Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Presidential Election 2020 Outlook: A Perspective

Sep 29, 2020

On September 23, Summitry hosted a live webinar for our clients, featuring Dan Clifton, Partner at Strategas Research, to discuss some of the trending topics surrounding the 2020 Presidential election.

It’s important to us to bring these experts and their insights to our clients, addressing the concerns they likely share with many Bay Area residents. We found Dan’s perspective and outlook both enlightening and entertaining. Click the play button above to watch the webinar. Below we have recanted just a few highlights from the hour.

If you’re wondering if your portfolio is structured to weather this year’s election outcomes or more importantly, to achieve your financial and lifestyle goals, contact us today.

This Presidential Election Backdrop is Unlike Any in the Last 100 Years

The confluence of a recession, a global pandemic, mass national protests, and a presidential election is unprecedented. This unusual backdrop presents a range of possible outcomes that may surprise us with its impact on the election result or with some sort of contested election.

Dan sighted quite a few historical data points, not the least of which being that any president who has led during a period of recession within the two years before their election has gone on to lose reelection, while any president who has avoided a recession in the two years before has won reelection.

It’s important to have a framework to understand how the next 50 days can impact the election outcomes.

These Three Elements Provide a Framework for Analyzing the Upcoming 2020 Election

Creating a Referendum. Incumbent officeholders get reelected if they do two things well – govern, and turn the election into a choice between himself and the opposing candidate. Is Trump successfully campaigning as the better choice between himself and Joe Biden?

The Economy. There was already a very high degree of political volatility prior to COVID-19 happening. The pandemic has amplified the political divide and had a devastating impact on the economy. While the rebounding economy has contributed to an increase in Trump’s polling numbers, a significant rise in COVID infections in October could easily reverse that.

The Swing States. As in recent presidential elections, the outcome is primarily in the hands of a few battleground states where polling is close. Trump is currently losing in many of the swing states. However, he only needs to succeed in some combination to attain the 270 total electoral votes. He’s improving dramatically, albeit slowly, in several of the key swing states he would need to win. Trump’s deficit in the swing states was about 7 percent in July but is now about 3 percent. The states to keep an eye on are Florida, Arizona, Pennsylvania. If Trump wins those three, he’ll likely win the election – and he’s making progress in two of the three.

The race has tightened quite a bit in the last few weeks, though it isn’t getting as much attention because Biden’s national lead is still quite strong.

Four Historically Strong Indicators of a Winning Presidential Candidate

According to Mr. Clifton, aside from polling numbers, there are four other items that he and his team watch as predictors of an election outcome.

