Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Market Volatility Happens but Recovery Can Be Swift

Mar 9, 2020

Monday, March 9, 2020

Saudi Arabia and Russia threw a new curveball into the global economic calculus over the weekend, when their talks on crude oil production cuts broke down. This news came to the markets at a time that they are already concerned over COVID-19, so the impact on stock prices Monday morning was swift and severe. Once trading was suspended shortly after the equity markets opened, they stabilized, but the damage was done.

Our investment team has been pouring through the news, reading commentaries by analysts whose opinions we value, and most importantly, analyzing the businesses we hold for their exposure to oil prices, COVID-19, interest rates, or general economic slowdown. Based on this review, we have not yet made any changes in the portfolio we hold. Rather, we believe the analysis confirmed the financial strength and durability of the businesses our clients own. We believe earnings will certainly be impacted by these factors in the near term for many of our holdings, but we are confident in their recovery. The intrinsic value of these holdings is a function of earnings generated over years to come, not just the short term.

We also know that market disruptions create opportunity, so at Summitry, we are reviewing our alternatives for establishing new positions in companies whose stocks have been unnecessarily punished. In the last 13 trading sessions (Feb 19 through Mar 9), the S&P 500 has declined by 18.9 percent, but many companies’ shares have fallen much farther. We are confident that our management teams are buying back their own stock at what they conclude are bargain prices.

Learn more about our approach to customized investment strategies.

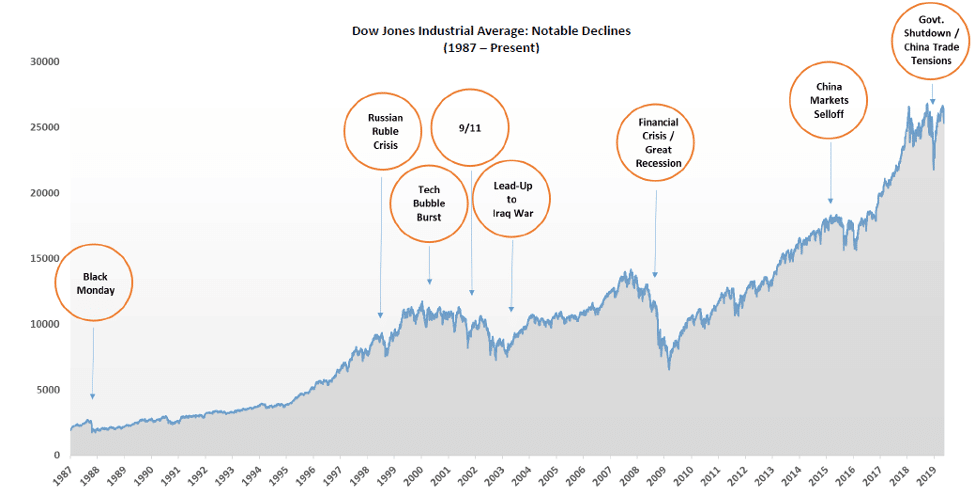

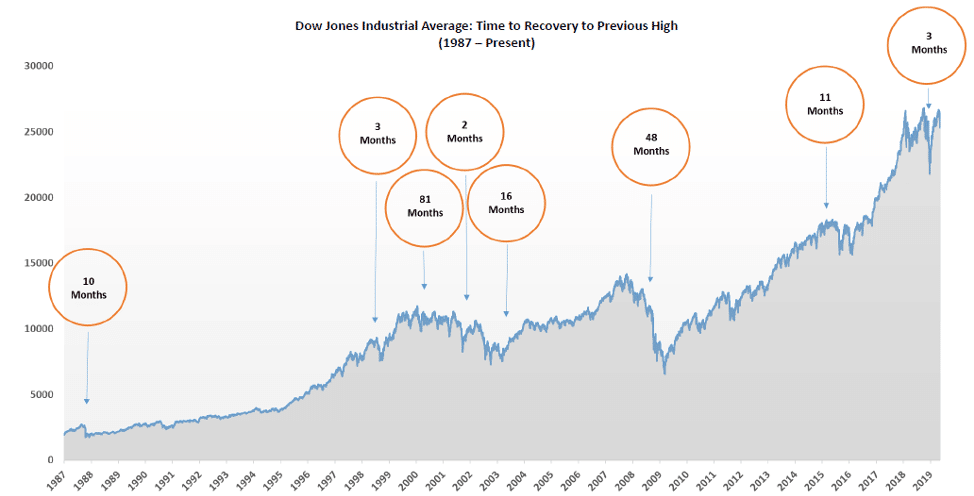

We thought it would be useful to present a pair of charts that we produced for one of our 2019 client events to provide some perspective on past market declines due to significant events. In the first chart, we detail a series of these very concerning events since the late 1980s. In the second chart, we note the time it took for markets to recover to their previous peak. In most cases, the recovery was swift.

Market Volatility Happens

Source: Bloomberg

Source: Bloomberg

But Recovery Can Be Swift

Source: Bloomberg

Source: Bloomberg

We recognize that the current series of events is different from those prior ones, but are also mindful of the adage attributed to Mark Twain: History doesn’t repeat itself, but it does rhyme.

We expect that we will look back on this period in much the way we looked at these previous events. In times like these it’s increasingly hard to maintain courage and discipline. Our mission is to help the Bay Area community feel empowered and financially secure.

Reach out to learn more about who we are and what we have to offer you.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President