Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Sustainable Income Review – Q4 2024

Feb 10, 2025

Sustainable Income Strategy – January 1, 2025

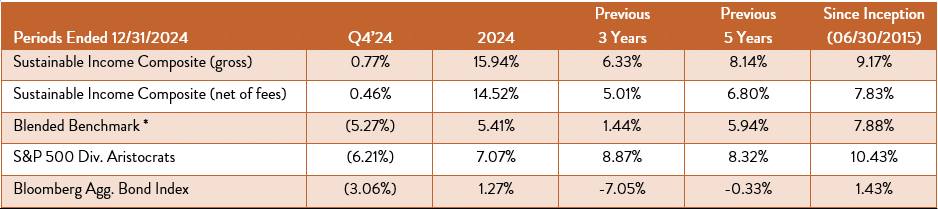

Rising long-term interest rates became a headwind to income producing securities in Q4’24. While our benchmarks—the S&P 500 Dividend Aristocrats for stocks and the Bloomberg Aggregate Bond Index for our income securities—declined by -6.2% and -3.1%, respectively, our Sustainable Income Composite rose +0.5% after fees. This brings full-year 2024 performance for the Sustainable Income Strategy, which is allocated roughly 70% to dividend growth equities and 30% to high quality bonds, to a respectable +14.5%, net of fees, compared to +5.4% for our blended benchmark.

Individual client account performance varied around this composite average, reflecting their specific mix of stocks, bonds, preferred stocks, and bond ETFs. As always, we remind you that returns from this strategy and performance relative to our benchmark will ebb and flow over time, as do the stock and bond markets in which this strategy invests.

Here is the record for the Sustainable Income Composite since inception (please see performance disclosure at end of this note)[i].

* Blended Benchmark: 70% S&P 500 Dividend Aristocrats/30% Bloomberg Aggregate Bond Index

Dividend Growth

Seven companies in the Sustainable Income portfolio increased their dividend in Q4, including: CARR (+21%), COR (+8%), LMT (+5%), MCD (+6%), MSFT (+11%), TSM (+29%), VZ (+1%). One other holding, ODFL, announced a dividend increase of +30%, but we sold the stock prior to the ex-dividend date. Once again, no companies reduced their dividend during the quarter.

Of the many factors that we consider when selecting companies to own in the Sustainable Income portfolio, the capacity and commitment to pay sustainable and growing dividends are among the most important. The capacity to pay growing dividends is derived from earnings growth and strong balance sheets. The commitment comes from company managements and boards of directors who choose to share surplus earnings with shareholders. Not every great company will pass through earnings in the form of a dividend, which is a reasonable choice if the earnings can be reinvested in the business in initiatives that promise high returns on investment. Those stocks will not qualify for the Sustainable Income strategy, but they may be held in other strategies managed by Summitry. But when a management team cannot redeploy cash in a manner that will generate a high return within the company’s operations, we would prefer they remit that cash to shareholders. Such companies that return cash in the form of a dividend are ideal stocks for Summitry’s Sustainable Income portfolio strategy.

Q4 2024 Top Contributors

- Old Dominion Freight Line (ODFL) generated a return of +36.1% during our brief holding period in Q4, prior to its sale on 11/7/24. ODFL is a cyclical, economically sensitive business that is feeling the impact of industrial headwinds, but its management team has a discipline that has enabled it to maintain pricing with customers who understand the value and reliability of its services. The stock was strong following the election due to views that the second Trump administration will pursue policies that will bring more industrial manufacturing to US shores. While our views about the attractiveness of the business remain unchanged, we felt the stock performance got ahead of business fundamentals and this lowered dividend yield to 0.5%, a level we felt your capital would be better served elsewhere.