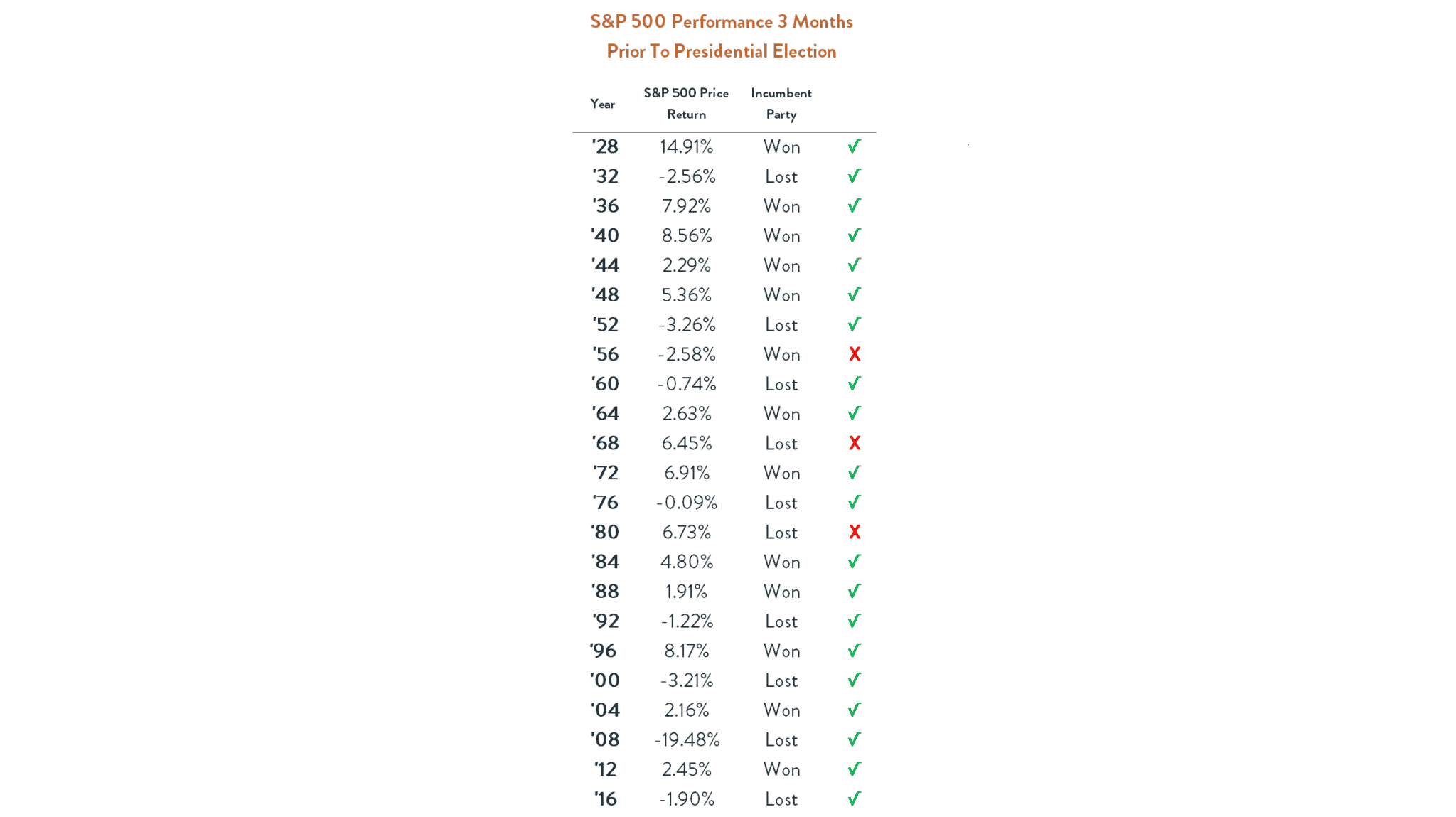

The Stock Market. The S&P 500 has predicted every presidential winner since 1984 and has predicted 87 percent of the presidential election winners since 1928.

Historically, if stocks are higher in the three-month period prior to the election, the incumbent party wins; if stocks are lower, the opposition party wins.

In 2016, according to this marker, for Hillary to win as the incumbent party, the S&P would need to be positive on August 8 through November 8. It was in fact about 2 percent negative.

What about this time? As of today, the S&P is flatlined, suggesting that each candidate a 50/50 chance.

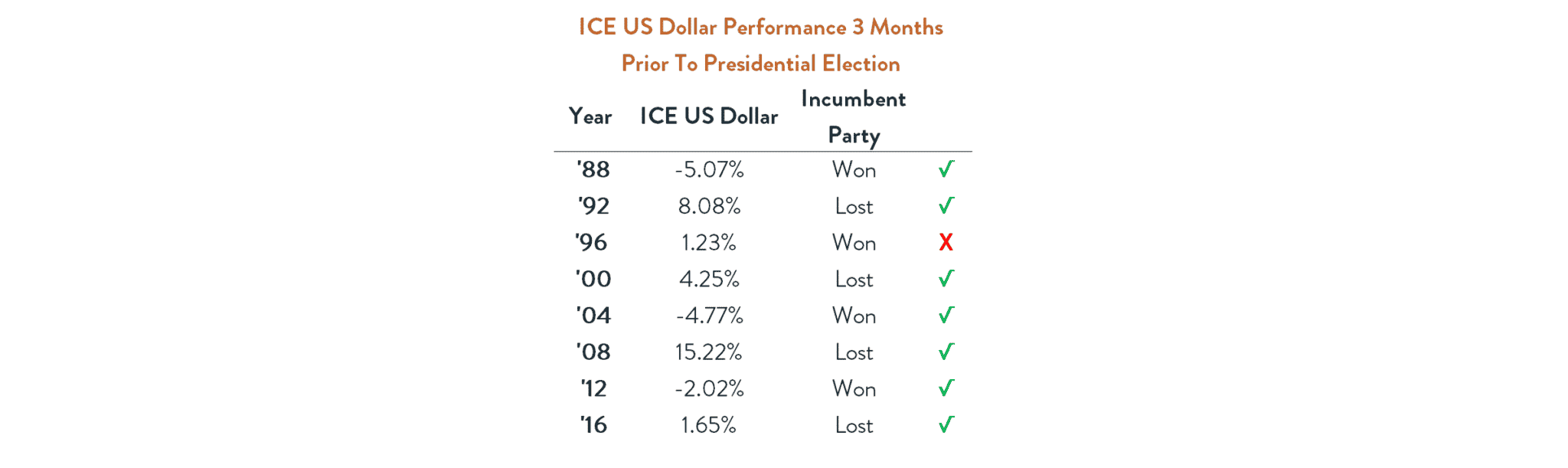

The Value of the U.S. Dollar. If the dollar is negative in the last three months leading up to an election, that has predicted 7 of the last 8 election winners. As of the date of the webinar, the trade-weighted dollar index is roughly flat as well, underscoring the tightness of this race.

