Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Maximizing Wealth: Insights on Concentrated Stock Position Strategies (with Nvidia Analysis)

May 2, 2024

At Summitry, we have the good fortune of working with clients from all over the Bay Area who have accumulated significant wealth through some combination of either their participation in employee stock option plans or savvy early investments in leading technology companies. The common concern we hear from both prospective and current clients is “What should I do about my significant company stock position, given the taxes I will have to pay if sold?” The short answer is universal: “It depends.”

So, let’s unpack this answer further and speak about what exactly it depends upon.

Your relationship with the stock

As the old investment saying goes, “Don’t fall in love with a stock!” This is difficult enough when it is a stock you have bought and it has done very well for you, but when the stock is from the company where you work (or worked), there tends to be more of an emotional connection. This is not surprising – you know the company, you trust the leadership, in many cases, your RSUs/ Options/ ESPPs have generated significant wealth for you and most importantly you believe in the future direction (and growth) of the company.

We find that people typically fall into one of these three categories:

![]()

Your relationship with risk

Over the last five years having most of your wealth tied up in a single tech company’s stock may have been great for your net worth, most people know intuitively that where there is massive upside potential, the downside potential is equally severe. This is certainly true of the Magnificent 7 (NVIDIA , Meta, Tesla, Amazon, Google, Microsoft, Apple) which have been some of the largest drivers of recent stock market movement. The finance industry adage in this situation is that “concentrated positions are a great way to build wealth, but not a great way to sustainably maintain wealth.” Painting with broad brushstrokes, clients tend to fall into one of two categories:

When it comes to risk, our clients look to us to establish how much risk is required to achieve their financial goals. We use sophisticated software to quantify a “risk tolerance score” of 1 to 99, which you can think of as an “ability to sleep at night” score. We import their existing portfolio and score their current portfolio’s risk. Frequently, we meet clients with personal risk tolerance scores in the fifties who own a portfolio with risk scores in the nineties. It is unlikely their financial plan requires them to take on this much risk, so clearly there is work to be done.

How much concentration is too much concentration?

Ideally, you should diversify your portfolio to avoid investing too much in a single stock. If one company comprises over 20% or 25% of your total investments, then you may be over-concentrated in that position. More conservative sources recommend putting no more than 10% of your holdings in any single stock. The Bay Area has historically been home to companies that offer stock incentives to senior-level employees. In our experience, many folks in this position hold significantly more than 25% of their liquid net worth in their company stock, not to mention future RSU stock grants that will only exacerbate the concentration risk.

I don’t want to pay the taxes

There are strategies to defer or “gift” away the tax liability. However, until you have a clear narrative about your financial future and what this wealth needs to accomplish for you, selecting a tactical solution to your concentrated wealth “problem” is putting the cart before the horse.

Here are several potential strategies to illustrate the point:

- If you are charitably inclined, you have several potential tax-advantaged diversification strategies. Creating a Donor Advised Fund (DAF) or a Charitable Remainder Unit Trust (CRUT) can create significant tax benefits while also accomplishing your philanthropic ambitions in a more efficient manner. See how that played out for one of our clients here.

- If you have adult children or relatives that you want to help financially, gifting the stock to them to sell and pay tax at their personal tax rate might be a good solution. In 2024, an individual can gift anyone up to $18,000 a year, without needing to file a gift tax return. The limit is doubled for married couples.

- If retirement is in the near term, and your taxable income is about to be significantly reduced, this may influence the diversification options as well as the replacement strategy that may need to produce sufficient income. If you are planning to work another decade and simply want to “kick the tax can down the road” while diversifying out of your concentration, an exchange fund becomes part of the solution set.

- For many clients, they will continue being in the highest tax bracket for the next several years and want their cash-free and clear to fund whatever financial goals they may have, biting the tax bullet, while painful as it may be, might be the right solution. You don’t want to pay less tax…because that implies your investment has declined in value.

Summitry’s Investment Research Value-Add

For most individual stock positions, our in-house investment team can assess what the business is worth incorporating different future scenarios. As an example, the most frequent concentrated position we see in client portfolios is NVIDIA, a widely held security that has been an exceptional performing business and investment. While we actively follow NVIDIA, it is on our “Focus List,” we do not currently own it across all our managed client portfolios. Providing the reasons goes beyond the scope of this blog but can be best understood within the context of our investment philosophy which focuses on determining both the quality and value of a business. It is important to understand that the price of a security represented by the current stock price and the value are often not equal. We focus on “intrinsic value” which is a calculation that determines a business’s value based on the sum of all its future cash flows discounted by an appropriate return threshold. We then seek a “margin of safety” which means that the current price of the security trades at a significant discount to what we estimate the value of the business to be. Simply put, our investment analysis requires a high degree of confidence that we will know what the future will look like to determine whether any investment we make has a sufficient margin of safety to provide satisfactory investment return for our clients.

Specific to NVIDIA, we have identified the following key risks which we have simplified here for brevity:

- Competition from large cloud customers (AMZN, MSFT, GOOG, META), who are eager to find an alternative or internal source of supply, designing their own specialized chips. AMD/Intel are also launching competitive products.

