Schedule a talk with one of our advisors to learn more about Summitry and how we can help you get a foothold on your financial life. For career opportunities please visit careers at Summitry.

Team

Insights

Pages

- Let's Talk

- Phone / Directions

Mixed Returns: A Closer Look at US Equity Markets in Q2

Jul 11, 2023

Q2 2023 Quarterly Commentary – July 1, 2023

The broad US market, as commonly measured by the S&P 500, provided a total return with dividends of +8.7% during the second quarter, generating a year-to-date total return of +16.9%. The tech-heavy NASDAQ Composite gained +13.1% in the second quarter, making 2023 the best start for that index for a calendar year since 1983, with a year-to-date total return of +32.3%. Returns were not even across all equity markets. The Dow Jones Industrials offered a total return of only +4.0% in the second quarter and +4.9% for the calendar year-to-date. Global “developed economy” equity markets, as measured by the MSCI EAFE Index, scored a total return for the second quarter and year-to-date of +3.2% and +12.2%, respectively. Small cap stocks, represented by the Russell 2000 Index, returned +5.2% and +8.1%, respectively.

Ten-year Treasury yields rose by 28 basis points (+0.28%) during the second quarter, reaching 3.82% by June 30th. Rising yields weighed on bond market performance, and the Bloomberg Aggregate Bond Index, a broad measure of the US fixed income markets, dropped by -0.8% for the quarter, returning +2.1% year-to-date. The Treasury yield curve remains negatively sloped, meaning that interest rates on short-term bonds exceed interest rates on long-term bonds. This is an aberration that will not persist forever, and it signifies that the consensus believes the economy will slow and inflationary pressures will diminish.

We admit to being somewhat surprised by the resilience of the US economy, corporate profits and the broad stock market indexes in the face of higher interest rates, tightening credit standards imposed by banks, a shrinking money supply and a lighter foot on the stimulus pedal by the Federal government. We believe it speaks to the dynamism of the US economy, which has shown more resilience than any other G7 economy in the post-Covid period. The job market remains robust, and the US consumer continues to spend, particularly for services. The markets currently reflect an optimism that inflation will be tamed, and economic growth will continue. Overseas economies have been less strong overall but have shown some resilience nevertheless through some of the same fiscal and monetary pressures as we see in the US.

Market Observations

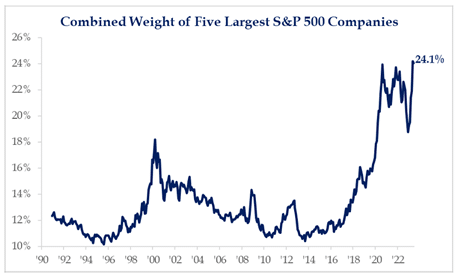

Behind the strong headline numbers for the broader stock market indexes, we see a few mixed signals. The market rise has lacked breadth. Specifically, the S&P 500 and NASDAQ Comp indexes have mostly been driven this year by a small number of individual stocks. According to an analysis by Strategas Research Group, the top ten stocks by market capitalization in the S&P 500 Index contributed 77% of the S&P 500’s return through June 30th. On an equal-weighted basis–weighting each of the Index’s 500 stocks equally instead of by market capitalization–the Index would be up for the year by a more modest +7.0% vs. the +16.9% recorded by the cap-weighted index. It is not uncommon for cap-weighted and equal-weighted index returns to diverge, sometimes significantly, but the largest companies’ stock prices have increased so rapidly that by quarter end, the top five collectively accounted for roughly 24% of the Index’s market’s capitalization (see chart below). On June 30th, Apple Computer was valued by the stock market higher than all 2,000 companies that comprise the Russell 2000 Index, combined. We believe this top-heaviness in the market has little precedent.

Source: Strategas Research Partners

These observations are not intended to trigger alarm, but we do recommend vigilance to those clients who may have significant concentrations in their portfolios of higher-valued equities, a situation that is common among clients who come to us for advice during careers with successful local technology companies. We think that having exposure to the world’s finest and most profitable corporations is a good thing, but we urge that some diversification is warranted when their valuations are relatively high compared to the broader market, based on traditional criteria such as multiples of current and future earnings. On Wall Street, investment fashions can change quickly. We believe that careful evaluation of the attributes of individual businesses and attention to disparities between price and intrinsic value, coupled with some diversification in the portfolio, will enable us to manage successfully through these fashion cycles. To us, this is far preferable than trying to guess what will be popular tomorrow, or worse, to be scared away entirely from investing in risk assets. Any hope to gain from investments requires one to be exposed to risk. It’s the selection of which risks are acceptable, and which are to be avoided that matters most at Summitry.

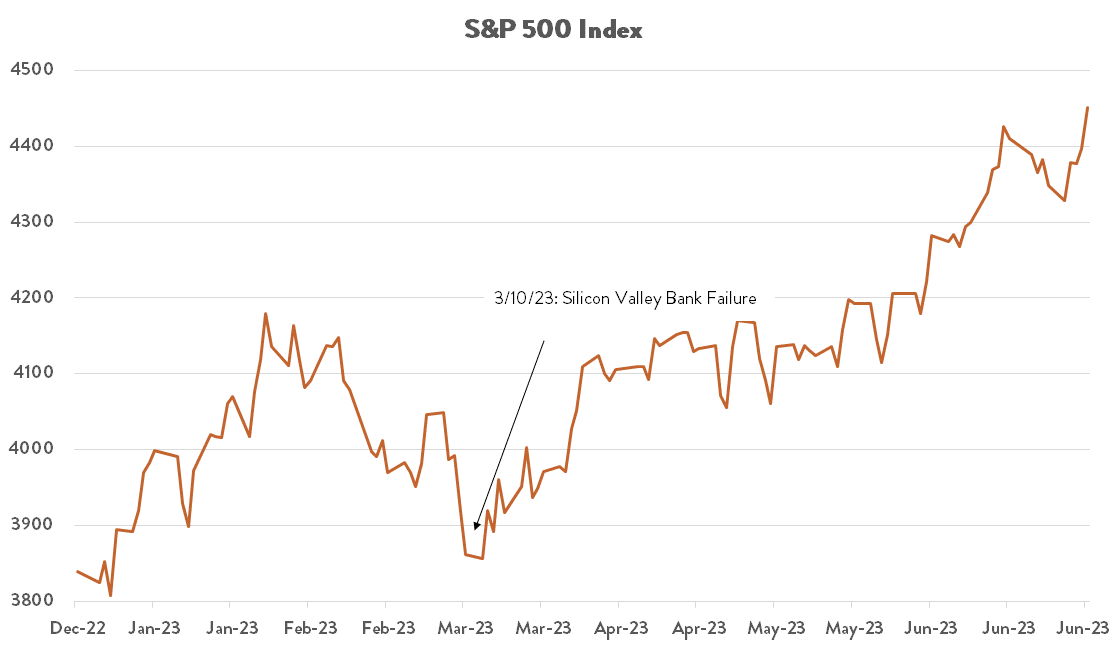

The market’s path during this year also exposes the danger of allowing economic and financial news to influence one’s purchase and sell decisions in the stock market. The failure of Silicon Valley Bank in March was believed to reveal serious flaws in the US banking system, according to press accounts, and it was widely expected that tighter lending standards and earnings compression would tip the economy into recession. Many in the financial press predicted a turning point in the markets—to the downside. Ironically perhaps, the Silicon Valley Bank failure corresponded almost perfectly with an upturn in the equity markets that has lasted through the end of the quarter (see chart below). This episode reminds us not to let sentiment be our guide, but rather to rely on our own analysis and good sense to determine whether to buy, sell, hold, or avoid an asset like a common stock or bond. Based on our experience, if a deep analysis suggests that an investment held over the long term should generate an attractive return, then it probably will.

Source: Bloomberg

Portfolio Changes

In the second quarter of 2023, we purchased and sold shares in client accounts to increase or decrease position weightings in our Core managed portfolios, but we neither introduced a new name nor sold completely out of any of our holdings. As we are long-term owners of businesses, this is not unusual within any three-month period. Meanwhile, the Research Team continued to build its Focus List of stocks that could become potential future holdings in our portfolios.

New to Summitry

In March, we welcomed Tyler Patterson, CFP®, CRPC® to Summitry as a Financial Advisor on our Private Client Group team. Tyler comes to us from Empower, a financial services firm based in Greenwood Village, Colorado. At Empower, Tyler honed his skills in providing advice around financial planning, tax strategy, and investment solutions. Previously, he served as a Financial Advisor to clients of T. Rowe Price. Tyler is a graduate of the University of Colorado at Colorado Springs with a degree in Communication and is a CERTIFIED FINANCIAL PLANNER™ professional and Chartered Retirement Planning CounselorSM. We’re thrilled that he agreed to pack his things and move west to California, and to bring his experience, talents, and warm temperament to benefit Summitry’s clientele and the firm.

We look forward to speaking with you, and if you would like to come in for a visit, please drop us a note or give us a call.

GET THE NEXT SUMMITRY POST IN YOUR INBOX:

MORE INSIGHTS AND RESOURCES

Let's talk

Schedule a talk with one of our advisors to learn more about Summitry and how we can help you chart a path for your financial future.

Alex Katz

President