Source: Strategas Research Partners

Source: Strategas Research Partners

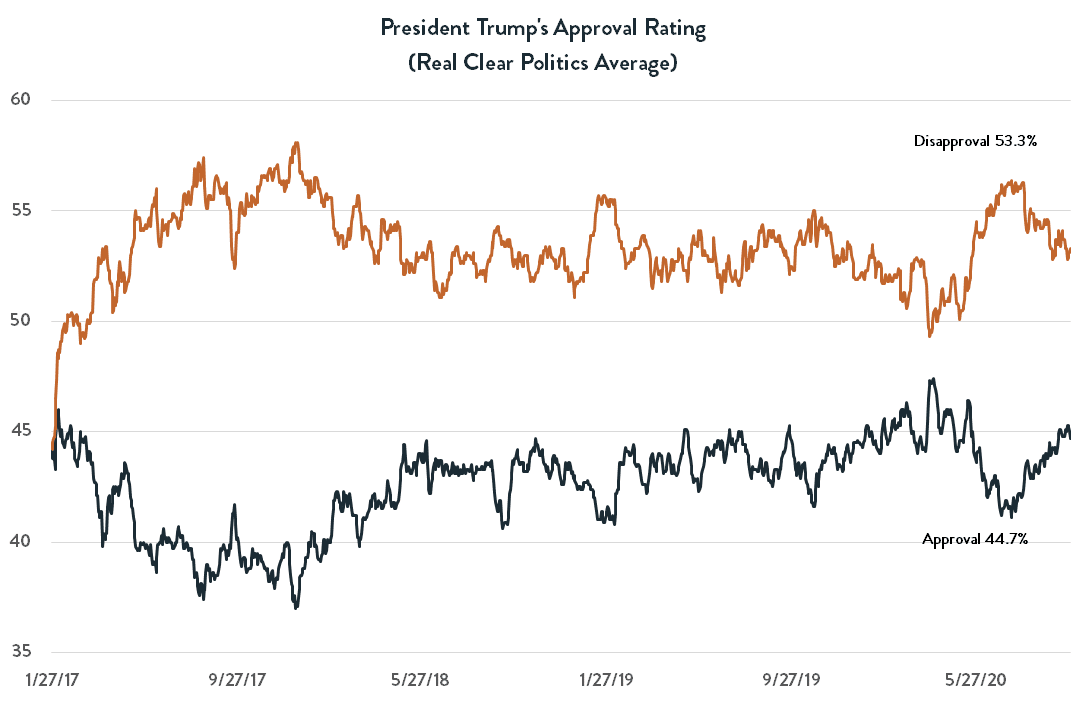

Presidential Approval Rating. This seems to be a stronger indicator than polling numbers because all of the key factors are rolled into the president’s approval rating. This indicator has varied fairly dramatically through his term in office, but today the outlook favors Biden.

