Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Summitry Turns Twenty: Reflecting on Two Decades of Reaching New Heights Together

Feb 8, 2024

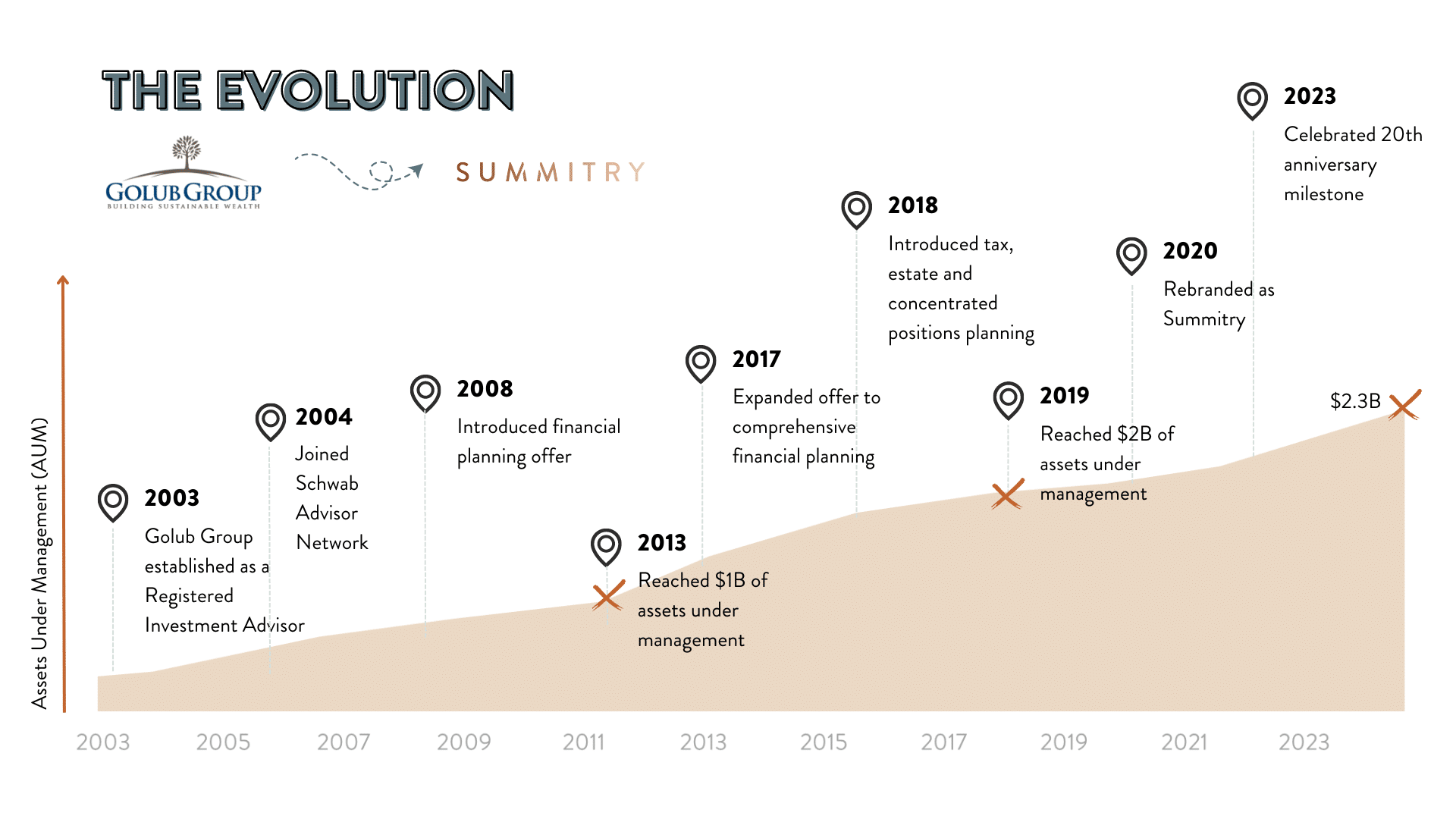

Twenty years ago, a few passionate individuals embarked on a journey to develop an investment management firm where building meaningful relationships, both among teammates and their families and with clients, was at the core – a departure from the traditional, larger companies where they had spent their earlier careers.

