Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Navigating the Rubrik IPO Tax Conundrum: What’s Your Move?

Apr 4, 2024

Your company just announced its IPO. Congratulations! Now what?

One of our clients expressed excitement about Rubrik Inc.’s recent announcement regarding its filing of registration statement Form S-1 for an IPO, stating, “It is a very exciting day at corporate!” As a long-time employee, you have been vesting RSU shares every paycheck, each quarter, and every year. The moment has arrived when those investments become a tangible reality. With this milestone comes a great number of important decisions to make because along with your big financial windfall comes a big tax event!

Immediate Action Item! RSU Tax Withholding Selection

As you review the stock documentation provided by your company (or the trading company), you’ll see that one decision must be made in short order: RSU tax withholding selection.

You will need to decide whether to withhold 22% or 37% of your RSU income for federal taxes upon vesting on the day of the IPO. Keep in mind that the election you select will result in the withholding of that percentage of your vested RSU shares to satisfy your tax liability.

In the case of Rubrik, whether you are a current or former employee, you officially learned about the company’s pending IPO on Monday, April 1, and need to make this decision by Thursday, April 11. Yet, several challenges make this decision very complex, to name a few:

- You have no idea at what price the company will be valued in the IPO, and how much taxable income you will have as a result.

- You have months of lock-up periods and can’t sell shares for cash to cover the extra tax liability, and there is a potential penalty and interest for under-withholding.

The default withholding percentage, as required by U.S. supplemental tax rules, is 22% for the first $1 million of RSU income, and 37% for RSU income over $1 million. For simplicity, let’s assume that you (and your spouse, if you are married) are already at the 37% tax bracket based on your other sources of income outside of these RSUs and you will have over $1 million in RSU vested at the IPO. In 2024, this equates to income above $609,350 for single filers and above $731,200 for couples filing jointly. Opting for the 22% withholding would result in an under-withholding of $150,000 on the first $1 million in RSU income. Conversely, in a scenario where you choose to take time off post-vesting, have a modest salary of $50,000, and your spouse doesn’t work, the under-withholding could be as little as $75,000 on the same $1 million RSU income. In either case, you will have withheld too little by electing 22% on RSU income of $1 million, but the degree of under-withholding depends on which scenario applies to you.

Depending on your financial situation and your available liquidity, the difference between $75,000 and $150,000 may be a significant amount of money.

Assuming you can come up with the cash for taxes, the “correct” answer is based on your personal situation, both financial (the stock concentration relative to your total liquid portfolio) and emotional considerations (your attachment to the company and conviction on the future performance of the stock). Let’s delve into these financial and emotional considerations.

Financial and Emotional Considerations when Choosing a Withholding Amount

Considerations favoring a 22% withholding include:

- You believe that the company’s stock price will continue to rise post-IPO and the high price will last through the lock-up period, and you can sell them at a higher price to cover the taxes.

- You have cash or liquid investments that you can sell easily to cover the under-withholding.

- You would feel perfectly okay if the share price drops significantly during the lock-up period and you have to sell more shares to cover the tax liability afterward.

- Your financial goals won’t be compromised despite potential substantial share price declines during the lock-up period.

Conversely, reasons supporting a 37% withholding include:

- You think the stock might fall after listing, and before the lock-up period ends.

- You have a desire to diversify quickly before the lock-up period ends. Even if you don’t owe additional taxes, a higher withholding will allow you to sell more shares at the listing price. Potential tax overpayments will be refunded the following year.

- You have significant unvested RSUs and/or options, and you will continue to benefit greatly from any future increase in the company’s stock price beyond your currently vested RSUs.

- You would feel okay if the stock price goes up even though you’ve taken more money off the table at the time of the IPO (FOMO is real!).