- Wells Fargo (WFC) returned +27.8% in Q4. We believe several factors are at play, including the prospect that WFC’s net interest income will recover and grow as the yield curve shifts from inverted to positively sloped, the potential that the Federal Reserve’s 2018 consent order that imposed an asset cap on the company will be lifted, and the potential that a Trump administration may relax regulation on the banking industry in general. Of all major banking institutions, WFC may have the most to gain from the last factor. Meanwhile, the Q3 earnings report showed that the company is managing its expense line well, and that it is on strong financial footing with respect to its asset quality and regulatory capital position.

- Emerson Electric (EMR) returned +17.0% in Q4. Recent results have been respectable in the face of economic crosscurrents across the company’s global footprint. Earnings topped Wall Street estimates, and management guided to high-single-digit growth in adjusted earnings per share in 2025.

Q4 2024 Top Detractors

- Lockheed Martin Corp. (LMT) declined -16.3% in Q4. The stock had been one of the SI strategy’s strongest performers in the prior quarter. In October, the company reported revenue growth that missed expectations, reduced by lower-than-anticipated deliveries of F-35 fighter jets. LMT is unable to book revenue and profit until government purchasers certify the combat readiness of units delivered. This process has been slow in a program that has been plagued by delays. On the other hand, the order backlog is the highest ever for its manufactured aircraft and systems, and the company raised its full-year outlook.

- Carrier Global (CARR) returned -14.9% in Q4. Like LMT, CARR shares were among the strongest performers in the prior quarter, so the declines may in part have reflected profit-taking. The third quarter earnings report, delivered in October, was not well received by the Street, notwithstanding a healthy growth of orders, revenues and profits. Street expectations were slightly ahead of these actual results. CARR’s management reiterated their previous guidance of 6-8% top-line growth over the medium term, and a continuation of share repurchases to offset dilution that resulted from the Viessmann acquisition.

- Target Corp. (TGT) returned -12.8% in Q4. In November, the company missed Wall Street estimates for the third quarter and forecasted weakness through the important holiday shopping season. Management cited cost pressures and supply chain disruptions, and it became apparent that shoppers were curtailing their purchases of apparel and other discretionary items in favor of food and other essentials. TGT is more heavily leveraged to non-essential items, so the most recent quarter offered a reminder that weakness among consumers will impact its results.

Income Securities

The Sustainable Income portfolio has traditionally held approximately 30% of its assets in bonds and similar securities that offer a fixed yield. Their primary purpose is to increase the overall portfolio yield rather than offer long-term appreciation potential. Nevertheless, in the short term these securities rise and fall in price, sometimes considerably, in reaction to changes in the interest rate environment. Recent job reports have shown considerable strength in the U.S. economy, contributing to fears of prolonged inflationary pressures and driving long-term interest rates higher. Rising interest rates in turn have pressured bond values, leading to recent capital losses for the asset class. Fortunately, we have maintained a defensive posture by maintaining lower portfolio duration than our chosen benchmark, leading to the recent outperformance by our composite of client bond portfolios. We were unwilling to lengthen our average bond maturities until “real” interest rates on long-term bonds (defined as the nominal yield minus the inflation rate) were high enough to offer us an attractive return. With the recent rise in longer-term interest rates, we may have an opportunity to lengthen average maturities of our bond ladders in the coming months.

Key Actions

The investment team executed two trades during the third quarter. On November 7, 2024, we sold our holdings in Old Dominion Freight Line (ODFL) and used the proceeds to purchase shares of Louis Vuitton Moet Hennesey (LVMH). The sale of ODFL was driven by that stock’s superb performance during our holding period, which drove the share price up and dividend yield down to approximately 0.5%, a point where we felt there were more attractive uses of your capital, given the strategy’s objective to generate high distributable income from dividends and income. At the time of our purchase, LVMH offered a dividend yield of 2.2%. In the weeks following our sell transaction, ODFL shares have fallen considerably notwithstanding the company’s strong business performance, so we will not rule out a repurchase of those shares in the future. Meanwhile, we are pleased to have exposure to some of the world’s best and most enduring luxury assets through LVMH. While near-term headwinds exist in the luxury market, we like our chances that this stock will produce wealth for you in the form of both current income and appreciation over the long term.