This year, as we celebrate our 20th anniversary, we reflect on the milestones, challenges, and innovative spirit that have fueled our growth, and we are excited to imagine the journey we’ll take in the decades that lie ahead.

The Journey

In 2003, our founder, Michael Golub established Golub Group, LLC. a small, five-person team of portfolio managers and client service professionals whose focus would be on providing investment services while forging strong relationships with clients, understanding their life objectives, and helping them to achieve their financial goals. Michael constantly reminded us that we would find success in this business if we approached it with the attitude that we’re in the “people business” first, and that stocks and bonds were merely the means we employ to provide clients with exceptional service and to achieve their broader life goals. Michael also imparted other important advice as we launched the firm. Inherently volatile markets trigger emotional responses, leading investors to overreach during the good times and shrink from accepting risk in the difficult times. This is natural and understandable. Our job as investors is to protect our clients from these and many of the other natural human tendencies that hinder their success.

While we were founded as a portfolio management firm, the Global Financial Crisis of 2008 provided us with the opportunity to enhance our offering by investing in our financial planning services. We realized that we had an opportunity to help people put their investment management into a much-needed context, especially in tough times, to feel safe and secure.

“We had just outperformed the stock market by a mile, but our clients were understandably unsettled by the experience of investing through that difficult period. Providing a holistic financial plan would give people the context they need to feel safe. One thing I’m particularly proud of is how well clients weathered the financial storms over the past 20 years. Trusting us, having our steady hand and diligent investment approach – those clients have done very, very well. With deep financial planning, our clients could better see it for themselves, because they could see their future would be financially secure.” – Kurt Hoefer, CFA®, Chief Strategy Officer

In 2020, we changed our name to Summitry after a year-long effort of reflecting on our differentiated approach of servicing clients facing the unique risks and rewards that come with life in the Bay Area. The re-branding was representative of meaningful upgrades to our service in the areas of estate planning, tax strategies, and concentrated stock solutions – all designed to help clients experience ongoing stability while reaching higher.

Deliberation Above Acceleration

It’s clear the wealth management industry is consolidating quickly. This poses an opportunity for us to distinguish ourselves clearly from the large and impersonal investment supermarkets growing around us. Twenty years ago, we wouldn’t have thought of a firm with $2 billion in client assets under management (“AUM”) as small, but today it is ‘boutique’. The opportunity in a consolidating industry is that we can maintain our boutique, relationship-focused approach and serve the people who desire our level of dedication.

Each time we’ve expanded our service offering or adopted a new major tool, we’ve taken a diligent, restrained approach to determine the best outcome for our clients and our firm – not the least costly, or most profitable. For example, when the industry was rushing to add estate planning to their offer by hiring in-house estate planners, we paused and posed the question: how can we offer our clients the best estate planning service? Rather than just tick the box and add a service to our offering, we sought out the best estate planners in the Bay Area and partnered with them in a unique and innovative way. We facilitate and collaborate with them and our clients, making sure clients have their plans in place and review them annually within the context of their overall financial plan. We continue to maintain 100% control over the areas where we excel and that are our core competencies – and to augment our offer with those who are superior in their own areas of expertise, delivering them in a seamless way to clients.