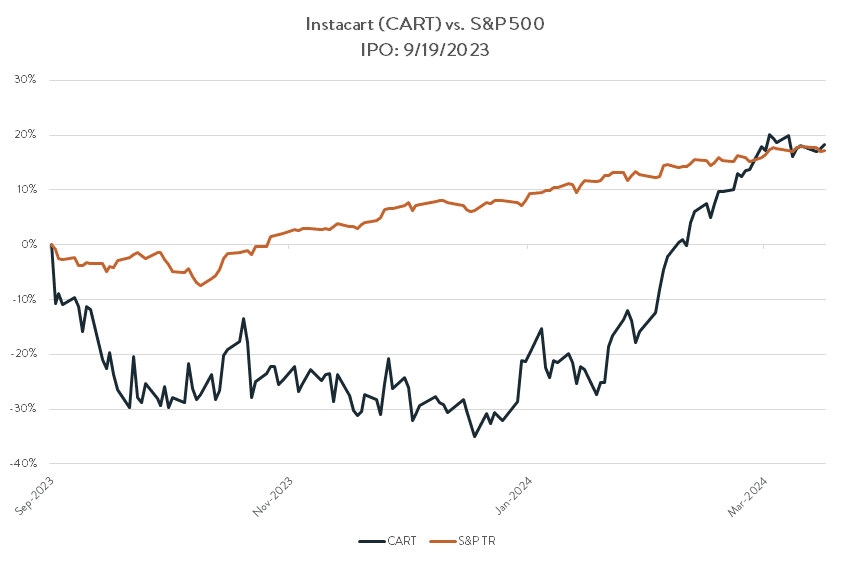

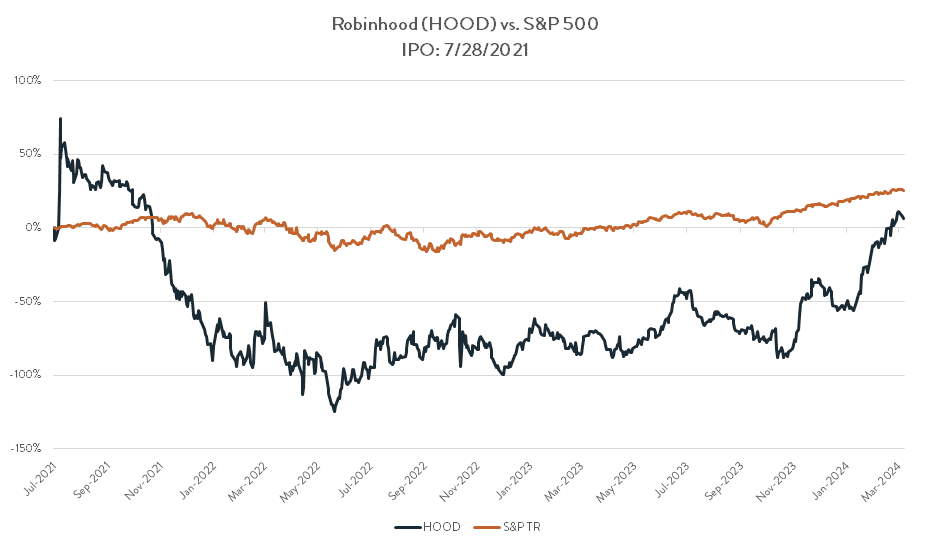

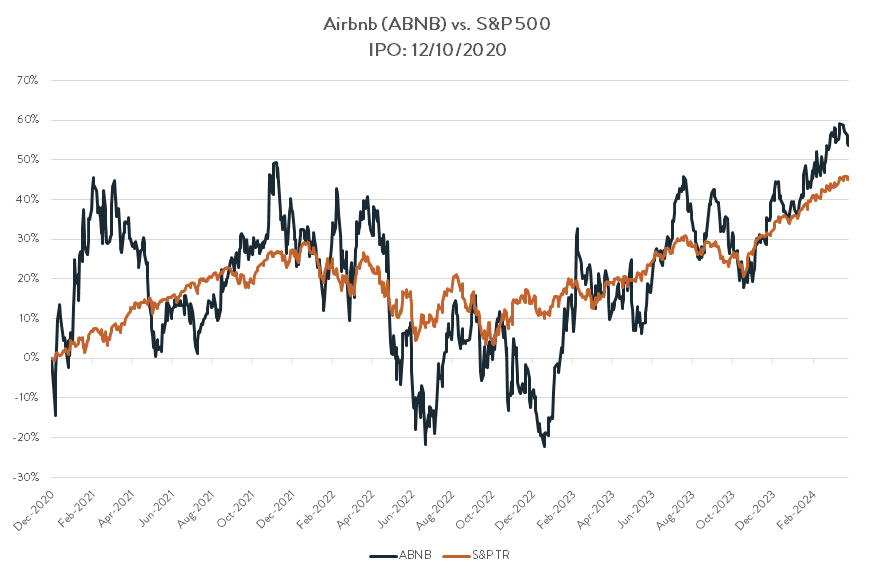

Hindsight is 20/20

We can only tell whether 22% or 37% would have been the right decision in hindsight. We can, however, look at the experience of your peers from the IPOs in recent years. Below are a few recent IPO stock performances, relative to the S&P 500. The record suggests that despite a similar excitement accompanying their debuts as public companies as is currently felt at Rubrik, not all IPOs are received equally in the aftermarket. Here are a few notable offerings.

Instacart (IPO September 19, 2023)

Robinhood (IPO July 28, 2021)

Airbnb (IPO December 10, 2020)

Whatever you decide, this year is likely an abnormally high-income tax year, presenting numerous unique opportunities to optimize your tax strategies in line with your financial goals. It’s important to consult with a financial advisor or your CPA to fully comprehend your options. Additionally, you may find it beneficial to reference our tax webinar last November, where we delved into specific strategies tailored for navigating a higher tax year. Just as with any exciting event, an IPO can also be quite stressful. Remain calm, seek sound advice, and make good financial decisions!

If you’re seeking comprehensive wealth management services tailored to address the unique financial considerations of living in the dynamic Bay Area, look no further. Our team at Summitry is dedicated to guiding you towards financial peace of mind and security in this thriving region. Whether you’re weighing out options during a major liquidity event, planning for retirement, navigating investment opportunities, or strategizing for your financial future, we’re here to assist you every step of the way. Contact us today to learn more about how our personalized approach to wealth management can help you reach new heights and achieve your financial goals.

This article is for informational purposes only. Summitry, LLC does not provide tax advice. Nothing herein constitutes investment advice or any recommendation that any particular strategy or security is suitable for any specific person. Past performance does not guarantee future returns. Investing involves risk and possible loss of principal capital. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer