depreciating assets, requiring ongoing maintenance and investment to sustain their usefulness, are in a disadvantaged position when compared with those businesses that are “asset light,” whose cash flows can be freely allocated by management to their best use. A third key differentiator, sometimes associated with the second one above, is balance sheet strength. Those companies that are beholden to the debt markets to finance their operations and growth have learned the hard way that for all the value that it can deliver when prudently employed, debt also comes with a cost, and that cost just increased dramatically. Those who have been conservative in managing their balance sheets should be able to sustain their growth without issue, while those that need to refinance maturing obligations face the potential of higher costs, lower growth, or both. Other key differentiators exist, and we try to ascertain the degree to which the new prevailing forces of inflation and interest rates will affect the businesses we review for potential investment over the near and long term.

In our recent client webinar, hosted by Senior Financial Advisor Cynthia Duncan and featuring members of the investment team, we discussed our philosophy on investing in a higher interest rate environment, shared a case study involving a stock in our Core equity portfolio and responded to client questions on a range of investment topics of current interest. We host a similar webinar in the third month of each calendar quarter and invite you to join our next one. An invitation will be sent a few weeks ahead of our next event.

Q3 Portfolio Changes

Please keep in mind, these commentaries should not be construed as a recommendation to buy or sell the securities discussed. Such decisions are made only within the context of the market environment as we perceive it at the time of the decisions and the structure of the diversified portfolio of which the securities are a component. ***

During the quarter we didn’t initiate any new position but exited our position in Dollar General.

Dollar General

Dollar General is one of the largest discount retailers in the country. Our thesis was that the company’s focus on rural areas isolates it from competition. The company also benefitted from low-cost operation driven by scale in sourcing cheap merchandise. We assumed these advantages would protect the business from online and omni-channel retailers.

We also liked that this was a growing business. The company was opening new stores in new locations and investing in the product assortment. Management’s goal was to grow beyond the rural footprint and to attract new shoppers by offering a wide range of products. Past performance was nothing but remarkable, and we assumed it could continue.

Past performance is no guarantee of future results, and Dollar General is case in point. Over the course of our ownership period, it became clear that more intense competition from Walmart, Amazon, and other retailers is hurting the business. After performing well during the pandemic, Dollar General started to lose market share to peers. The new product assortment resulted in inventory headaches and management failed to adjust to the changing conditions.

We have a thesis for each stock we own in your portfolio. The research team works tirelessly to monitor its progress. In most cases, the business will perform in-line or better than our expectations and we will gladly continue to own the shares. In a few rare occasions, the performance will disappoint. If that happens, we work to understand the cause. If the business is facing a temporary challenge, we will tend to hold on to the stock. If the issue is more acute and we think the thesis is broken, we will exit the position. It’s not a decision we take lightly, and it will typically be preceded by an extensive research and debate. But as soon as we conclude the thesis is broken, we act quickly. The decision to sell Dollar General followed the same blueprint.

New Teammates

October 1st marks the date that we are joined by two new colleagues who will serve as Client Service Specialists. We strive to offer unrivaled service to you, delivered with a smile by a team that you know and trust. To that end, we were able to recruit a terrific pair.

Misty Martinez joins the firm following roughly seven years of experience in education, first as a grade school teacher with the Diocese of San Jose, and later as a Customer Manager for the Bay Area adult school operator, Burlington English, Inc., where she offered curriculum training and support to the 30-plus schools in that system. In these roles, Misty honed a skillset that fits our business well. She is a Bay Area native, and completed her own education at Holy Names University (BA, Communication Studies and English) and Santa Clara University (MA, Teaching, Elementary Education). During her leisure hours, she delights in outdoor pursuits, experimenting with novel culinary creations, and savoring an eclectic blend of music genres.

Kenji Nagase comes to Summitry from another firm, IEQ Capital, that caters to families with significant wealth, where he served as an Investment Operations Associate. Before that, Kenji was a licensed agent with New York Life Insurance Company. Drawing from his pertinent expertise, he helps us enhance our internal procedures and ultimately provide an even higher level of service to you. Kenji received Bachelor’s degrees in Economics and Finance from University of Nevada, Reno. As a Bay Area native, he passionately supports the Golden State Warriors and enjoys local culinary experiences, always ready for new adventures during his travels.

We look forward to speaking with you, and if you would like to come in for a visit, please drop us a note or give us a call.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer