Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

How Do Presidential Elections Affect the Stock Market?

Sep 19, 2024

We have a Presidential election coming in less than two months. We don’t want to minimize the importance of elections in this country. They are a big part of what makes the United States the world’s largest economy and a great place to call home. Elections enable this country to continue to evolve and grow.

Our firm has been through many election cycles and we recognize the concerns investors have about the potential impact election results could have on the market and their investments. Our overarching belief is that investors who take a long view will likely have far better results than those who try to react to election headlines or anticipate outcomes.

There are several questions that a number of clients have posed to us in recent weeks. We thought we would share some of our thoughts in relation to those questions. If you have additional questions about investment strategies for your situation, please contact us.

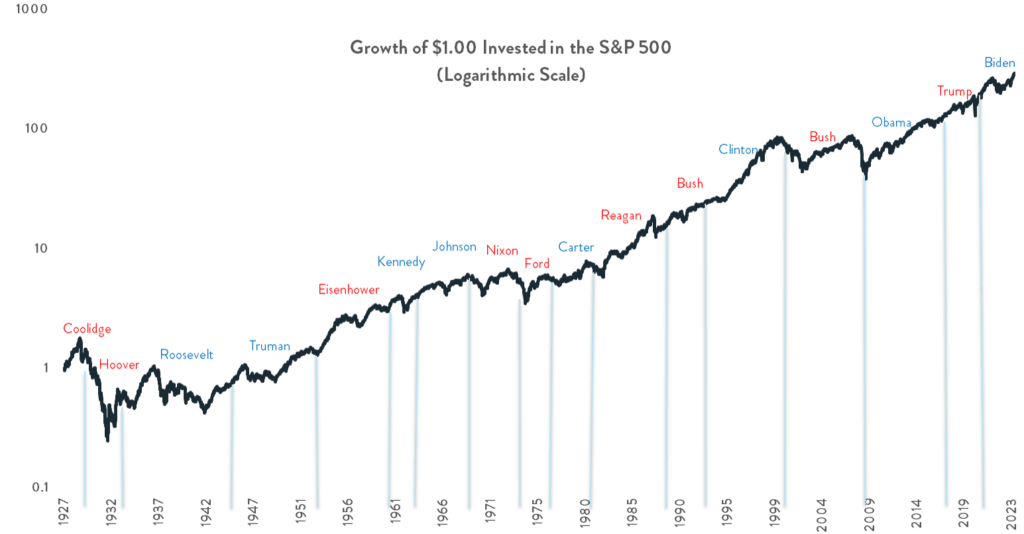

#1: Does the Market Perform Better Under Democrat or Republican Leadership?

From the standpoint of the investor, we think the occupant of the White House is not a basis for changing one’s approach to the market and investing. We believe businesses learn to cope with whatever tax regimes or regulations are thrust upon them. They assess the business opportunities that are presented to them, manage risks, and seek to grow profits.

Here’s a simple chart with a simple message. Through the last century, there have been a lot of presidents, enacting a lot of policies and facing a lot of crises. They’re Republican and they’re Democrat. The chart reflects that businesses marched on and became more valuable. Patient investors can compound their wealth.

Source: Bloomberg

#2. What Are the Most Common Investor Mistakes During an Election Year?

Elections in this country happen every two years at the Federal level and lobbying and campaigning happen every year in anticipation of those elections. Consequently, we don’t really see election years as particularly different from any other year. Investor mistakes may be compounded during presidential election years because of a widespread perception that they are hugely consequential from an economic standpoint to businesses and the markets. We’ve argued that they are not and that investment decisions in reaction to these perceptions are often wrong.

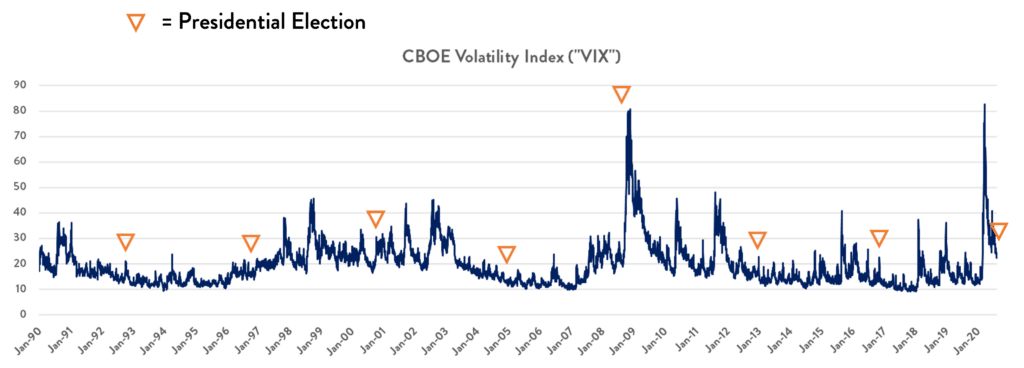

Also, while we learn that markets hate uncertainty, and often react violently to it, the evidence shows that the presidential election cycle does not stand out as particularly impactful on the markets. The chart below shows the CBOE Volatility Index (VIX) since 1991 through the last election. The VIX measures the market’s expectation of near-term volatility based on the price of S&P 500 index options. It is often referred to as a “fear gauge”. The orange triangles represent a presidential election. Looking at this chart, we don’t see any historical pattern that says we should be any more worried about this election.

Source: Bloomberg, Summitry

#3. Are There Specific Stock Market Sectors to Watch Leading Up to the Election?

Investors who take a long view will likely have better results than those who try to pick short-term stock winners. Certainly, there will be winners and losers leading up to and as an immediate consequence of the election. For investors who want to play that game, the outcomes will be binary. They will win or they will lose. Meanwhile, these speculators will have no control over their outcomes. Rather, they will have put their fortunes in the hands of the voting public. We prefer to keep our hands firmly on the reins when investing. We want to control our outcomes. We do this by owning shares of companies we believe are durable businesses with long-term growth prospects, managed by executive teams and boards who serve our best interests. We do not let short-term reactions of markets to events like elections determine whether a stock is something to be held or sold. We allow wealth to accumulate in these businesses over time with the confidence that markets will recognize and reward this growth in their intrinsic value.

#4. How Could a Contested Election Result Impact the Market / My Investments?

A contested election could introduce uncertainty into the markets, resulting in near-term volatility. But we note that the Gore vs. Bush election provided a taste of such a scenario, and the VIX did not appear to register any material or sustained increase in volatility. More importantly, investors should continue to focus on economic and business fundamentals and look beyond temporary periods of volatility, should they occur. We’d wager that if the ultimate victor in that election were Gore instead of Bush, long-term investment outcomes would likely have been similar.

Our business exists to provide our clients with research-based counsel and perspective drawn from long experience with markets and wealth management issues. Reach out today if you would like to learn more about our unique approach to wealth management.

Live Webinar: Election 2024 – Insights from an Insider

Join us with special guest, Daniel Clifton, Partner & Head of Policy Research at Strategas Research, for an engaging and timely webinar that will dive into the critical economic and geopolitical issues shaping the Election in 2024. Dan will share his insights about the upcoming election, the potential outcomes, proposed policies, and implications for the economy. If this sounds like something you’d be interested in watching, register here to join us live or to receive the recording!

Note: All material of opinion reflects the judgment of the Adviser at this time and is subject to change. This material is not intended as an offer or solicitation to buy, hold, or sell any financial instrument or investment advisory services. Past performance does not guarantee future results. Investing involves risk of loss.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President