Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

A Perspective on Index Investing

Feb 6, 2020

Passive index funds and ETFs are often great products, but they’re not perfect. Here are some things to consider before investing.

According to Morningstar, investors placed $207 billion into passive U.S. equity funds and pulled $174 billion out of active U.S. equity funds in 2018. Active U.S. equity funds finished 2018 with 51% market share versus 49% for their passive counterparts. And this trend shows no signs of stopping.

The benefits of passive investing are clear. It’s cheap. It provides diversification. Since most active funds don’t outperform the market, it’s probably not worth trying to identify the funds that can. For many investors, this is great advice, and we expect passive funds will continue to take market share from active funds, which is one reason we have invested client accounts in BlackRock (the manager of iShares).

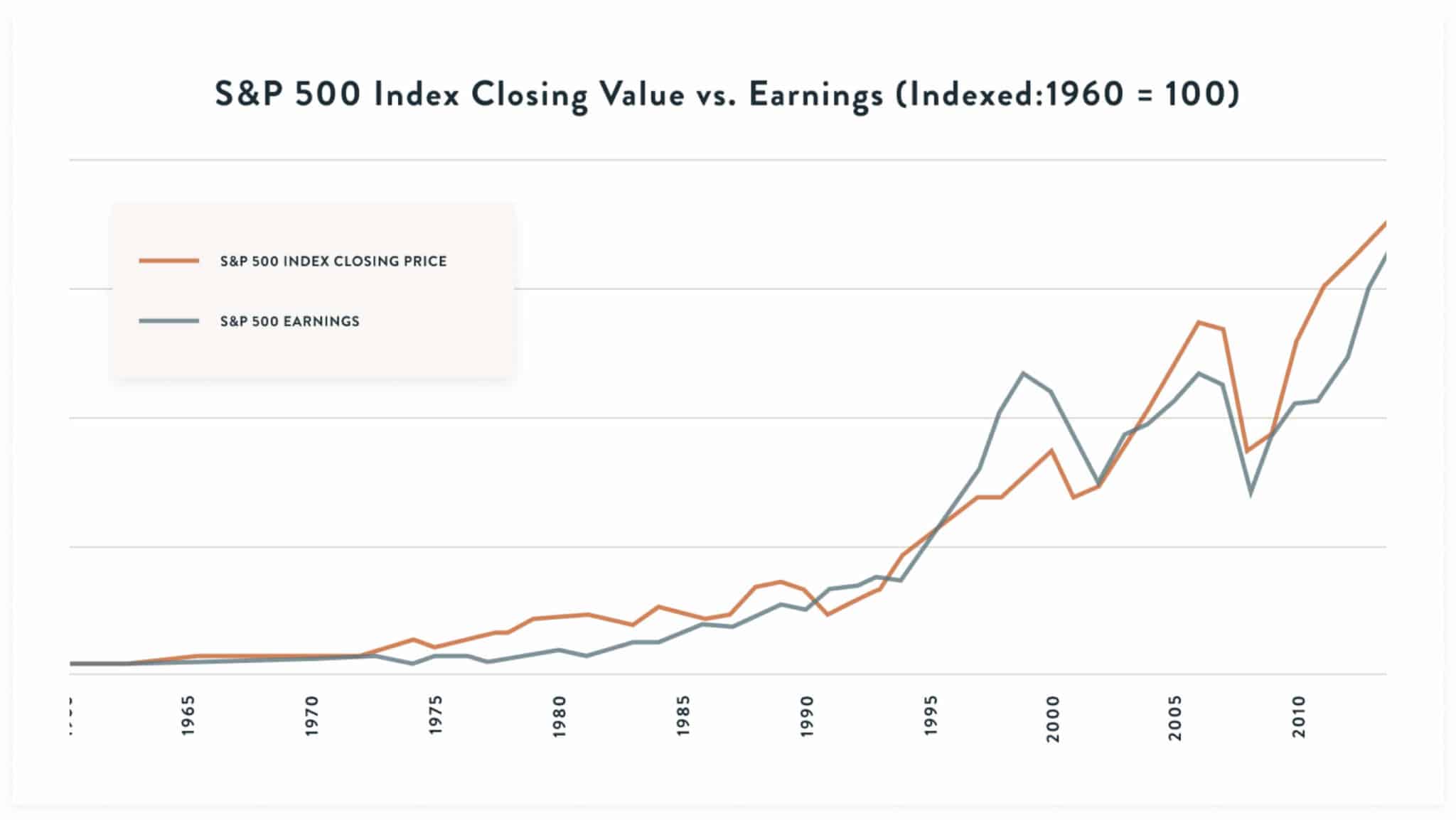

It’s hard to argue against low-cost passive indexing when the market is undergoing its longest bull run in history, but investors sometimes forget that passive investments not only capture 100% of the gains when an index rises, but also 100% of the losses when an index falls.

It is precisely at times when new conventional wisdom drives unchecked optimism that we, as investors, must act with caution.

In September 2019, Michael Burry, a very successful investor and one of the first to identify the mortgage lending bubble that led to the global financial crisis, penned a thought-provoking letter about the implications of the rise of passive investing. He listed a number of warnings but I will highlight two here.

First, index investing inherently “removes price discovery from the equity markets.” Rather than investing in superb companies that create and compound value, passive investors allocate investments indiscriminately towards the constituents of an index. Take the S&P 500, for example, the most widely-tracked index in the world. Have you ever wondered what comprises the criteria for inclusion in the index?

Broadly, a company must:

- Be domiciled in the United States

- Have a market capitalization of $8.2 billion or greater

- Have annual dollar value traded to float-adjusted market capitalization greater than 1.0

- Have minimum monthly trading volume of 250,000 shares in each of the six months leading up to the evaluation date

- Have the sum of the four most recent consecutive quarters of GAAP earnings be positive

The selection process is not intended to pick only the best the US market has to offer. Imagine putting all of your savings into an investment because 1) its market cap is at least $8.2 billion 2) the last 4 quarterly earnings add to a positive number and 3) it is liquid.

Burry’s second main argument is that many indices include securities with insufficient trading volume relative to the value of assets in funds linked to those indices. The combined value of five popular S&P 500 funds and ETFs at the end of 2019 – VFIAX (Vanguard), IVV (iShares), FXIAX (Fidelity), SPY (SPDR) and SWPPX (Schwab) – was $1.3 trillion. 360 of the 505 stocks in the S&P 500 trade less than $100 million per day. So does this mean we should expect another market meltdown due to mismatched liquidity? Only time will tell.

As long as the stock market exists, so will the doubters and doomsayers. Some will be right – most will be wrong. Despite the seemingly catastrophic market crashes we have experienced throughout history, the market has always recovered, and often quickly.

As long-term investors, we choose to follow the advice preached by Warren Buffett to buy superior businesses at attractive valuations. Because we know what we own and why we own it, we are better able to weather the storm. Does this mean that index investing is a dangerous way to invest? Not at all. Could it be an appropriate sleeve of your overall investment strategy? I believe so. What is critical is to understand what you invest in – including all of the risks.

Learn more about our approach to investments.

Sources:

https://www.morningstar.com/blog/2019/01/28/us-fund-flows-trends.html

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President