Conclusion

The Sustainable Income strategy has produced respectable returns in volatile markets and over a market cycle. Looking forward, in an interest rate environment that offers higher yields on fixed income and preferred securities than we have experienced for many years, Sustainable Income remains a good choice for the client who seeks growth of income over time and reduced portfolio volatility, while retaining some opportunity for capital appreciation.

About Summitry’s Sustainable Income Strategy

Many clients ask us to address the tradeoff between their need for current income and desire for capital growth. Bonds alone are unlikely to generate sufficient returns to preserve purchasing power over the long-term, but stocks subject the investor to greater volatility. The power of long-term compounding of wealth provided by the equity markets can be lost if volatility compels clients to liquidate securities during market drawdowns. This concern typically grows more acute as clients age and time horizons compress.

To meet this challenge, we devised a portfolio strategy in 2015 that attempts to balance the need for reduced volatility with a desire for capital appreciation. Our solution is a diversified portfolio primarily consisting of blue-chip companies that pay regular and growing dividends out of surplus cash flow. We believe these companies generate earnings beyond what is needed to grow their businesses. This surplus allows management to raise their dividend payouts over time. We call this our Sustainable Income strategy. To learn more, we gave a behind-the-scenes look at our Sustainable Income strategy here.

Summitry Dividend Growth Strategy

Summitry’s Dividend Growth Strategy is comprised 100% of dividend-paying equities and is made available to clients who wish to have exposure to the income generation and total return opportunity that is offered from the equities held in the Sustainable Income strategy, but without the exposure to SI’s bond and preferred stock holdings. Your Financial Advisor can help you decide if this is a useful and appropriate strategy given your personal financial circumstances.

This commentary reflects the opinions of Summitry, LLC and is for informational purposes only. Nothing herein constitutes investment advice or any recommendation that any particular security, transaction, or strategy is suitable for any specific person. The securities identified do not represent all the securities purchased, sold, or recommended for client accounts. Past performance does not guarantee future returns. Investing involves risk. The reader should not assume that an investment in the securities identified was or will be profitable. An index is a hypothetical portfolio of securities representing a particular market or market segment and is used as an indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses, and cannot be invested in directly.

[i] Sustainable Income Composite includes all Sustainable Income accounts with a long-term target of 70% investment in primarily U.S. dividend paying stocks and 30% investment in income producing securities which include bonds and/or ETFs, preferred securities, REITs and MLPs. The allocation among asset classes generally may vary around this long-term target by plus or minus 10 percentage points and we may hold cash balances. The primary objective of the strategy is to produce monthly income that grows at a rate faster than inflation through a portfolio principally invested in equities, and a secondary objective to participate in the long-term appreciation of the equity securities held. Bonds and preferred stocks are selected to add stability to the portfolio’s cash flow. Summitry employs a value-based investment strategy focusing on high-quality multi-national businesses that can be purchased at a discount to their estimate of intrinsic value. The benchmark for this composite is a blended benchmark consisting of 70% S&P 500 Dividend Aristocrats Index, and the Bloomberg Aggregate Bond index (30%) (Formerly Barclays Capital Aggregate Bond Index) and is rebalanced monthly. After March 31, 2020, the equity portion of the blended benchmark was replaced from the S&P 500 Index to the S&P 500 Dividend Aristocrats Index. Summitry believes this most closely represents the strategy pursued in the equity allocation. Anytime the individual components are shown, should be considered supplemental information. The minimum account size for this composite is $250 thousand.

The U.S. Dollar is the currency used to express performance. Returns are presented net of management fees and include the reinvestment of all income. Net performance is calculated by reducing the gross performance by the model fee of 1.25% applied monthly. The inception and creation of the Sustainable Income Composite was on June 30, 2015.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President