Source: Strategas Research Partners, Real Clear Politics

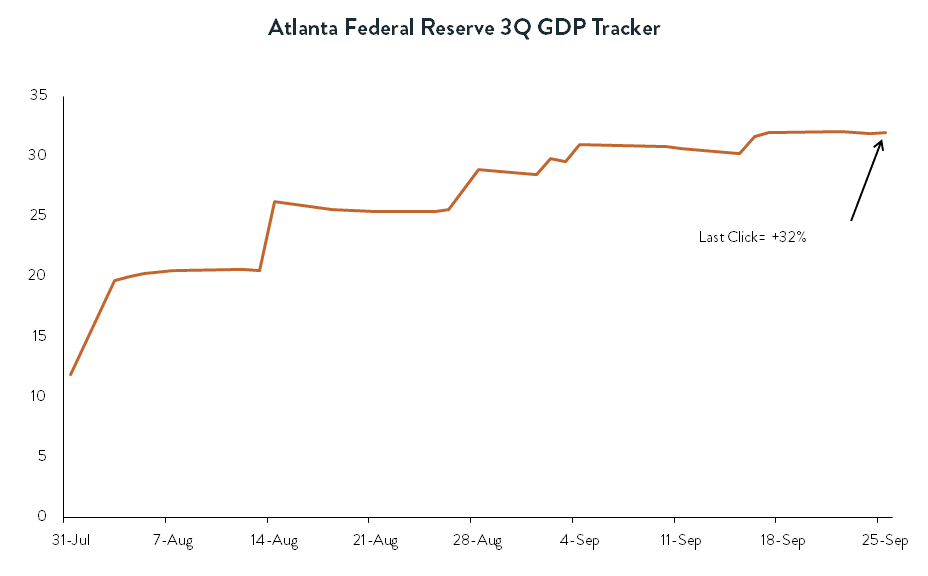

Growth of the Economy. On July 31 the Atlanta Fed estimated growth of GDP for Q3 2020 at 19 percent (Seasonally Adjusted Annual Rate vs. Q2 2020), and in September it has dramatically increased its estimate to 32 percent – which is a benefit to Trump and a key reason why he’s been able to close the gap between him and Biden.

Source: Strategas Research Partners

Note: this is not investment advice, but purely an interesting historical data.

The Contested Election

One of the growing hot topics consuming air-time in recent weeks has been the potential for – and ramifications of – a contested Presidential election. This is probably a more important topic for investors to be focused on. There are several scenarios Mr. Clifton shared with us.

Consider how people are planning to vote in key states. If Joe Biden wins Florida, we will be fairly confident that Biden is the new president. Having failed so miserably in 2000, Florida has become incredibly efficient at counting and processing the vote. They begin voting mail-in ballots two weeks ahead of time. At this point, Biden is losing in three polls in Florida.

If Trump wins Florida, the election will move up to the Midwest. There, mail-in voting is fairly new. They don’t allow for the verification process to start until election day, or the counting to start until after the polls close. Data suggest 60 percent of Democrat voters and 15 percent of Republican voters in those states are planning to vote by mail. The massive volume, combined with those states’ inexperience in the process can mean significant delays in the results.

The Republican Contested Election

Imagine on November 3rd Trump wins by a landslide, but as mail-in ballots are counted, his lead wanes. What’s likely to follow would be a very vocal objection by Trump (to put it mildly) that the Democrats are trying to steal the election. This could cause uncertainty in the market.

The Democratic Contested Election

A large portion of Democrat voters are reportedly planning to vote by mail – and a significant number of them are doing so for the first time. There are three very common errors made that disqualify a ballot, particularly for first time mail-in voters:

- Failure to sign the ballot. As we know, the signatures on mail-in ballots are verified against signatures on record.

- The form is filled out incorrectly such that the intention of the voter cannot be discerned.

- The ballot is not placed in the envelope.

Mr. Clifton thought it reasonable to assume that 4 – 5 percent of ballots could be disqualified. This means theoretically that Trump could win a state by less of a margin than the number of ballots that are thrown out. In this scenario, Democrats will be outraged, believing that we know the intention of the voter, yet the voter is being disenfranchised.

The 269/269 Electoral Vote Tie

The third scenario, though a small possibility, would be a 269/269 tie of electoral votes – victories by Trump in Arizona, Pennsylvania and Florida, but the loss of the Omaha Nebraska congressional district. Nebraska is one of two states to split its electoral votes by congressional district, and this particular district gave its vote to Obama in 2008. An electoral vote tie would force the case to the House of Representatives.

This is uncharted territory. Though the probabilities of some of these scenarios are fairly low (10 or 20 percent), they are still possibilities and the team at Strategas are working through those scenarios.

Parting Thoughts

The above summary of Mr. Clifton’s comments mostly deal with the dynamics of this election. We concluded that the outcome, even at this late date, is far from certain. The 2000 and 2016 elections are proof that one should not call any election before the votes are counted. Mr. Clifton also touched on the economic policies of the candidates and the parties that support them. It is in the area of economic policy that Summitry’s research team takes a particularly keen interest, by evaluating the environment in which the businesses we own will operate. These include changes on the tax and regulatory front, among other areas that can be affected by the political party in power.

As always, we are happy to speak with you about your financial circumstances, your portfolio, the election or any other area where you would find our perspective useful. Contact us today.

Note: All material of opinion reflects the judgment of the Adviser at this time and is subject to change. This material is not intended as an offer or solicitation to buy, hold, or sell any financial instrument or investment advisory services.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.