- Cyclicality – the industry goes through periods of intense demand and soaring margins followed by oversupply and falling margins. Currently, the consensus is that we are in an extraordinarily strong demand cycle which is being met with massive investment in capacity. How long and strong this cycle will last is indeterminable.

- Geopolitical risk – the China export ban could signal the beginning of a prolonged period of disruption to not just NVIDIA’s customer base but also the entire semiconductor supply chain.

- Commoditization/Obsolescence – GPUs were not originally designed for AI purposes; there’s no guarantee future computing will run on GPUs. Improved software could also commoditize hardware. NVIDIA has a history of large technical and strategic bets that have mostly worked out. There is no guarantee that future product designs will continue to see the same level of success.

The recent cover story from Barron’s provides deeper context on these primary concerns. To summarize, the article outlines the rapidly changing competitive landscape NVIDIA is facing and the potential for pricing pressure and share loss to these emerging highly capitalized and motivated competitors and current customers. While NVIDIA has many of the attributes we look for in a quality business, its future is uncertain.

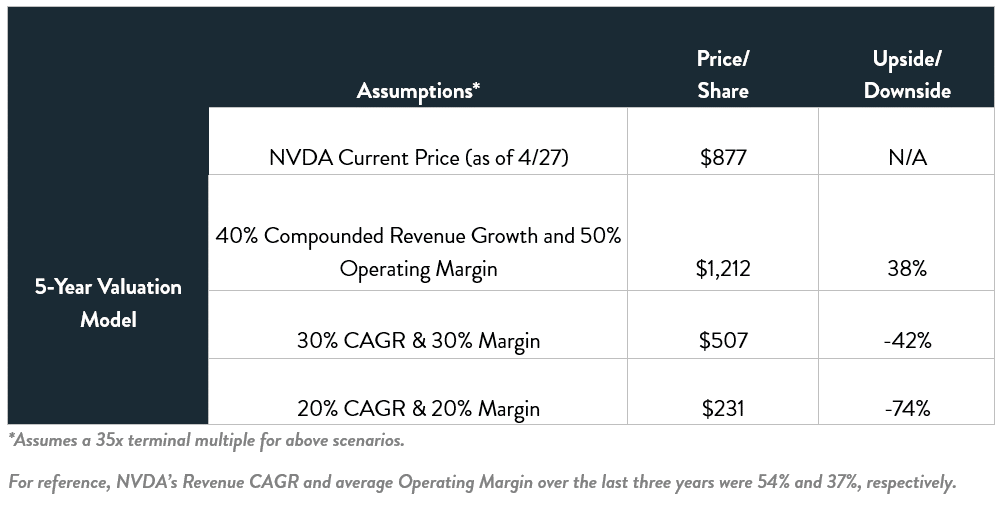

As part of our more in-depth work on NVIDIA, we have created the following scenario analysis which provides a range of potential values for the business.

Using the following assumptions, the result of our analysis shows that the potential value of NVIDIA has a very wide range of outcomes:

- Scenario 1: NVIDIA achieves 40% compounded revenue growth for the next five years and an operating margin of 50%. Valued at 35x earnings, shares will be worth roughly $1,212 per share today representing 38% potential price appreciation from the current price of $877. To achieve this, NVIDIA will have to reach $327.7B in revenue and $163.8B in operating profit compared to its most recent annual run rate of $60.9B and $33.0B, respectively. This equates to a 438% growth in revenue and a 397% growth in operating profit.

- Scenario 2: NVIDIA achieves 30% compounded revenue growth for the next five years and an operating margin of 30%. Valued at 35x earnings, shares will be worth $507 per share today representing a 42% potential price depreciation from the current price of $877. To achieve this, NVIDIA will have to reach $226.2B in revenue and $67.9B in operating profit. This equates to a 271% growth in revenue and a 106% growth in operating profit.

- Scenario 3: NVIDIA achieves 20% compounded revenue growth for the next five years and an operating margin of 20%. Valued at 35x earnings, shares will be worth $231 per share today representing a -74% potential price depreciation from the current price of $877. To achieve this, NVIDIA will have to reach $151.6B in revenue and $30.3B in operating profit. This equates to a 149% growth in revenue and an 8% decline in operating profit.

It is important to note that valuing a business is a dynamic and continuous effort. We constantly learn new information on our portfolio or focus list names and adjust our valuation accordingly. The scenarios above are based on the information we have today. They reflect our current thinking, which is likely to change over time. Since we tend to favor businesses that grow in value, our valuation in each of the scenarios above will likely change over time.

This is representative of the same valuation work that we do on the individual businesses in our client’s managed portfolios. We share this analysis not because we are certain of our ability to predict the future direction and range of stock prices. We will be the first to admit that stock price movement cannot be determined with certainty but share this as an example of the type of analysis we perform to better quantify the risk or opportunity a client may need to make an informed decision on their concentrated stock position.

Working with the trusted advisors at Summitry aligns you with a team of experienced professionals who can help navigate the risks and opportunities when faced with such an impactful decision on how to best manage a concentrated position in highly appreciated stock.

Contact us to discuss what strategies may make the most sense for your particular scenario.

The securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. This is not a recommendation to buy or sell any security. Investing involves risk.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President