2023 marks another milestone where we’ve expanded our portfolio options to include International, Small-Cap, and Alternative Investments. These are options our clients and advisor network have requested, but which we have chosen historically to let fall outside of our internal core competencies. An easy approach would have been to follow the lead of many mainstream wealth management behemoths and give clients exposure through passive investment products targeting these new asset classes. But as a firm founded on principles of intrinsic value investing rather than on top-down asset allocation, we felt an obligation to deliver something more rigorous and truly complementary to our Core strategies. After diligent exploration, we established relationships with third-party managers who are experts focusing on these asset classes and whom we are confident share our intrinsic value philosophy. These managers employ deep research, understand risk management, invest with conviction and seek returns over market cycles that exceed those available in passive solutions. This approach is a differentiator for our firm and is designed to best serve our clients’ interests.

Similarly, we’ve adopted several advanced software and technologies to provide more granular financial planning, tax optimization, and richer client experiences, with each integration diligently investigated, modeled, and tested to ensure the outcomes would provide recognizable benefits to our team and our clients.

“Major milestones like this provide an opportunity to reflect on not only how much we’ve grown in number of clients, staff and assets under management, but more importantly how we’ve evolved the work we do for clients over the decades. With every step in our firm’s progression, we’ve always held true to the guiding principle of seeking ways to deliver more value to our clients. For us, it’s not a race to the bottom to see who can be the cheapest, instead, we want to hold costs steady and deliver more to our clients. Throughout this evolution, I’m so appreciative of the Summitry team’s desire to learn, grow, and continually up the ante.” – Alex Katz, Chief Growth Officer

Core Values and Rewarding Relationships

Our core values were defined on day one and remain unchanged:

As we commemorate our 20th anniversary, it’s essential to acknowledge the exceptional team that has been the driving force behind our success. As stewards of our clients’ futures, the importance of our mission is deeply recognized by our employees. We function as a closely-knit community, celebrating individual milestones and embracing new members along the way. From the dedicated employees who have been with us since day one to the new talents who bring deep knowledge, experience, and fresh perspectives, each person has played a crucial role in shaping our journey.

As we commemorate our 20th anniversary, it’s essential to acknowledge the exceptional team that has been the driving force behind our success. As stewards of our clients’ futures, the importance of our mission is deeply recognized by our employees. We function as a closely-knit community, celebrating individual milestones and embracing new members along the way. From the dedicated employees who have been with us since day one to the new talents who bring deep knowledge, experience, and fresh perspectives, each person has played a crucial role in shaping our journey.

Our goal has long been to be the most admirable firm in our industry. That’s quite different from being the “most admired” firm. We don’t seek third-party validation to the extent many do. Rather, our employees are aligned in a commitment to do the right thing – to contribute to the success of our clients, to support their teammates, and to take pride in how they’ve contributed to the success of the firm. – Colin Higgins, Chief Executive Officer

Our clients are the true driving force behind our longevity. We appreciate the opportunity they give us to contribute to the creation, growth, and protection of their wealth (in all its forms) with the goal of maximum benefit to their families so that they can focus on living their best Bay Area lives.

“As I look back on two decades, I’m astonished and proud of what’s stayed the same as much as on what’s changed. Sure, we’ve expanded our offerings and accordingly expanded our team, but at the core, we’ve maintained the “people-first” philosophy that has defined us as a firm. Our clients reward us every day by putting their trust in us during major and minor life events and in challenging economic and personal times. It is such a privilege to sit at the table with our clients to discuss what matters most to them and what steps to take to achieve their goals.” – Joe Martin, FBS®, Chief Client Experience Officer

This coming year also marks 20 years as a Schwab Advisor Network (SAN) partner; such longevity we realize is rare. Schwab Financial Consultants (FCs) continue to partner with Summitry to work with many of their largest and most complex clients’ needs. Our partnership with the Schwab FCs goes beyond working together on clients. Over the years, they have provided some of the most insightful feedback that has helped us continually refine and expand our offer.

Looking Ahead

The celebration of two decades is not just a look back; it’s also a gaze into the future. The next chapter promises exciting challenges and opportunities. We remain committed to our core values, embracing change, and continuing to innovate as we strive to be the most admirable firm in our industry.

If you’re looking for a wealth management partner, contact us today.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer