Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Checking the Health of Your Investments Amid Coronavirus

Mar 3, 2020

March 1, 2020

The past week served as a good reminder that markets go in both directions, sometimes violently. As noted in our previous post, the team at Summitry takes seriously the threat of the Coronavirus COVID-19, and have spent a great deal of time considering the impact of the virus on supply chains, consumer behavior, trade and other factors relevant to the evaluation of securities held in our clients’ accounts. The most important conclusions that we’ve drawn are that the businesses we own are fundamentally sound, well-managed and poised for long-term growth. We consider them well-worth owning at their current prices. The bonds we hold are structurally sound and creditworthy.

Learn more about our customized investment strategies.

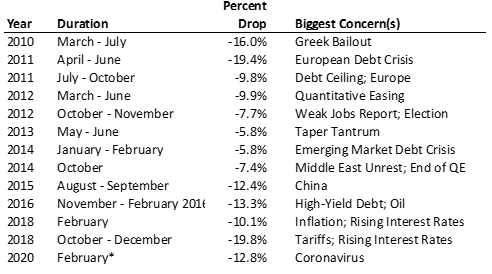

13 Recent Examples of Economic Unrest

We can’t know how the market will react in the coming weeks to news about COVID-19, but we can share with you some interesting data about past stock market corrections that we think provides some useful perspective. Following the market crash of 2008-09, investors have enjoyed the longest bull market in history, but it has not been without disruptions along the way. We counted 13 instances since 2009, including the current one, that had the investment community gravely concerned about prospects for the economy and markets:

Source: Bloomberg; * Through 2/28/2020

It is difficult to rank the threat of COVID-19 relative to these other events, but we can recall the level of apprehension among investors and in the financial press to be similar to today. When you are in them, every crisis seems unprecedented and worse than the last one.

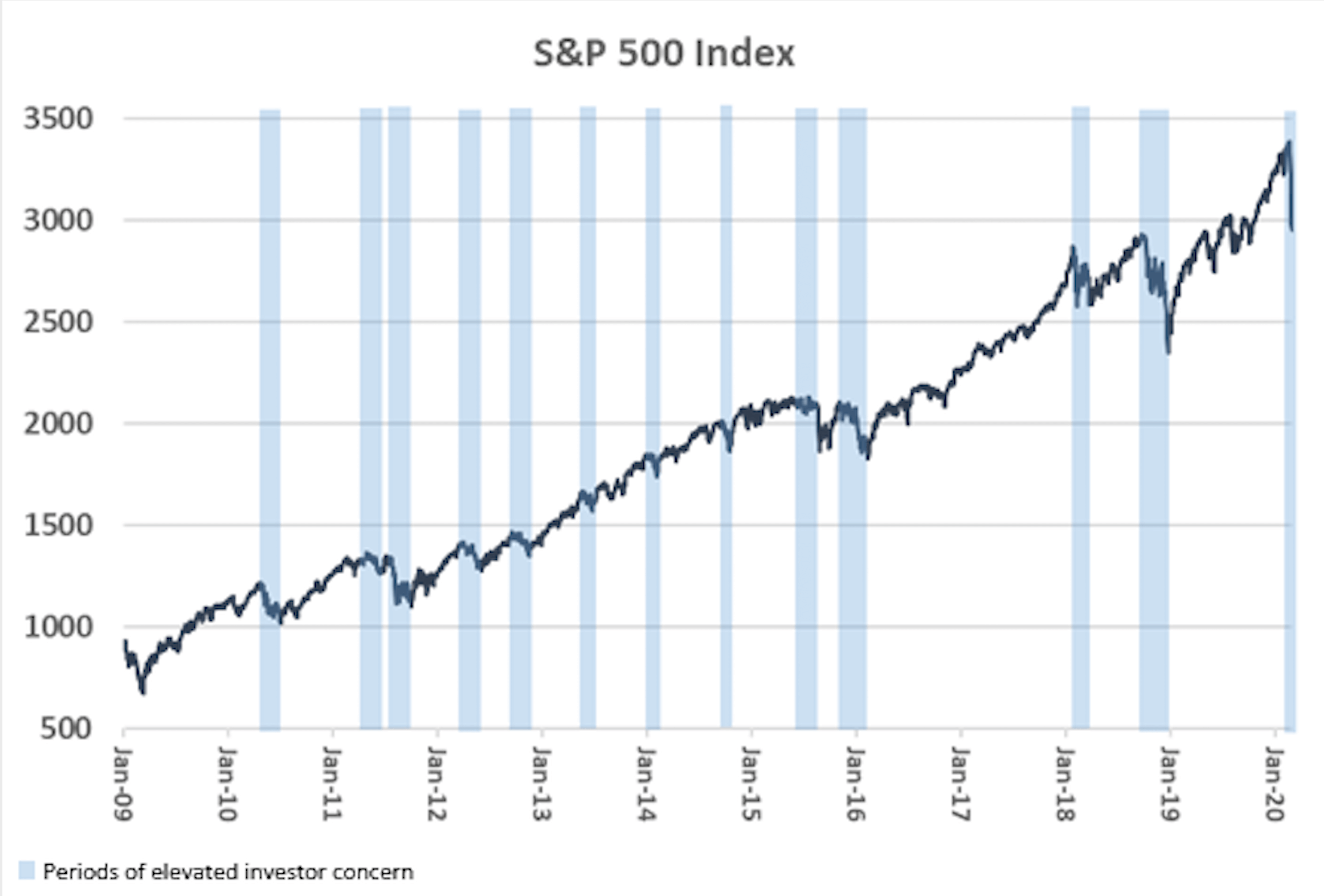

One thing that seems very clear, however, is that investors who have maintained a long-term discipline and successfully fought the immense pressure to react to adversity have been rewarded by the stock market.

Analysis period: 1/2/2009 – 2/28/2020; Price only CAGR 10.89%. Source: Bloomberg

Periods of elevated investor concern

Reviewing Your Long-term Financial Plan

Events like these are calls to action to review your long-term financial plan and consider your investment posture against these plans. Most will find that they are well served by their current allocation between equities and fixed income securities because they were structured with the knowledge that volatility is a normal part of well-functioning markets, and that investment time horizons are long.

We encourage our clients to contact us directly to discuss individual circumstances. We are here to help.

If you’re considering a partner to help you navigate the economic times of today and tomorrow, let’s talk.

Past performance does not guarantee future returns. Investing involves risk and possible loss of principal capital.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

Chief Growth Officer